Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

03 Jun, 2025

By Nick Lazzaro

|

Germany's stock market performance outpaced many global peers through May as a bullish outlook for the country's fiscal expansion offset fears of economic pressure from global trade tensions.

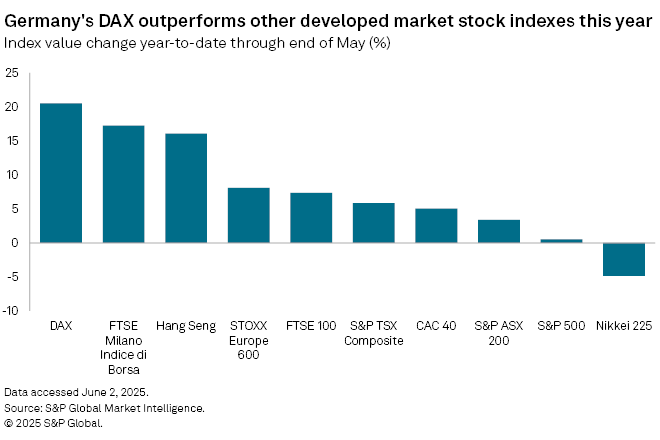

The country's DAX index posted a year-to-date return of over 20% at market close May 30, outperforming the S&P 500's 0.51% return and most other peer index returns in developed markets, according to S&P Global Market Intelligence data. The DAX bounced back in May after taking one of the hardest hits among global stock indexes on April 3, with a 3.01% loss in the aftermath of US President Donald Trump's global tariffs announcement.

Concerns stemming from the proposed US tariffs on most countries sent the DAX down to a near 2% year-to-date loss by April 9 from a gain of over 16% in mid-March. Yet, investors continue to eye Europe for capital diversification opportunities this year amid US market volatility, and German stocks have rebounded as the country retains its status from earlier this year as a favored investment target due to its new spending plans.

"It can't be understated how significant of a change this is, with Germany historically a fiscally conservative country amending the constitution to allow for significant rearmament and infrastructure stimulus packages," Nick Niziolek, co-chief investment officer, head of global strategies and senior co-portfolio manager at Calamos Investments, told Market Intelligence.

Following the country's February elections, Germany's leadership signaled that it would prioritize its security and economic needs while playing a larger role in Ukraine's defense against Russia amid an increasingly strained relationship between the US and Europe. Germany's newly elected government later adopted an expanded fiscal budget in March that established infrastructure and defense spending funds that were exempt from the country's debt limits.

"You can see banks and other investors are going back into that market on the basis that investment in Germany, in particular, and Poland and other surrounding states are extremely well positioned to provide additional defense to Ukraine," John Bohan, head of business development at Apex Group, said in an interview. "Germany is seen as a stronghold jurisdiction from a defense perspective, so the investment into those traditional areas in which we know Germany to be so strong has been doubled down on."

Germany's financial account surplus reached a record €59.97 billion, or $68.08 billion, in March, according to Deutsche Bundesbank data. The financial account data represents the balance of capital flows of Germany's economy.

Risks to Germany's outlook

Still, Germany's slow emergence from recent economic weakness and exposure to US tariff policy pose potential challenges to its outlook.

"Germany entered its third year of recession, battered by high energy costs, declining exports, and its slow adoption of new technologies, while political uncertainty continues to result in investor concerns," Richard Surrency, group chief commercial officer at IQ-EQ, told Market Intelligence. "Export-dependent markets such as China and Germany are likely to remain challenged moving forward as trade imbalances are the focus of the new US administration."

Market Intelligence forecasts Germany's real GDP to grow just 0.01% in 2025 after contractions of 0.2% in 2024 and 0.06% in 2023. The country's real GDP is projected to increase by 1.08% in 2026, 1.71% in 2027 and 1.66% in 2028.

Germany was also the world's second-largest net exporter behind China in 2024, with a trade balance of nearly $260 billion, according to Market Intelligence data. Its largest trading partner is the US, with which it had a trade balance of $102.41 billion in 2024. The country's top export to the US — automobiles — is now subject to a 25% tariff.

Capital deployment into global markets may also have already peaked this year, which could cause further gains in indexes such as the DAX to lose steam, according to Garrett Melson, portfolio strategist with Natixis Investment Managers.

"You're getting to some pretty extreme levels in terms of a lot of investors positioning overweight to Europe relative to underweight in the US, and you're getting to points where those tend to have a habit of mean-reverting," Melson said in an interview. "I would be a little bit skeptical that you continue to see this degree of outperformance persist through the remainder of the year."

Influence on other markets

Germany's new leadership has been at the forefront of acknowledging the need to reduce reliance on the US. Ahead of becoming chancellor in May, Friedrich Merz said in February that his "absolute priority will be to strengthen Europe as quickly as possible so that, step by step, we can really achieve independence from the US."

"While Germany was one of the first countries to adapt to this new environment, our expectations are that this will be a catalyst for change globally," Niziolek with Calamos Investments said. "In a weak dollar environment, foreign central banks should have more flexibility to ease monetary policy, and as geopolitical and trade risks rise, more countries will likely turn inward for growth and consumption."

More generally, as Europe's biggest economy, investor attraction to Germany has benefited overall capital flows into the continent.

"Launching EU funds allows you to sell one fund in the EU from state to state just by registering that fund, so more US investment managers are looking toward the EU and tapping into that population of over 400 million to try and raise capital," said Apex's Bohan. "There's definitely a lot of optimism for Germany, and being one of the strongest economies in Europe has also helped buoy European securities."