Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 28 Sep, 2023

By Jordan McKee

Introduction

Payments orchestration is often confused with payments optimization. The latter involves techniques focused on enhancing the outcome of an individual transaction, whereas the former encompasses approaches targeted at enhancing the reach, adaptability and performance of the payments stack. In simpler terms, orchestration can create the foundation for optimization to thrive.

The technology is a critical competency for any high-growth or enterprise-scale merchant. It has direct impacts on operational efficiency as well as top- and bottom-line performance. In this report, we discuss the business rationale for payments orchestration and the vendor ecosystem that has emerged around it.

Payments orchestration has become one of the most popular areas of inquiry among our clients in recent years. This has in large part been fueled by a growing appetite among enterprises to harness payments as a lever to optimize top- and bottom-line results. Many enterprises have historically taken on elements of payments orchestration in-house to achieve desired optimization outcomes, but some are finding it to be an increasingly resource-intensive effort that taxes organizational performance. This has sparked heightened interest in third-party payment orchestration platforms that aim to abstract the complexity of managing and optimizing the use of multiple payment processors.

The multi-processor approach to payments

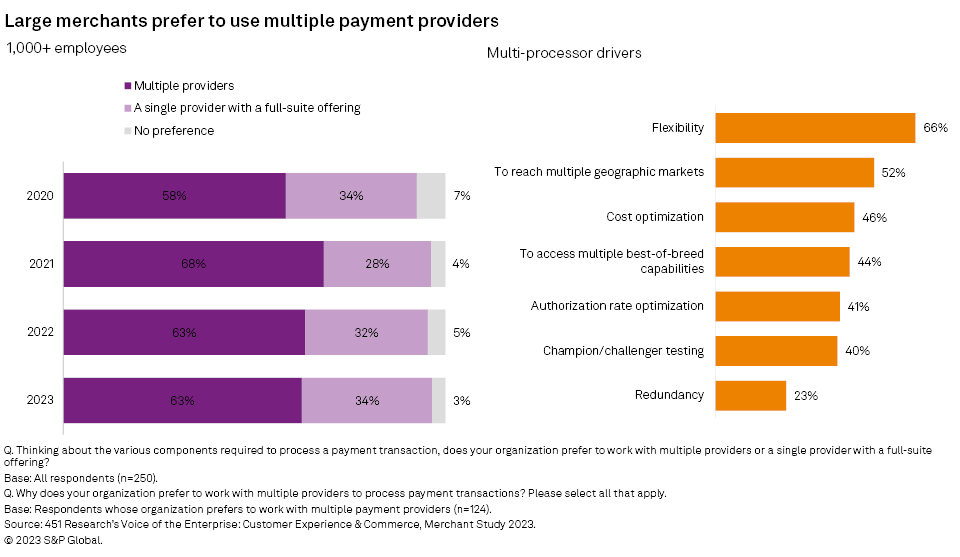

Our research has consistently shown that large merchants generally prefer to work with multiple payment processors. We note three key business drivers supporting the multi-processor approach to payments:

– Adaptability. Common rationale includes reducing vendor lock-in, achieving greater control over the payments stack, supporting specific business needs/requirements and redundancy.

– Reach. Multiple payment partners can help to support global expansion, such as by enhancing support for local and alternative payment methods and enabling local acquiring.

– Performance. Many merchants apply sophisticated logic to route and retry transactions across multiple partners in an effort to optimize for top- or bottom-line performance.

As merchants increase in size or scale, the need for more payment partners often increases in unison. It is not uncommon for us to encounter large, multinational merchants with two dozen or more processor, acquirer and gateway connections to support their global operations.

Although we do see desire among enterprises to consolidate at least some of their payments vendor estate, in many cases the fragmentation has been born out of necessity, to support the diverse needs and requirements of the business that no single partner can deliver on. The global chief technology officer at a multibillion-dollar hospitality business put the rationale for multi-processor to us simply: "No payments provider is truly global and does everything well."

The tradeoff for having multiple payment partners is complexity. It creates a need for some degree of orchestration to optimize the value and usage of multiple providers. Payments orchestration involves tasks including, but not limited to:

– Coordinating and managing multiple processor integrations and contracts.

– Monitoring partner performance and adherence to service-level agreements.

– Developing and maintaining transaction routing and retry logic.

– Consolidating data, reporting and reconciliation.

– Performing A/B testing and champion/challenger testing.

– Vaulting and tokenizing payments data.

– Applying transaction optimizers (e.g., 3D Secure, network tokens).

– Integrating payments with adjacent systems (e.g., fraud prevention, logistics, enterprise resource planning).

– Managing and maintaining customized payment pages.

Many large merchants take on some or all payment orchestration tasks themselves, often supported by custom, in-house platforms. While there are benefits to be had in terms of customization, owning all orchestration tasks is often a resource-intensive endeavor that can sap the bandwidth of payment teams and eat up engineering cycles.

