S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

26 Jun, 2025

By Nick Lazzaro

International Monetary Fund officials discuss the economic outlook for the Western Hemisphere during a press conference at an event hosted by the IMF and the World Bank Group in Washington, DC, on April 25. In a report released in April, the IMF projected that US real GDP growth would slow in 2025 and 2026 from the previous two years. This economic headwind could disproportionately impact small-cap stock returns. |

US small-cap stocks face an uncertain trajectory for the second half of the year as benchmark indexes sag and trail their larger peers.

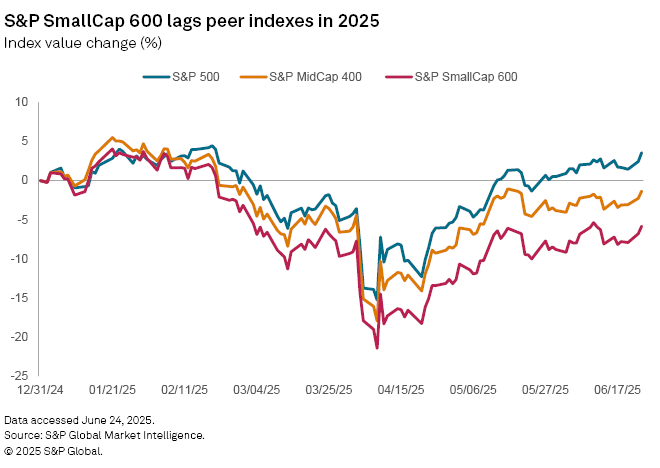

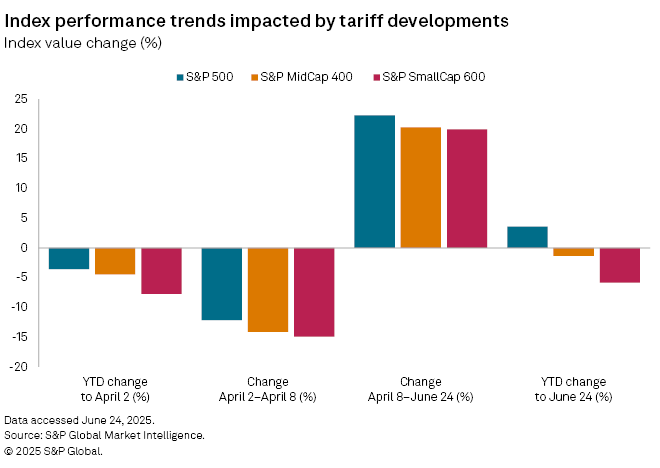

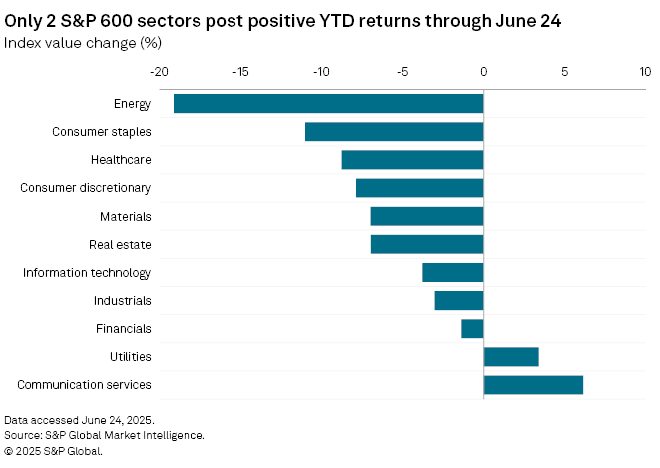

The S&P SmallCap 600 index is down almost 6% this year through June 24, lagging the slimmer loss for the S&P MidCap 400 and a positive return for the large-cap S&P 500, according to S&P Global Market Intelligence data. The index measures the performance of 600 small companies in the US.

As of May 30, the index's constituents had a mean total market capitalization of $2.29 billion.

Stock indexes across market capitalizations and regions plunged in early April after the US proposed wide-ranging tariffs on most of its trading partners. Markets largely recovered from the April sell-off after the US opted to delay most tariff implementation and pursue trade negotiations.

Trade uncertainty persists, and small-cap company stocks are under more pressure than their large-cap peers even with the potential advantage they might wield if tariffs ultimately go into effect.

"It seems investors are pricing small-cap stocks based more on the impact of tariffs on economic growth than on the potential benefits to small-cap companies from their lower connection to overseas markets," Compound Planning Chief Investment Officer Steve Dean told Market Intelligence.

US real GDP is projected to grow 1.42% this year, slower than the growth rates of 2.8% in 2024 and 2.89% in 2023, according to Market Intelligence data as of June 24.

