S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

01 May, 2025

By Nick Lazzaro

|

US Treasury Secretary Scott Bessent speaks April 23 during the Institute of International Finance Global Outlook Forum at the Willard InterContinental Washington in Washington, DC. |

Investors are demanding higher returns for parking their money in investment-grade US corporate debt amid a broader reassessment of market risk stemming from changes to tariff policy that roiled financial markets this month.

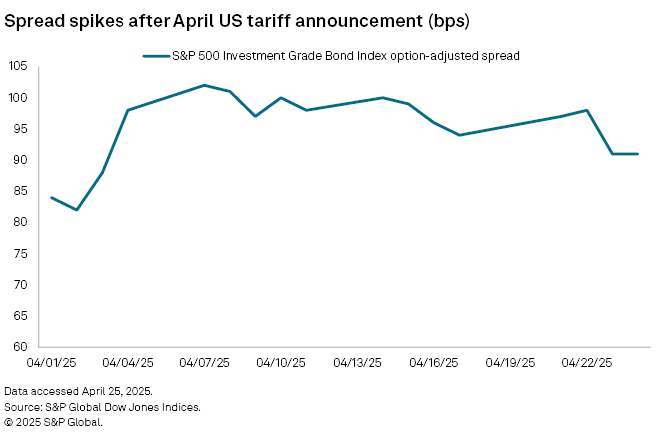

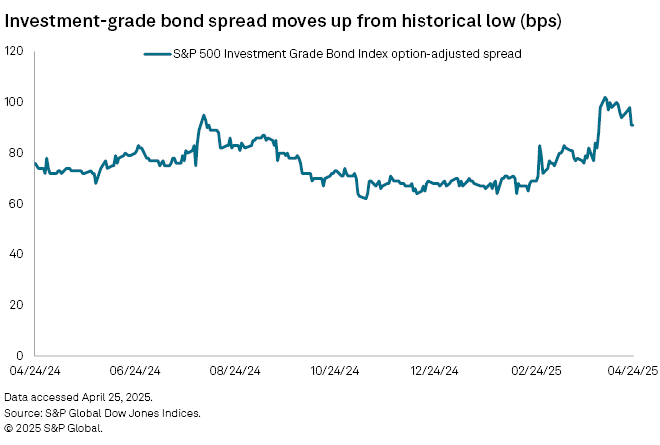

Much like equities, debt markets were rocked by President Donald Trump's April 2 announcement of global tariffs and subsequent decision April 9 to delay the tariffs' implementation by 90 days. The option-adjusted spread of the S&P 500 investment-grade corporate bond index climbed to a 17-month high of 102 basis points on April 7 from 82 bps on April 2, according to S&P Global Dow Jones Indices data. The spread measures the percentage difference in yields between investment-grade corporate bonds and Treasury debt, with wider spreads representing a rising risk premium demanded by investors.

The spread retreated since the recent high but has remained elevated above levels from earlier this year as markets continue to monitor updates to the tariff policy, international trade negotiation progress intended to avert tariffs and other concerns such as Trump's suggestions that he could potentially replace Federal Reserve Chairman Jerome Powell due to differing stances on monetary policy.

"We've had a change from the administration on its view of the world, specifically around tariffs, and that has the market questioning whether or not we are pricing for the risk that's apparent," said Jamie Newton, head of the Global Fixed Income Research team at Allspring Global Investments, in an interview. "You have to reassess how you're getting compensated for risk, and so we've seen spreads move wider across investment-grade and high-yield bonds."

Demand for investment-grade bonds, those from corporations with ratings of BBB- and above from S&P Global Ratings, has been robust in recent years as investors have been drawn to their elevated yields in the higher-for-longer interest rate environment. The recent spread widening appears to only reflect investor desire for greater risk premiums rather than a bond selloff driven by weakening demand.

"In our day-to-day conversations and discussions with the broker/dealer community, we haven't seen major capitulations or large de-risking from the real money community or the institutional investors," Neil Sun, portfolio manager within the BlueBay Investment Grade team at RBC Global Asset Management, said in an interview. "The recent activity is more from the hedge funds pushing their levels around and the dealer communities updating their quotes in responding to the macro developments."

