Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Nov 4, 2024

In a year marked by a significant number of elections in prominent economies, the outcome of the upcoming US presidential election, less than a month away, will be among the most influential factors for global economics and politics. Markets were already attuned to the health of the US economy throughout 2024, as inflation and labor indicators defined the US Federal Reserve's monetary stance and swayed the US dollar and, therefore, the gold price. Meanwhile, an increasingly unstable geopolitical landscape also supports the yellow metal as a safe haven asset, with central banks growing their reserves and investors turning to physically backed exchange-traded funds as a portfolio diversifier.

Looking back over the past 50 years since the advent of fiat currency, we analyze how the domestic and global economic and geopolitical environments under each US president determined the gold price trajectory. With its intrinsic value, gold has long been a safe haven asset against volatility in economic and financial terms, as well as in times of geopolitical conflict, especially as no currency is backed by a gold standard. Most, if not all, the US presidential terms of the past half-century covered in this study have been rife with either macroeconomic or geopolitical concerns that drove the gold price, more so than any president and their domestic policies did. By superimposing some of these circumstances to our current global context and drawing parallels, we suggest a possible path for gold prices under the upcoming 47th US president.

2024 onward: In the Trump vs. Harris race, gold is the winner

We estimate that the winner of the present presidential race between former President Donald Trump (R) and Vice President Kamala Harris (D) will be but part of a global geopolitical chess game that will be the true driver of the gold price. Given that many supply chains are globally interconnected, including those of energy commodities, any shocks will cascade into the US economy, potentially fueling another inflation cycle and monetary response. As the Fed is independent of the government, its response to any such shocks would likewise be independent of government.

Although some fiscal policies will affect the domestic economy, we still anticipate that global macroeconomics and geopolitics and associated market sentiment will influence the US dollar and gold price more than the elected president. Many price thresholds have been breached over the past year, and we consider them as breakthroughs as investors engage in safe-haven buying amid a troubled geopolitical landscape that we describe further below. We can nevertheless anticipate some pullbacks on sporadic profit-taking or as the stock market outperforms but still envision an upward trajectory over the next four years. With a conservative 20% growth, compared with past gold price performances averaging almost 60% growth per term, from the current $2,650 per ounce level, we could see the gold price peaking around $3,200/oz as geopolitical tensions culminate sometime over the next four years.

1970s: The end of Bretton Woods

The picture at the beginning of our timeline in 1972 looks familiar: inflation was rising, and so was government spending, while the Cold War continued between the US and the Soviet Union, making for uncertain times. As investors turned to gold, the price surged 43% in the six months following former President Richard Nixon's reelection in November of that year and was up 53% over the year — the largest jumps for similar post-election periods until now. This came barely a year after the end of the Bretton Woods system of gold-backed currency under Nixon's first presidential term, which had introduced volatility in the US dollar and set up gold as a stand-alone safe haven asset and hedge against inflation. The gold price peaked at $195.50/oz around halfway through Nixon's presidency, up over 200% from the election day, but had dropped back to $122.95/oz by the time former President Jimmy Carter was elected at the end of 1976.

Over the following four years, the US entered a period of stagflation characterized by high unemployment and stalled economic growth. The US dollar was devalued and was further hit by high oil prices as the Iranian revolution tightened global supply, which the OPEC embargo a few years prior had already constrained. Gold prices climbed nearly steadily throughout Carter's presidency, peaking — like inflation — in early 1980 toward the end of his mandate. The value of gold went up eightfold over the four-year term, reaching a high of $835/oz from a low of $124.35/oz touched only a few days after the 1976 election.

