Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Jan 23, 2025

With ongoing challenges presented by a shifting political and energy policy landscape, accelerating capital spending and macroeconomic factors placing an increased emphasis on customer affordability, the level of regulatory risk across the energy utility sector has been rising in recent years. Even so, there have been notable shifts in the relative level of regulatory risk among the state-level jurisdictions analyzed by Regulatory Research Associates on an ongoing basis. In addition, pending proceedings and recent developments in other states bear watching as the outcomes could indicate that similar shifts in regulatory risk are on the horizon in those jurisdictions.

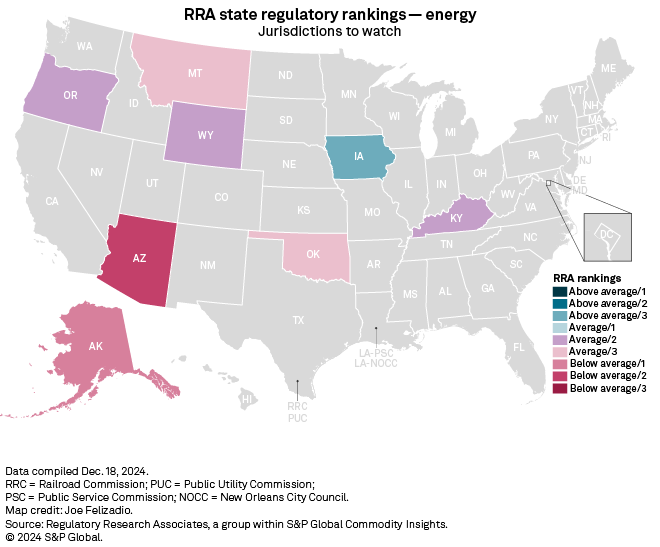

As part of an analysis conducted in December 2024, RRA identified four jurisdictions where a marked change in the level of comparative regulatory risk is discernible. In addition, RRA identified eight states that bear watching for near-term shifts in the regulatory landscape.

Commissioner turnover is a factor in five states to watch (Alaska, Arizona, Kentucky, Montana and Oklahoma), and energy transition-related issues were identified in three states (Arizona, Iowa and Kentucky). Alternative ratemaking policies are at center stage in four states (Arizona, Iowa, Montana and Oregon), and rate case-related issues bear watching in five states (Iowa, Kentucky, Montana, Oklahoma and Wyoming).

RRA ranks the regulatory climate in 53 state-level jurisdictions that oversee utilities to provide a comparative assessment of regulatory risk. The rankings reflect the interest of equity and fixed-income investors. The rankings reflect state regulatory commission decisions and the impact of the actions taken by the governor, the legislature, the courts and consumer advocacy groups.

Part 1 of this two-part series discussed the four jurisdictions that have seen a notable change in regulatory risk that prompted RRA to change their regulatory rankings.

In addition to the four jurisdictions where RRA has observed a shift in the regulatory climate, there are eight states where current trends and expected near-term developments could signal a shift in the level of regulatory risk for investors.

The Alaska regulatory climate warrants monitoring as the Regulatory Commission of Alaska (RCA) has experienced significant upheaval in its membership over the last few years. Most recently, since mid-2024, three experienced commissioners have left the commission. Typically, the commission has at least one commissioner who is an attorney, and one of the governor's recent appointees previously served in the state's Department of Law, which represents the public interest in commission proceedings on behalf of the attorney general in the department's Regulatory Affairs and Public Advocacy Section. Additionally, the newest member of the commission worked at the Alaska Public Utilities Commission — the predecessor of the RCA — and the Federal Energy Regulatory Commission. All three new appointees are serving pending confirmation by the General Assembly in the 2025 session. The recent staffing challenges and new regulator additions raise questions concerning the commission's ability to implement policies to modernize the electric system and improve the grid.

In addition, investor-owned utilities, state cooperatives and municipal utilities have expressed concern about a potential gas shortage due to dwindling natural gas supply in the Cook Inlet. While the state's only investor-owned gas utility, ENSTAR Natural Gas Co., has not experienced an interruption in service due to a lack of gas supply, the utility has warned that such an eventuality is becoming more possible. Furthermore, state lawmakers have requested a federal investigation into the region's predominant natural gas producer and alleged anticompetitive practices that lawmakers suspect might have contributed to the supply shortage.

