Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

01 May, 2025

By Brian Scheid

Consumer sentiment is souring and recession fears are rising, but spending in the US is on the rise as consumers and businesses are likely buying now to lessen the expected impact of President Donald Trump's tariffs.

Real personal consumption expenditures, a measure of spending adjusted for inflation, rose 3.3% from March 2024 to March 2025, the largest annual increase since December 2023, the US Bureau of Economic Analysis reported April 30.

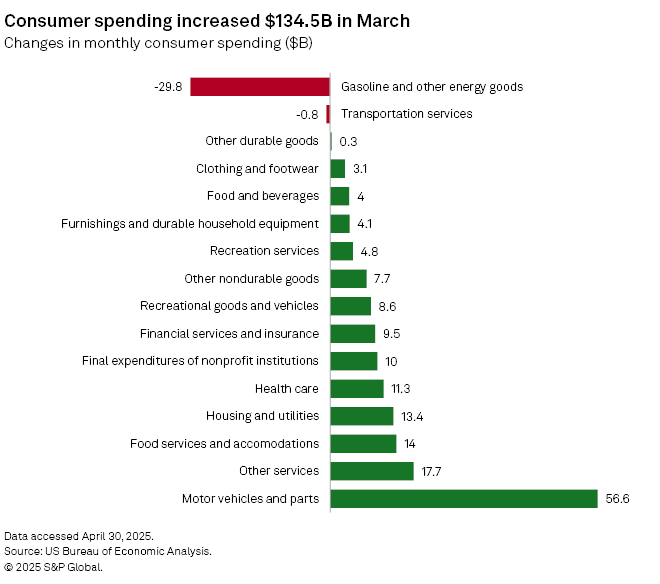

Consumer spending increased $134.5 billion from February to March, a 0.7% increase, including a $54.5 billion increase in spending for goods and a $79.9 billion jump in spending for services, the government reported. Spending on motor vehicles and parts increased $56.6 billion in March, after rising $12.7 billion in February and declining $41.1 billion in January.

"There has been a lot of front-running ahead of tariffs, particularly in the auto space," said Bret Kenwell, a US investment analyst with eToro. "Given the volatile trade policy that's been in place over the last few months, consumers and businesses are trying to get ahead of any potentially large price hikes due to tariffs, particularly on high-ticket items."

A roughly $45 billion increase in spending in the first quarter of the year compared to the third quarter of 2024 was mostly due to tariffs, according to an estimate by Dean Baker, senior economist at the Center for Economic and Policy Research. Further, roughly half the rise in consumption since the third quarter has been tariff-related.

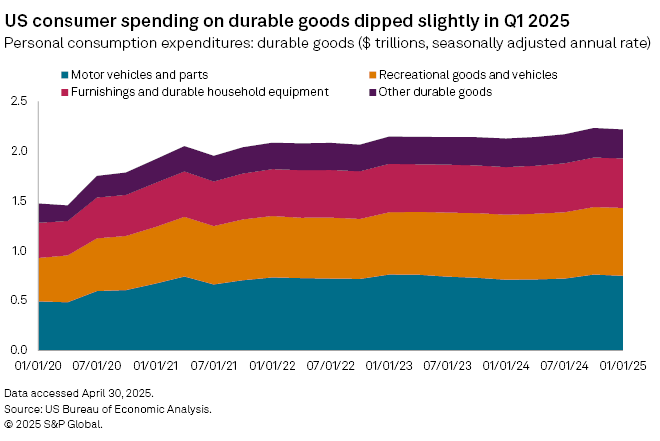

Durable goods spending increased about 2.3% from the third quarter of 2024 to $2.218 trillion in the first quarter of 2025.

"Most of this was tariff-related," Baker said.

Real US gross domestic product fell by 0.3% in the first quarter, the Bureau of Economic Analysis also reported April 30, the first decline in GDP since the first quarter of 2022.

Much of this was due to a surge in imports. GDP is an estimate of consumption, investment, government output and exports where imports are subtracted to prevent double counting. Imports in the first quarter of 2025 jumped to an all-time high of $342.75 billion, pushing the goods trade deficit to a record $162 billion, according to the latest government data.

Still, the rising levels of imports in anticipation of tariffs may have yet to peak, said Nancy Vanden Houten, a senior economist at Oxford Economics.

"While tariffs have been widely anticipated, it wasn't until earlier in April that the magnitude of the tariffs the Trump administration would impose was known," Vanden Houten said.