Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Dec 19, 2023

By Chris Rogers and Hannah Cotillon

The apparel and footwear industry is in the midst of a slowdown in sales activity and ballooning inventories. Financial analysts' estimates call for revenue growth of just 2.5% in the fourth quarter of 2023 and 2.1% in the first quarter of 2024. That makes effective supply chain management more important than ever.

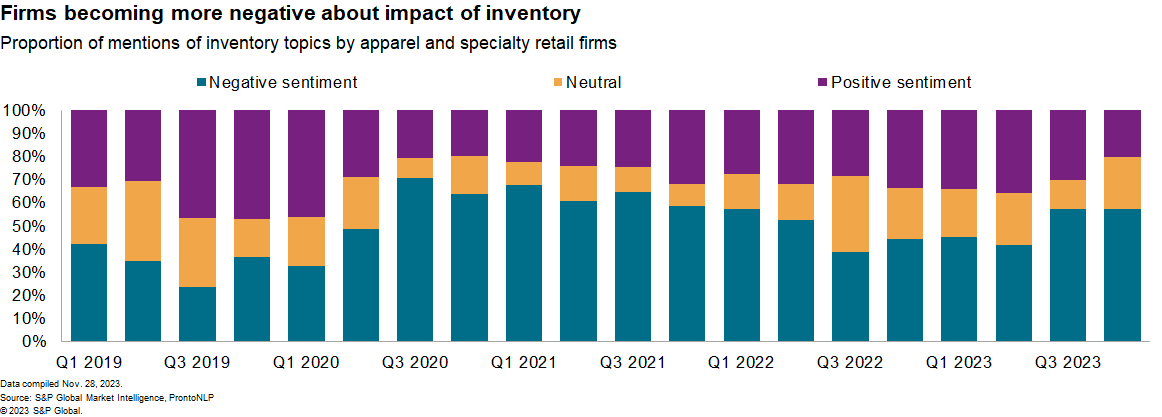

The slowdown in sales has led to an expansion of inventories as a proportion of sales for the US apparel retailers. Still, an analytical review of 19 apparel firms' comments — using machine readable transcripts via ProntoNLP's natural language processing system — shows many have yet to return inventories to their desired long-term level. More than half of firms mentioned inventories in a negative way (for earnings and cash flow) in calls held during the fourth quarter so far, the highest level since the second quarter of 2022.

Looking upstream, the cost of cotton and artificial fibers has fallen. The lower materials costs and weaker demand for clothing may have kept a lid on apparel consumer price inflation. The US apparel CPI rose by 2.7% in the past year and is expected to rise by just 1.5% by the end of 2024. While cotton prices are expected to fall by the end of 2024, the cost of artificial fibers is expected to rise.

Apparel supply chain operations are mostly back to normal in terms of logistics. US seaborne imports of apparel have remained in line with historic seasonal patterns but fell by 18% year over year in the three months to Oct. 31, 2023. That indicates a rapid decline in supply chain activity. Imports in the month of October alone were their lowest for that month since at least 2017. Global trade in apparel (clothing and footwear), adjusted for inflation, is expected to fall year over year in the fourth quarter of 2023, and will only return to growth from the second quarter of 2024.

A variety of supply chain risks still face the sector, including disruptions to shipping lanes via the Panama and Suez Canals, the need to remove "forever chemicals" from artificial fiber sources, and strikes in Bangladesh — which accounted for 20% of EU imports.

Bangladesh strike risk

Bangladesh has experienced anti-government protests and nationwide transportation strikes enforced by the opposition Bangladesh Nationalist Party and Jamaat-e-Islami since early November. These events are expected to intensify ahead of the January 2024 parliamentary election, causing nationwide disruptions.

Listen to our podcast episode on elections in South and Southeast Asia

Garment sector unions also took industrial action in November to demand increased minimum wages for garment workers, with workers receiving a minimum wage of up to 17,000 Bangladeshi taka ($154) per month compared with the previous 8,000 taka. A resumption of widespread simultaneous strikes by garment sector workers will likely further exacerbate government and economic stability risks. Strikes in November included around 300 of the country's 4,000 factories.

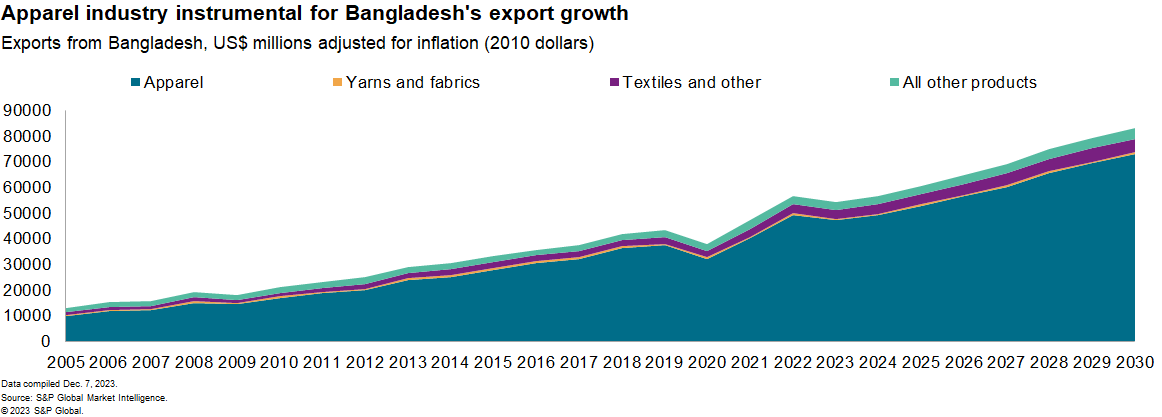

Bangladesh's apparel industry exports have been growing at a rate of 5.3% annually in the past five years, largely because of diversification of supply chains beyond mainland China. Growth is expected to improve to 6.8% annually in the next five years, assuming no material changes in the operational environment. In 2023 the clothing and allied industries accounted for over 90% of Bangladesh's exports on an inflation-adjusted basis.

Bangladesh's labor costs are a major advantage in the apparel industry, with manufacturing compensation estimates to be less than half the average regional and Association of Southeast Asian Nations (ASEAN) average. An increase in minimum wage could offset this advantage, and local currency wage inflation is expected to be higher than average in Bangladesh.

The country also faces elevated strike risks and higher overall operational risk scores compared with its peers. Aside from strikes, Bangladesh's garment industry has also had to deal with the impact of climate change, terrorism, and tragic industrial accidents over the past decade.

--With contributions from Peter Brennan

Sign up for our Supply Chain Essentials newsletter

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.