1980s: "Reaganomics"

Former President Ronald Reagan's election in 1980 and 1984 and his "Reaganomics" approach, involving tax cuts and reduced government intervention and spending, turned the country's economic tide. Aggressive monetary tightening to combat inflation — and a short-lived recession — contributed to the gold price falling 26% and 33% over the first six and 12 months, respectively, of Reagan's first term. The gold price fell 47% across his first term in office and declined 23% over his entire presidency, from 1981 to 1989. The support level remained high, however, as the geopolitical landscape remained volatile in the aftermath of the Iranian revolution and as tensions with the Soviet Union grew. Reagan notably increased military spending amid the Cold War, while his economic policies of financial market deregulation led investors to diversify their portfolios. In both cases — geopolitically-driven increased military spending and financial market deregulation — gold was a safe haven that a strong US dollar failed to dull.

1990s: Recession to recovery

The US economy and geopolitical scene remained shaky as former President George H.W. Bush took office in 1989. Despite emerging as the sole superpower following the end of the Cold War and the breakup of the Soviet Union, the US experienced a recession in the early 1990s, with high inflation, lower consumer confidence and rising unemployment. The high interest rate environment caused the gold price to decline 19% in four years. The downward trend continued under former President Bill Clinton, who was elected in November 1992 and again in 1996, as the US economy recovered, grew and flourished, the dollar strengthened and fewer geopolitical conflicts marred the global scene. Inflation had stabilized, GDP growth was consistent — aided by a boom in the technology sector — and unemployment plummeted. The gold price touched a two-decade low of $252.30/oz in the latter half of 1999, though spiked briefly thereafter on developments in the European gold market and Asian financial sectors.

2000s: The bursting of two bubbles

George W. Bush's presidency started and ended with a recession. The dot com bubble burst in 2000, exacerbating recessionary pressures and triggering a series of policies that led to the housing bubble burst in 2008, making for two significant market crashes within a decade. The banking sector crisis that started in 2007 as major financial institutions collapsed on default mortgages boosted the gold price after a scramble for liquidity triggered an initial drop. Further, tax cuts intended to revive the economy significantly grew the budget deficit, adding to concerns about the health of the US economy and its future; the rate of increase in the national debt ballooned after the 2008 financial crisis and continues to rise today. The US dollar weakened, sparking a flight to gold as a safe-haven asset against currency devaluation. Meanwhile, the geopolitical unrest following the 9/11 attacks and subsequent war in the Middle East enhanced investor appetite for gold. Starting around $260/oz in November 2000 and ending at $760/oz in November 2008, the gold price grew nearly 200% — the second largest increase under a president in our timeline; it breached $1,000/oz in 2006 as oil prices also rose on supply concerns amid heightened geopolitical risk in the Middle East.

2008–16: What goes up must come down

The financial crisis of 2008 was in full swing when former President Barack Obama entered office, with market pessimism at a high. To stimulate the economy, the Fed lowered interest rates in a now-familiar quantitative easing maneuver that raised concerns about inflation and currency devaluation. Simultaneously, Obama's fiscal approach to counter inflation further grew the US budget deficit. The European sovereign debt crisis of 2011 mirrored concerns about the US debt ceiling, as fear of contagion spread in the eurozone and thwarted economic growth. Republicans won a majority of the House of Representatives during the 2010 midterm elections, which stalled the Democrat's legislative agenda during the second half of Obama's first term.

Demand for gold as a hedge remained strong, and prices rose 130% during Obama's first term, peaking at just shy of $1,900/oz in September 2011, in part reflecting the polarized political environment that continues today. As inflation remained in check, however, the US dollar strengthened, and the US GDP growth improved over Obama's second term. Investor appetite for gold began to wane, and prices slowly declined to $1,275/oz by November 2016.

2016–20: Pandemic panic

Despite much volatility, the gold price traded sideways during the first year of Trump's presidency. Although the US dollar strengthened on a hawkish Fed stance and markets had optimistically turned to equities on Trump's proposed fiscal and financial deregulation policies, geopolitical tensions with respect to North Korea's nuclear threat started to mount, putting upward pressure on the gold price. Trade disputes with China emerged one year into the presidency, breathing uncertainty into markets, while the Fed's pivot to cutting interest rates on those trade tensions weighed on the US dollar. The gold price resumed its upward trend and gained nearly 50% over the four years to November 2020, boosted above $2,000/oz by the Fed's significant fiscal stimulus and monetary easing in response to the economic havoc wrought by the COVID-19-related lockdowns and general uncertainty.

