S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

17 Jun, 2025

By Brian Scheid

Institutional investors appeared to shrug off the US equities rally in May by boosting their selling of stocks.

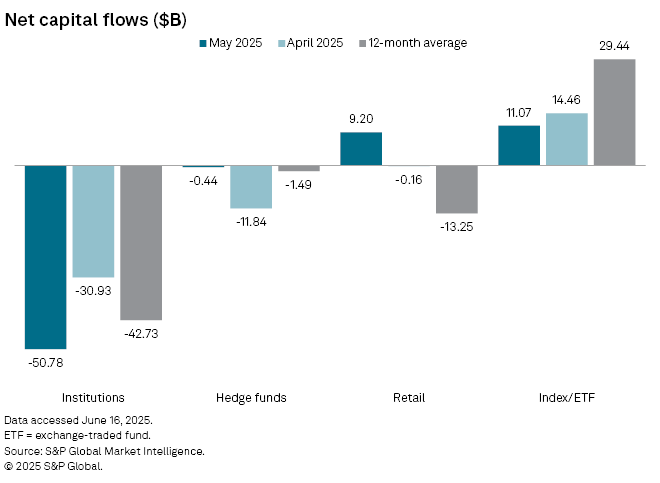

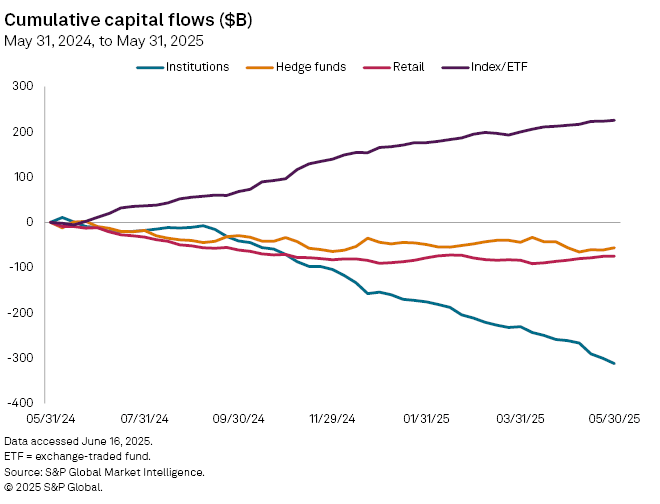

Institutions sold a net $50.78 billion in stocks in May, up from $30.93 billion in April and above the net $42.73 billion average sold by this investment group over the past year, according to the latest S&P Global Market Intelligence data. The sell-off took place as the S&P 500 rallied nearly 6.2% throughout May.

Institutional investors were pushed to sell by a number of factors in May, including ongoing trade uncertainty and a decision by Moody's Investors Service to cut its US bond rating.

"Institutions still don't feel that we are out of the woods in relation to tariffs, recession and overall global uncertainty," said Thomas McNamara, a director for issuer solutions with Market Intelligence.

As institutions sold, retail and index and exchange-traded fund investors bought.

Retail investors bought $9.20 billion in stocks throughout May, reversing this group's selling trend. Retail investors sold a net $163 million in stocks in May and have averaged $13.25 billion in monthly net sales over the past year, the data shows.

Index and exchange-traded fund investors bought a net $11.07 billion in stocks in May, down from the $14.46 billion bought in April and the net $29.44 billion bought on average each month.

"It is never a zero-sum when it comes to buying and selling," McNamara said. "There are a lot of factors that go into this on a general basis, but this month, a main driver was share buybacks. This may also be a reason why the market rebounded like it did without any long-only conviction."

Sector flows

Institutions sold stocks in 10 of 11 market sectors, boosting their positions only in information technology. This follows the recent run-up in stocks, a rally largely concentrated in tech.

"AI is one of the only positive stories that is exciting investors at this time, and with the overall returns it has produced, investors are not as afraid to put money to work there compared to other sectors," McNamara said. "Also, the big names in the space reported strong earnings, helping institutional investors find comfort in the sector."

– For more information on capital flows data from Issuer Solutions, contact Thomas McNamara at thomas.mcnamara@spglobal.com.