Recent events in Arizona merit continued scrutiny. The Arizona Corporation Commission's (ACC) ongoing examination, and possible repeal, of rules pertaining to renewable energy standards and energy efficiency requirements for electric and gas utilities remains an important consideration. The actions taken within these dockets stand in sharp contrast to the resource plans developed by the state's energy utilities, which are moving toward more renewables-heavy resource mixes. In another noteworthy development, in December 2024, the ACC adopted a policy statement favoring alternative regulation, which is generally constructive from an investor viewpoint. While this policy statement lacks the force of a more binding official rulemaking, it opens the door for the utilities to begin operating under streamlined formula rate plans rather than the traditional general rate case process.

There will also be changes in the commission's makeup in 2025. In November 2024, two new ACC commissioners were elected, and a third was reelected for terms that commence in January 2025. Moving forward, it is unclear what impact the new members will have on ACC leadership dynamics and general commission policy decisions.

Iowa continues to be a state to watch as the actions of the Iowa Utilities Commission (IUC) in the most recent advance ratemaking proceedings for new renewable generation projects could signal a shift in policy. In October 2023, the IUC modified a settlement for Alliant Energy Corp. subsidiary Interstate Power & Light Co. (IPL), including a reduced authorized return on equity (ROE) for a new solar project. Although the ROE ultimately approved by the IUC is above prevailing industry averages, it is below the returns previously approved by the IUC for these facilities. In a subsequent decision, the IUC approved Berkshire Hathaway Energy Co. subsidiary MidAmerican Energy Co.'s Wind PRIME project, but one commissioner expressed concerns about approving a "premium ROE" within mature renewable energy markets. Although IUC actions in future advance ratemaking proceedings bear continued observation, the commission's decisions in four base rate cases resolved in 2024 respected the integrity of the underlying settlements, somewhat lowering overall uncertainty around the regulatory environment for existing facilities.

Kentucky continues to bear watching as the Kentucky Public Service Commission's pattern of imposing modifications to rate case settlements over the past couple of years remains a cause for concern. The most recent rate case decision for a large utility occurred in January 2024, when the PSC authorized American Electric Power Co. Inc. subsidiary Kentucky Power Co. a rate increase that was meaningfully below the stipulated hike the parties had agreed to in a settlement; the revenue requirement difference stemmed largely from an adverse ruling on transmission-related cost recovery. The commission also rejected a settlement provision that called for the company to implement a distribution reliability rider.

On a more constructive note, legislation enacted in 2023 prohibits the Kentucky PSC from approving requests to retire fossil fuel-fired facilities unless the utility can demonstrate that the plant's retirement would not adversely impact ratepayers or the region's electric grid reliability. The PSC approved one such proposal — by PPL Corp. subsidiaries Louisville Gas and Electric Co. and Kentucky Utilities Co. — that will result in significant changes to the composition of the companies' generation portfolios.

In addition, a separate bill signed in 2023 allows the electric utilities to securitize certain costs associated with retired generation facilities and storm restoration efforts. Although the PSC approved Kentucky Power's securitization request, it is unclear how the commission will approach future requests.

Recent commissioner changes are also a cause for concern in Kentucky. The term of former Chairman Kent Chandler expired June 30, 2024, and he left the commission instead of seeking reappointment. Gov. Andy Beshear recently named John Will Stacy (D), a former state legislator, to fill the vacancy. This development adds uncertainty to the state's regulatory climate at a time when investors are seeking clarity regarding the commission's stance on a variety of regulatory matters. Four large base rate proceedings are pending before the commission.

The Montana regulatory climate merits ongoing observation, with interim rate increases arising as a point of contention between regulators and the state's electric and gas utilities and the addition of two new commissioners to the Montana Public Service Commission.

In their respective pending rate cases, NorthWestern Energy Group Inc. (Docket Nos. 2024-05-053 (elec) and 2024-05-053 (gas)) and MDU Resources Group Inc. subsidiary Montana-Dakota Utilities Co. (Docket No. 2024-05-061) have filed for reconsideration of PSC orders regarding the companies' requests to implement interim rate increases while their cases proceed. The PSC substantially lowered the interim rate hike sought by NorthWestern and rejected MDU's interim rate proposal in its entirety.

In most cases before the commission over the years, the PSC has generally authorized interim rate changes on a subject-to-refund basis, usually within two to four months after the date of filing. Utilities can ask for interim rates if they demonstrate that they are not covering their cost of service with existing rates or earning a reasonable return on their investments.

