Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Nov 22, 2022

The year ahead is likely to be another year out of equilibrium. Accumulating shocks like the COVID-19 pandemic and Russia-Ukraine conflict are proving pervasive and persistent, profoundly reorganizing global structures and relationships.

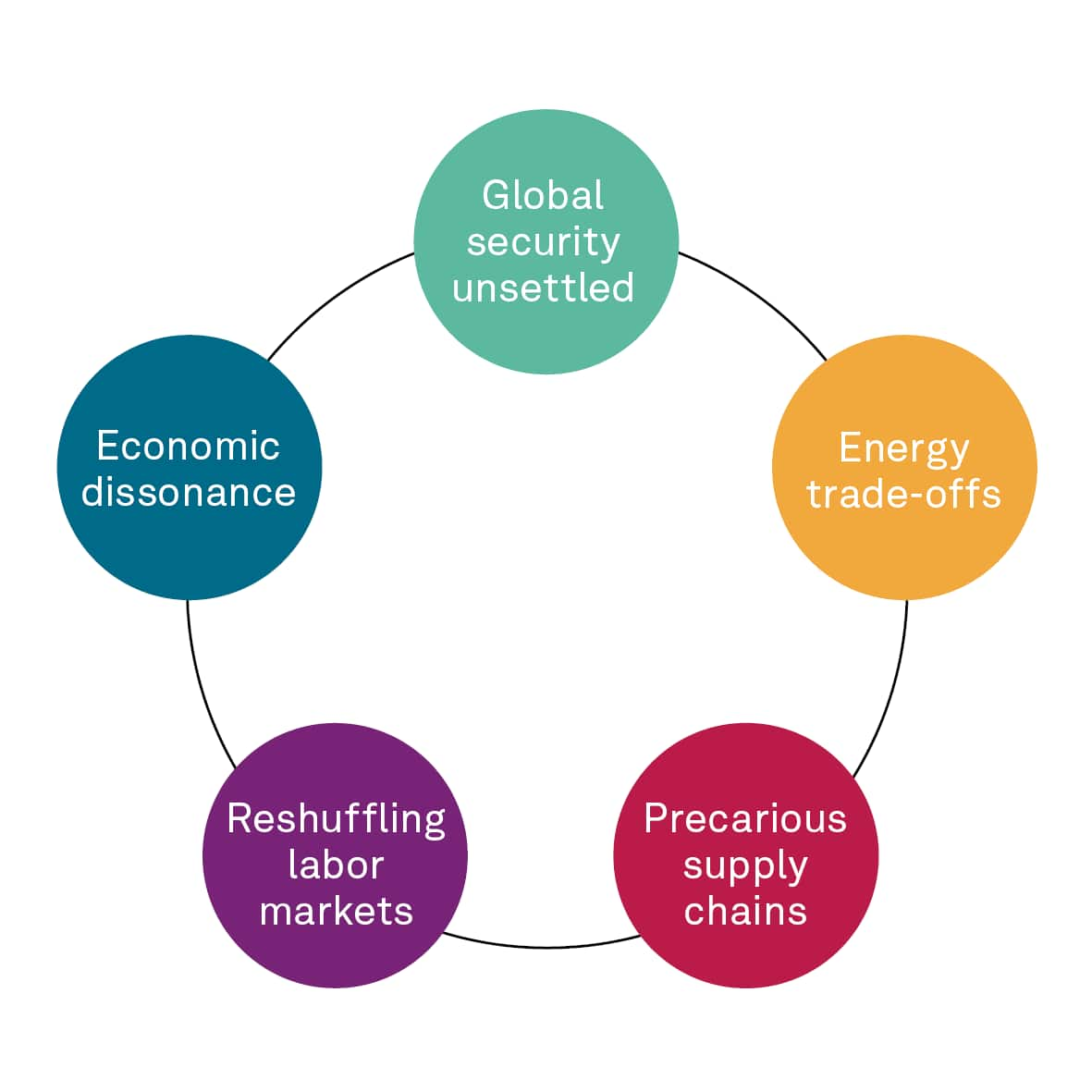

We see five organizing themes that will drive the economic and risk environment in 2023: global security unsettled, energy trade-offs, precarious supply chains, reshuffling labor markets and economic dissonance.

Global security unsettled

Unresolved conflicts and competitions will be sources of persistent risk in 2023,filtering into the global economic outlook. The invasion of Ukraine has transformed the near-term security picture for Europe on multiple fronts - as a ground conflict, across energy markets, and through European elections in 2023. The underlying drivers of the conflict are unlikely to be resolved in the year ahead. Outside Europe, the invasion of Ukraine has hastened a confrontation with global security risks like nuclear proliferation, cyber operations, infrastructure resilience and the future of security alliances. Economic and security spheres will become increasingly interdependent in 2023 and beyond, as countries apply financial levers including tariffs, export restrictions, and sanctions to advance national security priorities.

Energy trade-offs

With energy security back atop the agenda following Russia's invasion of Ukraine, countries will be balancing 2023 fiscal priorities against a new impetus to accelerate their energy transitions. Over the medium to long-term, we expect the geopolitical landscape and climate goals to align. In the year ahead, as countries juggle their fiscal demands and the existential climate threat, not all will be able to invest simultaneously. Instead, we expect a widening gap in the year(s) ahead between those that can accelerate energy transitions and those less well-positioned, bound up in resourcing questions including those around critical minerals.

Precarious supply chains

An expected easing in supply chain disruptions in the first half of 2023 remains vulnerable to labor and resource shortages including critical technologies and critical minerals. Already in late 2022, S&P Global's Purchasing Managers' Index (PMI) signaled a softening in supply chain strain driven by improved logistics and falling demand due to inflationary pressure. Even with these moderating indicators, the supply chain outlook will remain fraught with downside risks and will be closely linked to the broader regional and global economic climate.

Reshuffling labor markets

Labor markets are in transition as demand overruns supply, tilting leverage towards workers across major markets. With labor-market tightness across major markets expected to persist but ease slightly where recessions take hold in 2023, we expect any slowing in wage growth to be limited. The pivotal risk overhanging labor markets in 2023 will be the severity of expected recessions and any global spillovers, and the response of employers.

Economic dissonance

The risk environment will continue to underpin the economic outlook for 2023. As 2023 approaches, the global economy is teetering on the edge of recession. The twin drivers of fiscal policy responses to the pandemic and the Russia-Ukraine conflict shock have produced inflation rates at multi-decade highs. Central banks have sought to slow demand and achieve better alignment with supply by raising interest rates and reducing asset holdings, ending the monetary accommodation in place since the Financial Crisis of 2008. Even so, recessions appear likely in Europe and North America, while Asia Pacific (APAC) and other emerging markets are likely to skirt recession.

The tests ahead are interconnected and with vast commercial impact. As governments, civil society and multilateral institutions adapt to what appears to be a new era of uncertainty and instability, so too will businesses and markets navigate sanctions, increased protectionism, government interventions, alternative payment systems and reputational risk.

As a world rebalancing takes shape.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.