Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 11 May, 2021

By Julber Osio, CFA and Erik Keith

5G commercial rollouts accelerated in the past year despite disruptions due to the COVID-19 pandemic, reaching 158 local operators with active networks in 67 markets worldwide as of March 2021.

Click here for an Excel file containing data on completed 5G commercial service launches as of March 2021. It also includes spectrum and vendor partner data for 5G trials and launches worldwide (requires subscription).

The COVID-19 pandemic derailed the 5G timeline of many operators and regulators worldwide, primarily through postponed or canceled spectrum auctions and restrictions on tower building. Nevertheless, more commercial 5G launches happened in 2020 than ever before. At least 36 launches occurred in the first half of the year, followed by 56 launches in the latter half. Seven more launches followed as of March 2021.

Vodafone Group PLC and its affiliates still have the widest 5G footprint of 15 markets as of March 2021, with the Czech Republic (October 2020) and Greece (January 2021) as the latest additions. CK Hutchison Holdings Ltd. and its affiliates have launched commercial 5G in seven markets, including Denmark (December 2020), Ireland (September 2020) and Italy (November 2020).

Other large operators with an extensive 5G footprint include Deutsche Telekom AG (nine markets, including T-Mobile US Inc. in the U.S.), Telefónica SA (as Telefónica, Movistar, O2 and Vivo in five markets), Orange SA (in four markets) and Telia Company AB (publ) (also in four markets).

At least two operators have deactivated their 5G networks after launch: Sprint Corp. in the U.S. (absorbed into T-Mobile's 5G network in July 2020) and Telma Mobile in Madagascar (suspended by the local regulator in July 2020).

While most 5G deployments are still in non-stand-alone mode, at least six operators have claimed to have launched stand-alone 5G: Rain in South Africa (Feb. 2019), T-Mobile US in the U.S., Puerto Rico and U.S. Virgin Islands (Dec. 2019), Rogers Communications Canada Inc. in Canada (Jan. 2020), DIRECTV Colombia Ltda. in Colombia (Sept. 2020), Singtel in Singapore (Oct. 2020) and China Telecom Corp. Ltd. in Mainland China (Nov. 2020).

5G spectrum highlights

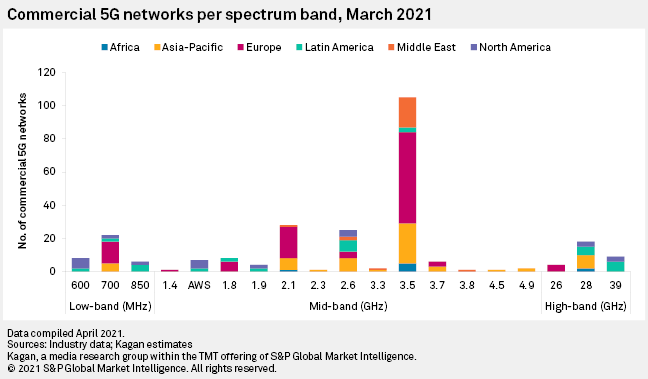

Mid-band spectrum for 5G has gained the widest acceptance worldwide, due to its good balance between coverage and capacity and also because of its adjacency to legacy 4G spectrum bands and the availability of large contiguous bandwidth. Out of the 167 commercial 5G networks in our list, 154 have used mid-band spectrum. This is quite impressive when compared to only 34 that use low-band and 26 that use millimeter wave, or mmW, spectrum.

Of the commercial 5G networks on our list, 105 have used 3.5 GHz, making it the most popular mid-band 5G spectrum worldwide. Pioneer 5G markets in the Asia-Pacific, Europe and the Middle East favor 3.5 GHz. North America is an exception, where 600 MHz and mmW spectrum are more popular for 5G. This may change soon, especially after the U.S. successfully auctioned 3.5 GHz licenses in August 2020 and 3.7 GHz in March 2021.

One interesting development in 2020 was the increased adoption of dynamic spectrum sharing, or DSS, for 5G. DSS technology allows the deployment of 5G networks alongside earlier generation networks on legacy spectrum bands even if they are not officially designated for 5G.

At least 44 commercial 5G networks worldwide use DSS as of March 2021. Most of these DSS deployments run on either low-band or mid-band spectrum currently used for 4G networks. This explains the sudden spike in commercial 5G networks using 700 MHz, 2.1 GHz and 2.6 GHz spectrum in our list.

