Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

11 Jun, 2025

By Audrey Elsberry and Annie Sabater

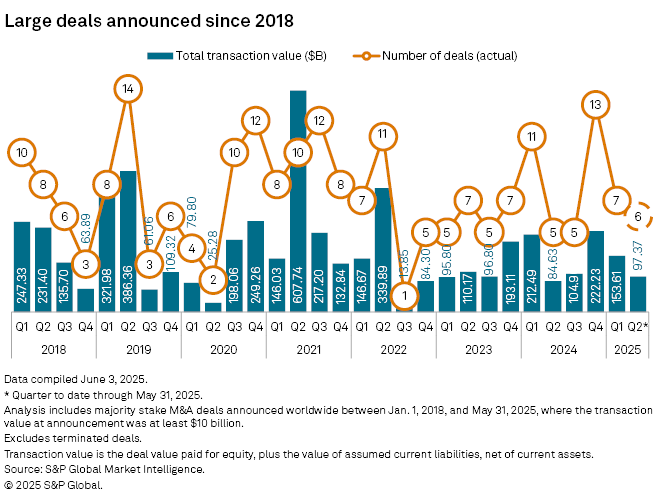

Four M&A deals with a transaction value of more than $10 billion were announced worldwide in May, putting the second quarter's deal count one shy of the first-quarter total.

Two deals were in the energy sector, one in the telecommunications sector, and one in the consumer sector. Charter Communications Inc.'s purchase of Cox Communications Inc., announced May 16 with a transaction value of $36.70 billion, is the third-largest M&A deal by transaction value in the past 12 months, according to S&P Global Market Intelligence data.

As deal consideration, Cox will receive $4 billion in cash and $6 billion in convertible preferred units in Charter's existing partnership, plus 33.6 million units in Charter's existing partnership with an implied value of $11.9 billion, according to the merger release. The combined company will take on Cox's roughly $12 billion in outstanding debt.

After a quieter month, with two $10 billion-plus M&A deals announced in April, activity picked up as the environment began to settle from prolonged uncertainty. The market has absorbed large transaction announcements well after tariff-related market volatility, Goldman Sachs President and COO John Waldron said during an industry conference.

"We've worked on a number of very sizable important M&A transactions," Waldron said. "I still think there's a pretty strong, resilient M&A market and if we get a little bit more certainty in the backdrop, you could see a pretty good size lift in volumes."

Goldman Sachs was an adviser to Parkland Corp. on its sale to Sunoco LP, announced May 5, with a transaction value of $10.06 billion. The oil and gas refining transaction, in which Sunoco expands its Canadian footprint with Parkland's presence in Alberta, Canada, is expected to yield $250 million in run-rate synergies in three years, according to the merger release.

|

– – Read the M&A and equity offerings research paper. – Read more |

In another energy deal, Blackstone Inc. said May 19 that it plans to acquire TXNM Energy Inc. in a deal with a transaction value of $11.94 billion. The purchase by Blackstone provides capital for the New Mexico-based electricity infrastructure company to make clean energy advancements and grow its Texas footprint, according to the merger release.

In the consumer sector, shoemaker Skechers U.S.A. Inc. announced plans to sell to private equity firm 3G Capital Inc. in a deal valued at $11.35 billion. Skechers Chairman and CEO Robert Greenberg will remain at the head of the company as it shifts to a privately held institution after the deal's close, according to the merger release.

Skechers shareholders will be given the option to receive $63 per share of Skechers common stock or $57 in cash and one unlisted, non-transferable equity unit of the newly formed private parent company after the transaction closes, according to the release.