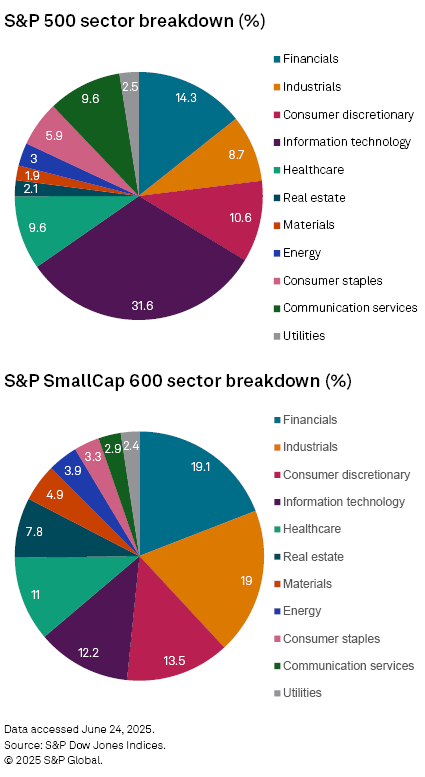

Small-cap stocks may continue trailing large-cap indexes due to their smaller exposure to technology companies that are pursuing investments related to AI, Dean said. Companies in the IT sector make up 31.6% of the S&P 500, compared with a 12.2% representation in the S&P SmallCap 600.

Valuation advantage

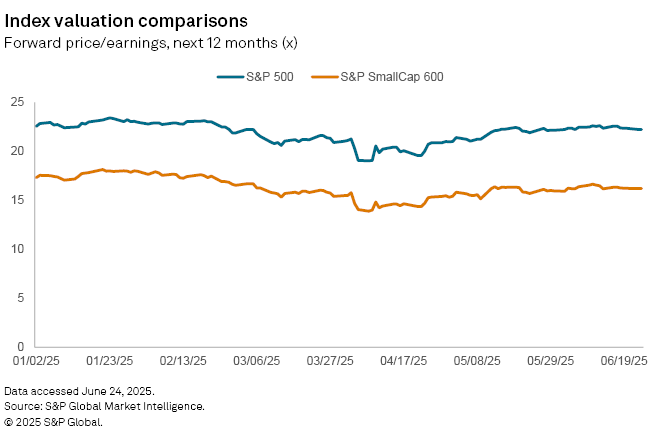

One potential point of optimism for small-cap stock performance could stem from relative valuation levels relative to large-cap stocks.

"From a pure valuation perspective, small-cap stocks look comparatively cheap," said Jim Baird, chief investment officer with Plante Moran Financial Advisors, in an interview. "Given the valuation disparity, if we can get greater clarity on the trade front, if we can get greater clarity in terms of the economic outlook, I think there's a story there. But right now, it's a story in search of a catalyst."

As of June 24, the constituent stocks of the S&P SmallCap 600 index were trading at 16.21x their forward earnings estimates for the next 12 months. This compares to the higher forward price-to-earnings multiple of 22.23 for the S&P 500's constituent stocks.

The S&P SmallCap 600 index was hit harder than its midcap and large-cap counterparts during the early-April market sell-off, falling nearly 15% from April 2 to April 8. However, the index's rebound of nearly 20% from April 8 to June 24 following the US tariff delay suggests that the sell-off did little to alter small-cap pricing and valuation fundamentals.

"You are resetting where you were originally," said Paul Cavazos, senior vice president and chief investment officer at American Beacon Advisors, in an interview. "If you have a(n) [asset] holding period of two to four years, then if things go back to being fundamentally based, then it still could be a good hold."

Other economic challenges

Small-cap stocks tend to have thinner profit margins that are more susceptible to deteriorations in economic cycles, uncertainty and recession fears, Plante Moran's Baird said.

Elevated interest rates also continue to weigh on small-cap companies. The US Federal Reserve has adopted a cautious approach to interest rate cuts this year after issuing three cuts to its benchmark rate in 2024. However, the central bank's current policy rate range of 4.25% to 4.50% is still higher than at any time between 2008 and late 2022, when it was approaching the end of its aggressive rate hiking following the COVID-19 pandemic.

Moreover, US Treasury bond yields remain elevated. The yield for the US 10-year Treasury note settled at 4.38% on June 20. Though this has retreated from levels nearing 4.8% earlier this year, the 10-year yield exceeded 4% only once in the decade before the pandemic.

"Small-cap companies are more likely to be dependent upon bank loans or variable rate debt," Baird said. "They tend to not have the ability to go to the bond market and lock in debt at competitive rates, so I think they've been negatively impacted there as well."