We expect that DSS deployments will only be a temporary measure while some operators await the awarding of official 5G spectrum since spectrum bands used for them are not internationally standardized.

5G vendor highlights

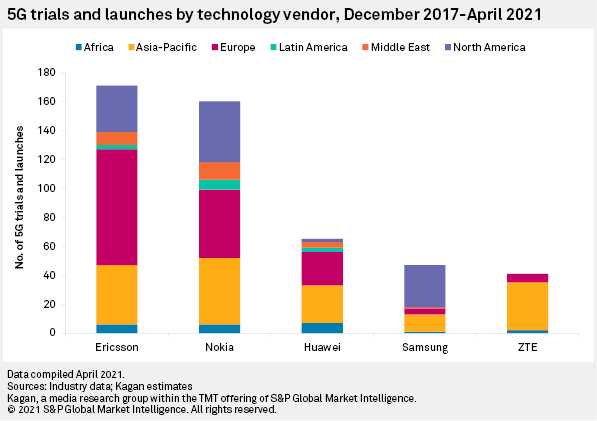

According to our data spanning from December 2017 to April 2021, Telefonaktiebolaget LM Ericsson (publ) and Nokia Corp. have the largest footprints worldwide in terms of total 5G trials and launches.

In terms of sheer small cell shipments, Huawei Technologies Co. Ltd. is the leader, as discussed in our fourth quarter 2020 market share report. However, Huawei's leading position is bolstered substantially by its dominance of its Chinese home market, where small cell shipments dwarf those of other markets.

Due to geopolitical pressures, Huawei's global customer footprint actually receded in 2020, based on its February 2020 claim of 91 commercial 5G contracts. At Huawei's recent Global Analyst Summit, the vendor cited 50 commercial 5G contracts but also claimed to have built over 140 5G networks worldwide, in 59 countries. So, there is a bit of 'hedge room' for interpreting Huawei's customer count — as there is with other systems vendors — given varying definitions of commercial contracts, deals, and agreements vs. deployments. However, the only major, publicly-disclosed 5G implementation by Huawei outside of China in the past six months was with an existing Huawei customer, Russian operator Mobile TeleSystems PJSC.

In contrast, Ericsson had a banner year on the 5G customer acquisition front. As of April 2021, Ericsson claimed 136 commercial 5G contracts, including 85 live networks in 42 markets. Ericsson's global presence has expanded substantially since it reached the 100 commercial contract milestone in August 2020, thanks to customer traction in every global region. This includes mainland China, where Ericsson is effectively the only major western supplier of 5G solutions that will continue to pursue new business in the Chinese market.

Ericsson's persistence in China contrasts with that of Nokia, which in 2020 decided to limit further exposure in China due to the degree of difficulty in competing primarily with home market vendors, which limited Nokia's ability to be profitable in this market. But outside of China, Nokia also generated increasing traction in the global 5G infrastructure market during 2020 and first quarter 2021. As of April 2021, Nokia claims 160 commercial 5G deals, more than 220 commercial 5G agreements and 63 live networks supported. This includes 84 5G contracts with service providers: 13 in the Americas, 38 in Europe, 24 in Asia-Pacific and nine in Africa.

After Huawei, Ericsson and Nokia, ZTE Corp. and Samsung Electronics Co. Ltd. account for the remainder of the global 5G systems shipped into (and deployed in) wireless operator networks. While ZTE faces the same geopolitical hurdles as Huawei, and as such its global customer footprint is limited (to an estimated 50 commercial 5G contracts), Samsung has come on quite strong over the past three quarters.

Samsung's momentum comes down to two key factors: wireless operators seeking out an additional, alternative top-tier 5G solution supplier and Samsung's extensive 5G experience in the advanced South Korean market. In addition to its big win with Verizon Communications last year, Samsung won major 5G contract deployments in Japan with KDDI Corp. and NTT DOCOMO INC. and in Canada with SaskTel Company and Videotron Ltd. Samsung received further validation from Verizon Communications Inc. in January 2021, when it was disclosed that Verizon became the first mobile operator to commercialize a fully virtualized 5G RAN.

Wireless Investor is a regular feature from Kagan, a media market research group within S&P Global Market Intelligence's TMT offering, providing exclusive research and commentary.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Research

Research