Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

27 Jun, 2025

By Brian Scheid and Annie Sabater

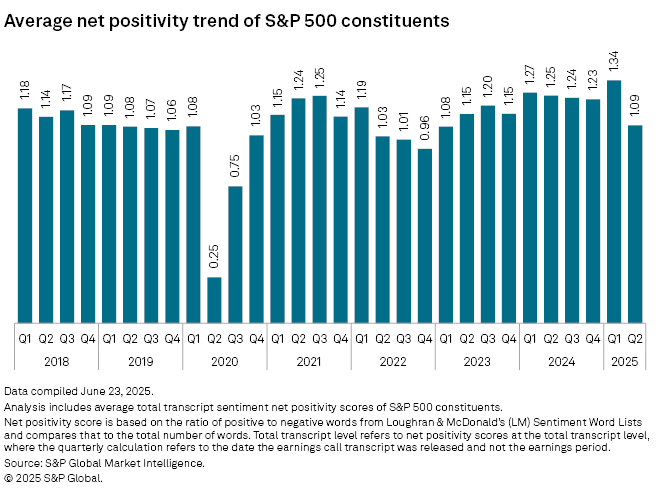

Optimism from S&P 500 company executives on earnings calls during the second quarter fell to its lowest level in two years, according to an S&P Global Market Intelligence analysis.

As market uncertainty and volatility soared as US President Donald Trump's tariffs on nearly all global trading partners began to take shape, average net positivity on S&P 500 earnings calls from April through June tumbled to 1.09 from 1.34 the previous quarter, Market Intelligence data collected through June 23 shows. That was the lowest net positivity score since the second quarter of 2023.

Executives' attitudes sharply reversed from positivity in the first quarter, which was at its highest point since at least the start of 2018, when Market Intelligence's dataset measuring earnings call sentiment began. Net positivity is a measure of the ratio of positive to negative words in call transcripts.

First-quarter results, which were reported during the second quarter, largely exceeded expectations. Aggregate earnings per share of all S&P 500 companies in the first quarter climbed 13.1% year over year. S&P 500 EPS saw a 16.2% year-over-year increase in the fourth quarter of 2024.

As of June 25, the S&P 500 is up about 3.6% since the end of 2024 and has rallied nearly 22.3% since April 8, which marked the large-cap index's low point so far this year.

Steep drop in energy

The S&P 500 energy sector's average net positivity score fell to 1.00 in second quarter calls, a 48-basis-point decline from the first quarter and the steepest drop of any of the index's 11 sectors.

Valero Energy Corp. had the lowest net positivity in the energy sector, with a score of -0.09, the analysis shows. On April 24, Valero reported a net loss attributable to Valero stockholders of $595 million, or $1.90 per share, largely due to a $1.1 billion pretax asset impairment charge related to its plan to exit its operations in California.

"We delivered positive results for the first quarter despite heavy maintenance activity across our refining system and a tough margin environment in the renewable diesel segment," R. Lane Riggs, Valero's CEO, during a call in April.

The consumer discretionary sector had the highest average net positivity, with a score of 1.34, though that was down from 1.59 the previous quarter.

Williams-Sonoma Inc. had the had the sector's highest score at 3.11, up from 3.02 the previous quarter. The company announced May 22 that it exceeded estimates in the first quarter with an operating margin of 16.8% and per share of $1.85.

"We are optimistic about 2025," CEO Laura Alber said during the most-recent earnings call. "We are planning to gain market share, enhance the customer experience and deliver strong earnings."