Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

14 May, 2025

By Brian Scheid and Annie Sabater

The US consumer price index, the market's preferred measure of inflation, is rising at the slowest rate in more than four years, but economists believe consumers will soon see the effects of President Donald Trump's tariffs.

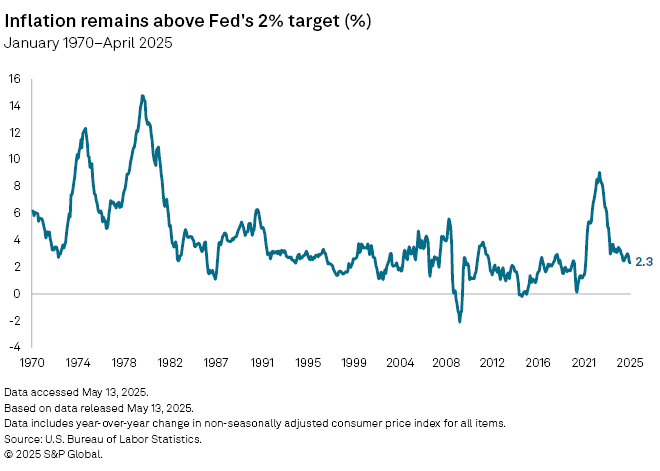

The US consumer price index increased 2.3% year over year in April, the third month of annual declines in inflation growth and the smallest increase since February 2021, the Bureau of Labor Statistics reported May 13. Core consumer price inflation, which removes volatile energy and food prices, increased 2.8% year over year, nearly unchanged from the annual growth a month before.

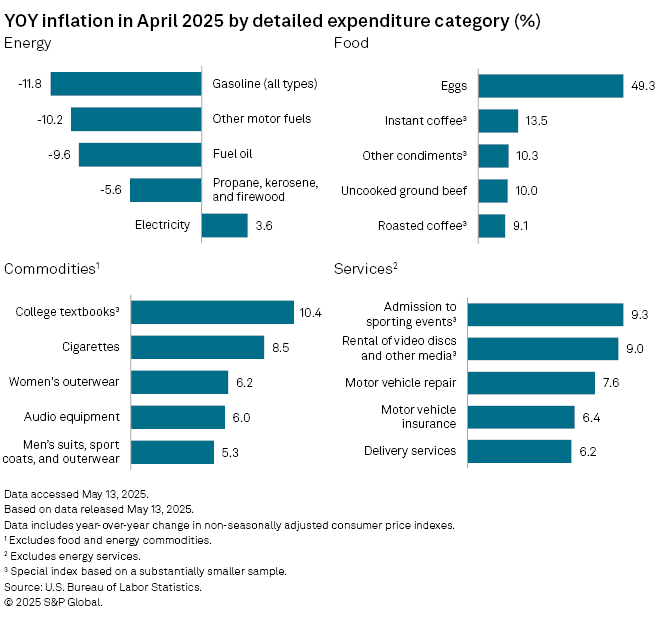

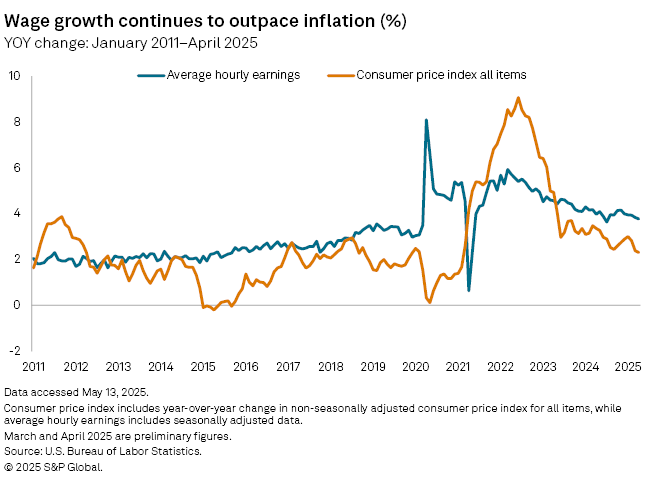

The data shows a clear slowing in inflation as the rate of rising prices nears the Federal Reserve's 2% growth target, but the latest data will likely not prove to be a turning point for the domestic economy with tariffs looming, Lale Akoner, global market analyst with eToro, said in an interview. Cheaper oil and the largest decline in grocery prices since 2020 helped cool inflation in April, but housing costs remain high, services are climbing and any pricing reprieve last month was at least partly assisted by retailers clearing pre-tariff inventory, according to Akoner.

"That buffer may not last," Akoner said.

There were some modest increases in furniture and electronics prices in April, but outside of that there was no widespread evidence that tariffs were impacting the inflation data yet, according to Thomas Simons, chief US economist at Jefferies.

"Consumers may have pulled forward demand, offering retailers some opportunity to reduce discounting, but frankly, the increases are small enough that they are hard to distinguish from month-to-month noise," Simons said in an interview.

China and the US on May 12 agreed to reduce their proposed tariffs on goods for an initial 90-day period, a trade truce that could prevent a steep spike in inflation later this year but will not prevent inflation from moving up from current levels, economists said.

Due to this truce, James Knightley, chief international economist with ING, said in an interview that he now sees year-over-year core inflation peaking at just below 4%, rather than at 4.5% to 4.7% that he had forecast before the 90-day pause. Knightley expects the consumer price index to end the year up 3.7% and eventually fall to the Fed's 2% target by the end of 2026.

Tariff wave

Under the Biden administration, the majority of imports entered the US with no or minimal duties as the effective tariff rate was about 2.3%. The Trump administration has moved this rate to a universal 10% baseline and an overall effective or average tariff rate about five times the Biden administration's rate, Akoner with eToro said.

It remains unclear whether Trump's tariff regime will cause a temporary increase in prices or more persistent inflation, but Akoner believes the true impact of these tariffs likely will not show up in the data until June or July due to imports already in transit being priced pre-tariff, a one- to two-month lag in customs data and a two- to three-month delay for government inflation data to full reflect pass-through to prices, Akoner said.

"The tariff wave will likely hit in stages, with visible price effects starting around June or July, but expectations and market reactions are already underway," Akoner said. "If Trump's policies remain in force and expand, and especially if China retaliates, the third quarter of 2025 could see the first real inflation pressure tied to tariffs."