RRA lowered its ranking of Oklahoma regulation in November 2023 due to uncertainty caused by changes in the composition of the Oklahoma Corporation Commission (OCC); the combative stance taken in several proceedings taken by Commissioner Bob Anthony, a long-time OCC member; and the commission's decision to depart from customary practice and require significant changes to a rate case settlement. Reflecting ongoing uncertainty regarding the OCC's future stance and settlements and given that a new commissioner, J. Brian Bingman, was recently elected to replace Anthony and will start serving in January 2025, RRA continues to view the state as one to watch.

Investors should also keep an eye on Oregon, with regulators opening the door to a potential shift toward multiyear ratemaking in the coming years. In an Oct. 25, 2024, order granting Northwest Natural Holding Co. subsidiary Northwest Natural Gas Co. a $95 million gas rate increase, the Oregon Public Utility Commission directed the PUC staff to present a report in 2025 that addresses the types of multiyear rate plans available, how other jurisdictions have implemented multiyear rate plans, the likely resource commitment and timeline required to effectively implement multiyear rate plans and any concerns raised by stakeholders.

Northwest Natural indicated that it would file for a multiyear rate plan in its next general rate proceeding, which would set rates over a potentially three- to four-year period and possibly allow for rate changes throughout the plan, avoiding the need for the utility to submit more frequent rate filings as the company contends with increasing costs associated with state clean energy rules and other factors. The case was filed on Dec. 30, 2024.

The Wyoming regulatory climate continues to bear watching as the legal and legislative ramifications of a contentious 2023 electric general rate case decision for Berkshire Hathaway Inc. subsidiary PacifiCorp continue to play out. The utility has filed federal and state suits against the Wyoming Public Service Commission's final order issued in January 2024, arguing that the PSC failed to account for the costs of maintaining reserve capacity, as mandated by FERC. While the appeals process continues, PacifiCorp filed a new rate case that is expected to conclude in June 2025. A small case is also pending for MDU Resources Group Inc., its first since 2020. In addition, the commission is reviewing requests by several of the state's electric utilities to address issues related to excess liability insurance premiums related to wildfire risk, which bears keeping an eye on.

|

RRA State Regulatory Evaluations — Energy Access the full interactive report. Access the supplemental data file.

|

Methodology

RRA ranks the regulatory climate in 53 state-level jurisdictions, including the District of Columbia and the New Orleans City Council, and two regulatory bodies in Texas — the Public Utility Commission of Texas regulates electric utilities, while the Railroad Commission of Texas regulates gas local distribution companies.

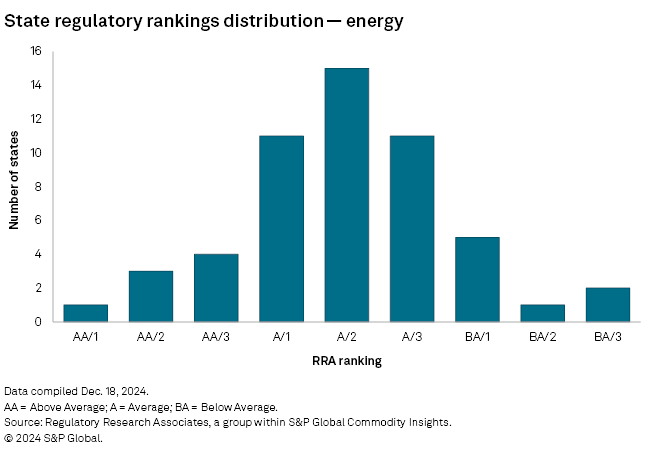

RRA maintains three principal ranking categories — Above Average, Average and Below Average — with Above Average indicating a relatively more constructive, lower-risk regulatory environment from an investor viewpoint and Below Average indicating a less constructive, higher-risk regulatory climate.

The numbers 1, 2 and 3 within each principal ranking category indicate relative position. The designation 1 indicates a stronger or more constructive ranking from an investor viewpoint; 2, a midrange rating; and 3, a less constructive rating.

The rankings reflect the interest of equity and fixed-income investors and reflect the state regulatory commission's decisions and the impact of the actions taken by the governor, the legislature, the courts and consumer advocacy groups.

RRA endeavors to maintain an approximately normal distribution, with most rankings in the three average categories and the remainder split almost evenly between the Above Average and Below Average categories.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

For a complete, searchable listing of RRA's in-depth research and analysis, visit the S&P Capital IQ Pro Energy Research Library.

Theme

Location