Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Case Study — 23 Feb, 2024

By Paul Vinzani

Highlights

THE CLIENT: A large U.S.-based institutional asset manager

Internal Users: Portfolio management, fixed income sales and relationship management

Redistribution End Clients: Institutional asset management clients, including insurance companies, pensions, endowments and corporations

Many institutional asset managers are fielding requests from their clients for increased transparency into their holdings with reporting that includes risk statistics to guarantee that mandates are being met or exceeded. This increased level of reporting often requires delivery of data in a format that enables details to be easily extracted and manipulated, such as delivery in Excel files or as comma-separated values (CSV). S&P Global Market Intelligence's ("Market Intelligence") feed solutions for S&P Global Ratings credit ratings offer reliable and flexible delivery of one of the industry’s largest databases of current and historical credit ratings across corporate, sovereign, U.S. public finance and structured asset classes.

This large U.S.-based institutional asset manager has been steadily increasing its fixed income assets under management and research desk capabilities. Its client base primarily includes insurance companies, endowments, pension funds and corporations looking to invest in income-driven funds that meet the risk thresholds of their businesses. These clients started to request statements containing S&P Global Ratings’ credit ratings that can be easily manipulated, which prompted the fixed income team to contact Market Intelligence to inquire about licensing data distribution in an Excel format.

This asset manager was feeling a sense of urgency to service its client’s reporting requirements with manipulable formats and flexible data delivery. To date, they had been delivering statements in a PDF format that restricted how the information could be extracted. Internal teams wanted to:

The team reached out to Market Intelligence to see what was possible.

Specialists from Market Intelligence discussed RatingsXpress delivered via XpressfeedTM, a powerful data feed management solution. This would provide the asset manager with:

|

|

Access to trusted credit ratings | RatingsXpress offers one of the industry’s largest databases of current and historical credit ratings from S&P Global Ratings with entity- and security-level data in one schema. The credit ratings cover nearly one million securities:

|

|

|

Reliable and flexible delivery | Xpressfeed offers streamlined delivery of credit ratings from S&P Global Ratings. The solution enables asset managers to ensure accurate, timely delivery of critical information while helping to automate client statement reporting processes. |

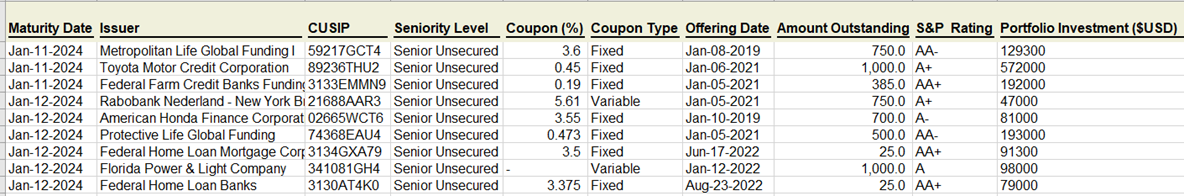

Figure 1: Sample Excel File Source: S&P Global Market Intelligence. For illustrative purposes only. Source: S&P Global Market Intelligence. For illustrative purposes only. |

||

Key Benefits

The asset manager is now able to license data in a way that:

[1] Coverage numbers as of January 2024.