Consider that 64% of merchants with 1,000-plus employees strongly agree that their business needs to reduce the time developers spend on payment functions, according to 451 Research's Voice of the Enterprise: Customer Experience & Commerce, Merchant Study 2023 survey. Our conversations indicate that many merchants with an in-house orchestration layer often sacrifice speed, agility and overall efficiency:

– "Having our own in-house [orchestration] system sometimes tends to overcomplicate things (our day-to-day), especially when we have to integrate it with an external system." – Head of payments, technology, $50 billion-plus, US.

– "We have a proprietary orchestration layer that ties processors together. ... It is legacy development that we own, as in built by us. We have maintained it and attempted to modernize, but some features lag from a technology sense." – Head of payments product management, hospitality, $1 billion-$5 billion, US.

– "Constant management of the [payments] estate means we have 25%-40% of teams' time [dedicated] to ensure that services are maintained and updated, [and] any changes deployed by partners are incorporated into our solutions. ... Flexibility to incorporate new payment partners is similarly slower due to the above-mentioned dependencies. Generally, our ability to adopt new payment types is slower than utilization of a [third-party] provider." – Head of payments technology, fashion, $1 billion-$5 billion, UK.

The rise of payment orchestration platforms

The challenges associated with in-house payments orchestration have given birth to a category known as payment orchestration platforms. Vendors in this space have dozens, if not hundreds, of payment integrations (e.g., gateways, alternative payment methods, acquirers) that merchants can connect to, supported by a cloud-based platform for managing and optimizing payments across multiple partners. As the chief technology officer of a beauty retailer deploying a payments orchestration platform vendor put it, "The partner is well integrated with a variety of payment providers and therefore provides a feature-rich series of options that we are too small to develop ourselves."

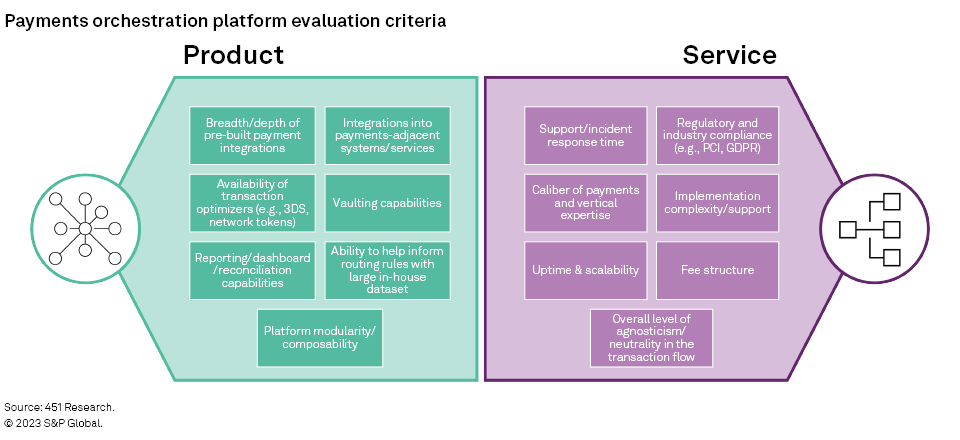

We see the value proposition of payment orchestration platforms rooted in the following:

– Streamline operations. Third-party orchestration platforms can reduce engineering requirements and operational overhead associated with onboarding and managing multiple payment integrations, as well as optimize their use. This can allow payment teams to shift their focus away from maintenance of an in-house platform and back to value-added tasks like A/B testing and strategy development.

– Centralize payments data and intelligence. A key value proposition of any orchestration platform is in centralizing reporting and reconciliation, delivering analytics, and tracking performance across key metrics and individual partners. This insight is often delivered via a comprehensive dashboard, which can result in faster and better-informed business decisions and optimization strategies.

– Maximize financial performance. Orchestration platforms streamline and expedite the ability to connect to multiple payment partners, provide a simplified interface to manage and apply transaction routing rules/logic, and offer access to various transaction optimizers (e.g., network tokens, account updater). This can enhance the speed at which a multi-processor strategy delivers financial results.

The head of finance at a meal delivery startup summarized the value of payment orchestration platforms to us as being able to help businesses, "drive efficiencies by being more agile and able to scale more rapidly." For a payments orchestration platform to truly deliver, merchants should seek out vendors with product and service attributes aligned with their specific business needs. While emphasis on core factors like uptime and scalability should be a universal priority, others, such as platform modularity, will vary in importance depending on a merchant's requirements and use cases.

In the table below, we highlight payment orchestration platform vendors that exemplify some or all of the characteristics mentioned in this section. This list is presented in alphabetical order and is not intended to be exhaustive. Inclusion does not imply that these vendors are market leaders, nor that they have a competitive advantage over other vendors not included in this report.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.