2020–present: A perfect storm of economics and geopolitics

Injecting money into a market with disrupted supply chains contributed to an inflation surge during Joe Biden's early presidency. Globally, central banks entered a monetary tightening cycle, with markets generally looking to the Fed for hints of the path ahead. While the higher interest rate environment bolstered the US dollar and consequently should have weighed on gold prices, the onset of the Russia-Ukraine war in February 2022 and the conflict between Israel and Hamas in October 2023 make for a troubled geopolitical landscape.

Central bank gold purchasing has surged in the wake of these conflicts, hitting an annual record high of 1,037 metric tons in 2023, with 2024 figures not far behind. One of the likely driving forces behind this demand increase is the sanctioning and asset freezing of Russian oligarchs and institutions, with Turkey and the People's Bank of China among the most active buyers. Despite the rising price, geopolitical instability will continue driving gold demand.

Two assassination attempts against Trump, the withdrawal of Biden from the 2024 race and the nomination of Harris all caused further upheaval in an already heated contest. Several political commentators have raised concerns about the possibility of unrest and political violence during the campaign and immediately after the election, and polls reflect similar fears among voters.

A perfect storm of macroeconomic and geopolitical factors has thus periodically pushed gold prices to record highs. The gold price breached $2,200/oz in March 2024, then $2,400/oz in April on a central bank buying spree fueled by the increasingly stressed geopolitical scene, and finally $2,600/oz in September as the Fed started cutting interest rates while Israel's war in Gaza spilled over into neighboring countries. From a respectable $1,903/oz on Nov. 4, 2020, the day after the US election, to $2,652/oz one month away from voting day, the gold price has risen 39%, which, despite the record prices, is not the highest price increase under one or two presidential terms.

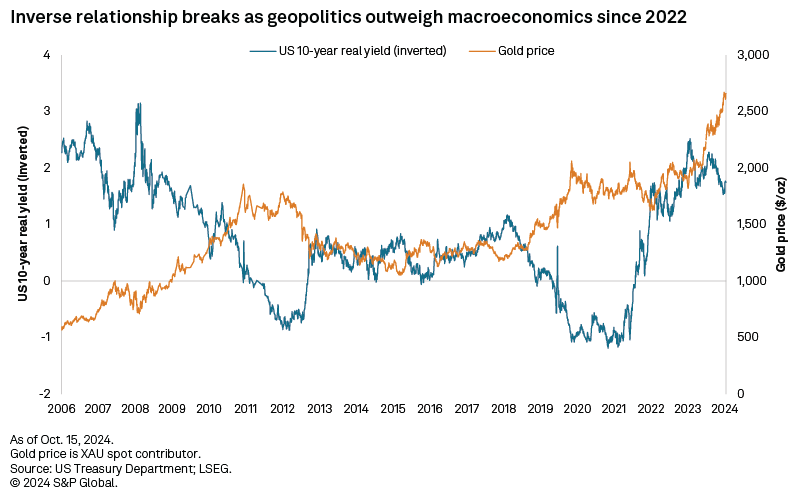

Gold prices and US real yields

Traditionally, gold prices negatively correlate with US Treasury real yields; higher yields tend to make the non-yielding bullion less attractive to investors and vice versa. This inverse relationship broke down at the beginning of 2022, however, with the US real yields and dollar rising concurrently with gold prices, with the former supported by robust investor interest fueled by the high interest rate environment and the latter by central banks buying, geopolitical upheaval and US recession fears. Despite the Fed starting the monetary tightening cycle more aggressively than expected, the US dollar did not completely lose all its gains, partly on a resilient US economy and partly on the possibility of extended tax cuts depending on the outcome of the upcoming US presidential elections. The Fed's first interest rate cut has restored the inverse relationship between gold prices and Treasury yields.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.