Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

12 Jun, 2025

By Dylan Thomas

Regulators are easing restrictions that prevented US retirement savers from investing 401(k) assets in private equity funds, as policymakers reconsider retail investors' access to private markets.

The Securities and Exchange Commission under the Trump Administration is removing barriers on access to private funds by retail investors. In May, Chairman Paul Atkins said the commission would end personal wealth requirements for individual investors in closed-end funds that invest 15% or more of their assets in private market funds.

“Allowing this option could increase investment opportunities for retail investors seeking to diversify their investment allocation in line with their investment time horizon and risk tolerance,” SEC Chairman Paul Atkins said at the SEC Speaks conference last month.

The door to private equity has not yet fully opened for defined contribution plans like 401(k)s, which are regulated by the Department of Labor. But the moves are setting off alarm bells for critics who argue the risk, illiquidity and fee structure of private equity funds aren’t a good match for most retirement savers.

“It just doesn’t end well,” said Brian Payne, chief strategist for private markets and alternatives at BCA Research. Nevertheless, Payne said the shift appeared “inevitable.”

Capital access challenges

Payne argued that pressure from large alternative asset managers, rather than regulatory initiative, drives the loosening of restrictions on retail access to private markets.

Those managers raise the vast majority of their capital from institutional investors such as pension funds, sovereign wealth funds, university endowments and family offices. And it’s getting tougher.

Global private equity fundraising declined for a third consecutive year in 2024 to its lowest annual total since 2015. The decline is directly linked to a weak exit environment, which has slowed the return of capital to investors.

“If you’re not getting money back as an institution, you’re going to be having a bit of a challenge allocating in,” Payne said. “How do you keep the music going if you’re a big asset manager? You tap the retail crowd.”

The opportunity is huge. At the end of 2024, US retirement savers collectively held $12.4 trillion in their 401(k) accounts, according to the Investment Company Institute, a trade association.

Evolving regulations

The SEC is pushing forward. Earlier this month, Natasha Vij Greiner, director of the SEC’s division of investment management, said the commission is already in conversation with managers of private fund of funds — investment vehicles that buy stakes in multiple private market funds — to broaden retail access.

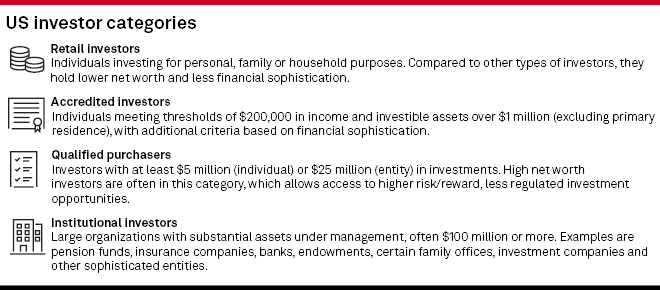

“I believe it is appropriate to consider under what circumstances private fund investments should be available to investors who are not accredited investors or qualified purchasers,” Greiner said.

Accredited investors must have an annual income of at least $200,000 or investable assets totaling $1 million. The qualified purchaser standard sets the wealth and income bar even higher.

While 401(k)s haven’t explicitly factored into the recent pronouncements from SEC officials, the commission seems to be looking in that direction, said Vadim Avdeychik, a partner at Debevoise & Plimpton and member of the law firm’s investment management group.

“It does sound to me like they're becoming more open to the idea of private markets, alternative assets within the 401(k) sphere,” Avdeychik said.

New investment products tailored to 401(k) plans are already starting to appear. In May, Empower Annuity Insurance Company of America, which manages $1.8 trillion in retirement savings for 19 million individuals, announced an initiative to add private market funds from a group of managers, including Apollo Global Management Inc., to certain retirement plans via collective investment trusts.

"I think those are going to be real accelerants to our business," said Apollo President James Zelter when asked about the deal at a conference.

‘A minefield’

Private equity investments would be “a minefield of danger” for administrators of 401(k) plans, said attorney Jerry Schlichter of law firm Schlichter Bogard, who has led lawsuits targeting excessive fees in employer-sponsored retirement plans. Administrators have a fiduciary duty to plan participants to thoroughly vet the plan’s investments.

“It's tough enough for a lot of people to understand traditional public investments, such as collective investment trusts or mutual funds. But this is levels of magnitude above that in the complexity, the opaque nature of it and the way fees are structured,” Schlichter said.

Payne shared Schlichter’s concern that the fees charged by private fund managers would erode returns for retirement plans. But he said the main risk for individual investors and retirement savers is that products created for the retail market will be stuffed with bad deals more sophisticated institutional investors want no part of.

“You're going to see a lot of unsophisticated investors getting these structures just because they call it private equity or private credit, and that leads to bad decisions,” he said.

Growing pains

Pushing deeper into the retail market is a multi-trillion-dollar opportunity for PE, but it also poses challenges, and even risks, for the industry. It's partly an issue of scale, with large asset managers bulking up internal wealth management teams for their initial forays into the retail market, a much vaster space than the relatively small pool of global institutional investors PE has worked with historically.

Widening the aperture to include average retirement savers exposes PE to heightened liquidity risks and an increased possibility that market volatility could prompt investors to demand their cash, Moody's Ratings cautioned in a June report. Blackstone Inc. went through that scenario in 2022, when it was forced to limit redemptions from Blackstone Real Estate Income Trust Inc.

Moody's also warned that if PE taps into the retirement savings market, it must identify suitable investments for the influx of capital. Increased competition could complicate this, potentially leading some managers to make poor investment choices.