Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Case Study — 9 Oct, 2023

Highlights

The Client: An airport authority

Users: Transfer pricing team

Transfer pricing establishes the cost of an intercompany loan that is provided between subsidiaries and affiliates that are part of the same larger enterprise. The “arm’s length” principle requires that a transfer price be the same as a transaction between unaffiliated firms working in a competitive marketplace.

In 2020, the OECD published the Transfer Pricing Guidance on Financial Transactions (“Guidance”) to establish common standards across different regions. This includes determining a borrower’s creditworthiness, as this is one of the main factors that independent investors consider when setting an appropriate interest rate.

This European airport authority owns and manages many airports in its region, plus operates others for partners in different countries. Members of the transfer pricing team needed a more transparent approach to assess the creditworthiness of subsidiaries and affiliates to establish an acceptable cost for intercompany loans to meet the OECD Guidance.

Pain Points

While some tax authorities are satisfied with multinational enterprises (MNEs) using quantitative models to assess creditworthiness, others want a more transparent approach that also includes qualitative factors. Members of the transfer pricing team therefore wanted:

The team contacted S&P Global Market Intelligence ("Market Intelligence") to learn more about the firm’s offerings in this area.

Solution

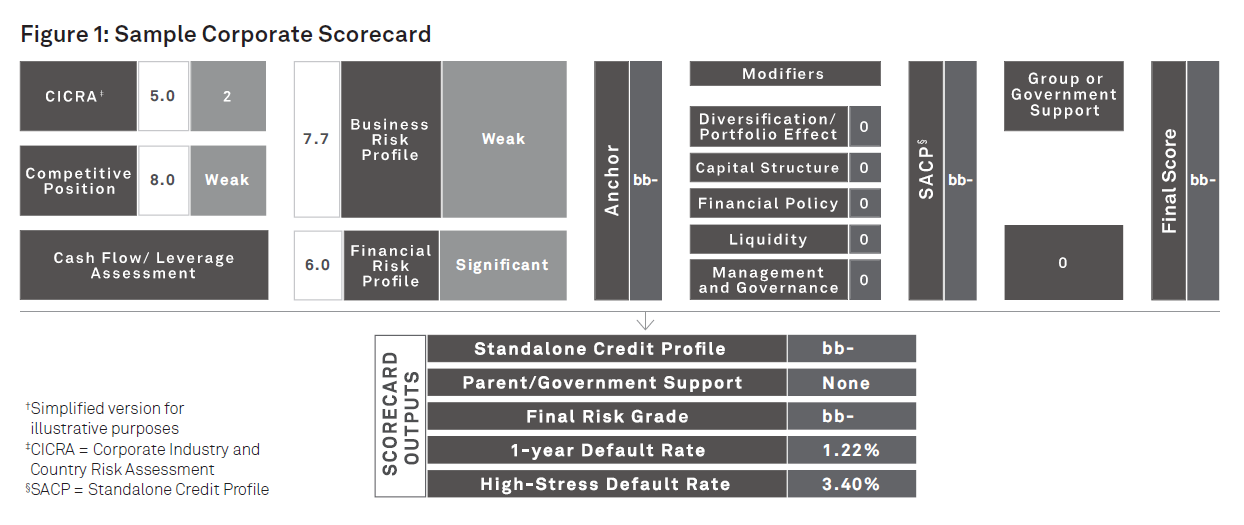

Specialists from Market Intelligence described the Corporate Credit Assessment Scorecard ("Scorecard") that is an easy-to-use tool that draws on a mixture of quantitative and qualitative questions in a check-box style to identify key risks. It is fully transparent and provides the underlying logic, including weights, and generates numerical credit scores that are broadly aligned with S&P Global Ratings’ criteria and are supported by historical default data back to 1981.[1] This would give the transfer pricing team:

| A transparent credit assessment framework that complies with OECD recommendations | The Scorecard combines point-in-time factors with forward-looking qualitative factors, converging trends and relationships between key drivers to provide a full picture of credit risk, giving users a trusted solution when dealing with tax authorities. A combination of business and financial factors provides a mixture of quantitative and qualitative issues. This includes consideration of an entity's competitive advantage, operational efficiency and business diversification. Results can be modified based on an entity's capital structure, liquidity, governance and more. The Scorecard is especially useful for low-default portfolios that, by definition, lack the extensive internal default data necessary for the construction of statistical models that can be robustly calibrated and validated. |

|

Quick deployment |

The Scorecard provides an off-the-shelf solution so users can free up resources to help increase efficiencies throughout the business. | |

| Full support | Ongoing support of credit specialists is available to discuss the Scorecard's questions, approach and other issues that may arise. Full technical documentation describes the analytical/ statistical processes used to develop the Scorecard, identifies the data used in construction and provides testing performance results. A rigorous development process and annual recalibrations ensure that the Scorecard is highly predictive of default risk. |

Key Benefits

The transfer pricing team liked the robustness, yet simplicity, of a solution that could meet the needs of different tax authorities around the world. They subscribed to the offering and now have:

The solution also provides the team with an ability to understand the methodology used by S&P Global Ratings for Its credit ratings, plus assess the creditworthiness of other counterparties, independent of transfer pricing.

Click here to learn more about the Scorecard.

[1] S&P Global Ratings does not contribute to or participate in the creation of credit scores generated by S&P Global Market Intelligence. Lowercase nomenclature is used to differentiate S&P Global Market Intelligence PD credit model scores from the credit ratings issued by S&P Global Ratings.