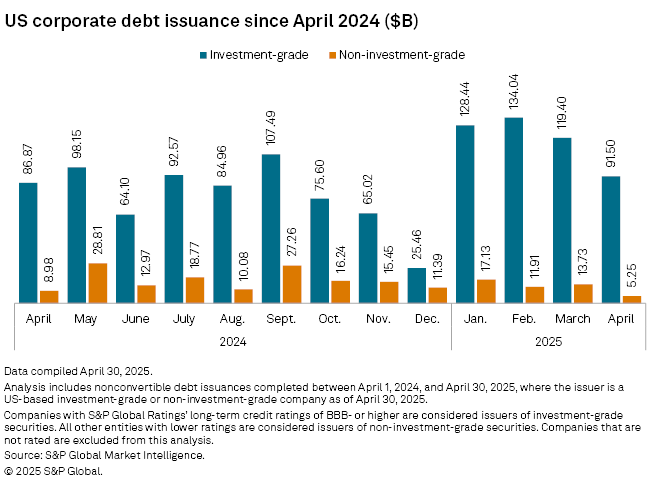

US investment-grade corporations in April have issued about $91.5 billion in non-convertible bonds through April 29, according to S&P Global Market Intelligence data on companies rated by Ratings. While this volume is down from each of the last three months, when issuance surged and collectively combined for a quarterly record, April's bond issuance so far has surpassed monthly activity seen in six of the last 12 months and is up from April 2024.

Spreads settle at a higher range

Since the early April spike, the S&P 500 investment-grade corporate bond index spread has decreased, settling at 89 bps on April 28 as market panic subsided due to indications that the US has been pursuing international trade deals and that Trump would not attempt to remove Powell from his position.

The spread is unlikely to return to historical lows between 60 bps and 70 bps seen in late 2024 and early 2025 as tariff-related concerns persist regarding the potential impacts on inflation and economic growth, according to Sun.

"Those two major macro-related risks [inflation and economic growth] push [spreads] into a new range, and on a forward-looking basis, until we gain more clarity on Trump's policy agenda, the risk will remain in the financial system, which warrants wider spreads," Sun said. "It is also worth noting that institutional investors who we have talked to came to this year on a very defensive stance. They already have a very elevated cash balance that they are looking to spend, and this wider level in spreads provides everyone with a decent buying opportunity into the investment-grade market."

Beyond tariff jitters, spread movement in April was likely influenced by ample bond liquidity from large financial institutions and uncertainty ahead of the month's US Treasury auctions, said Newton with Allspring.

"You had a 10-year [Treasury note] and 30-year [Treasury bond] auction which raised some level of concern as to how those would clear, and they cleared very well, so that's why we've gotten this retracement [in spreads]," Newton said.

Treasuries boost yield

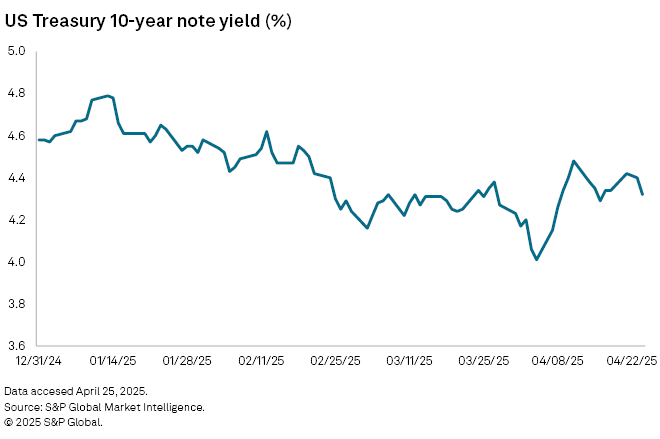

High Treasury security yields continue to support the elevated corporate bond yields that have partly driven demand.

The April 2 US tariff announcement prompted investors to seek safe-haven assets like US treasuries, driving up demand and prices while pushing yields lower. Yields move inversely to prices. The yield on the 10-year US Treasury note slid to 4.01% on April 4 from 4.20% on April 2.

However, the yield quickly rebounded, reaching as high as 4.48% April 11 and hovering between 4.30% and 4.40% during the following weeks. It settled at 4.19% April 29.

The rebound was driven by the unwinding of the Treasury "basis trade" and expectations that increased short-term inflation from tariffs could extend the Federal Reserve's pause on interest rate cuts, Compound Planning Chief Investment Officer Steve Dean told Market Intelligence. The basis trade, which seeks to benefit from an arbitrage in yield differences between bond futures and cash bonds, unwound as hedge funds and other traders sold cash bonds to cover losses or meet funding obligations, Dean said.

"Still, uncertainty about the policies and consumer and business sentiment will likely keep the yields high and support strong demand for corporate debt," Dean said.