Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

07 May, 2025

| Alpha Bank has announced four deals so far in 2025 and is keen for further M&A. Source: NurPhoto via Getty Images. |

Greek banks are expected to push ahead with their M&A plans even as US tariffs send shockwaves through markets.

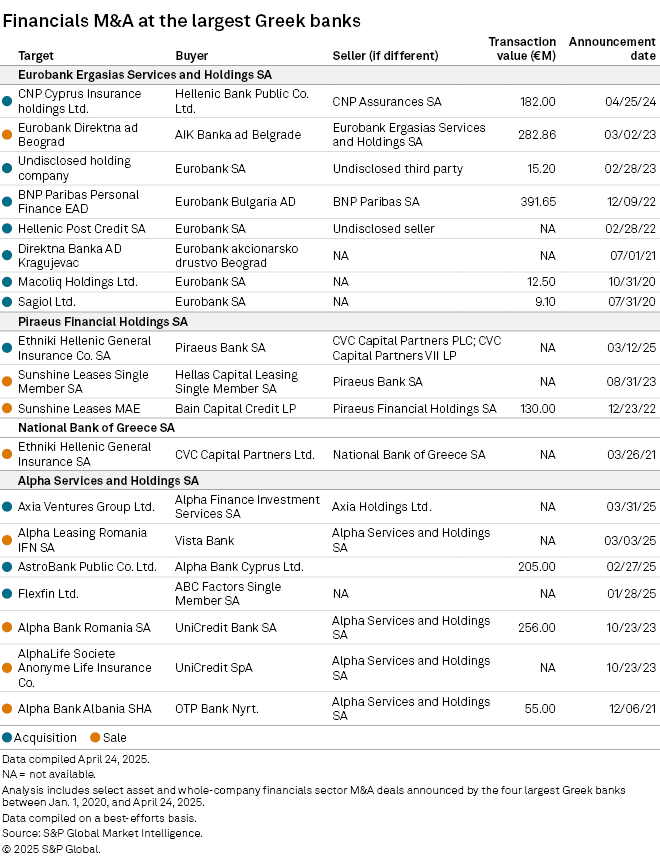

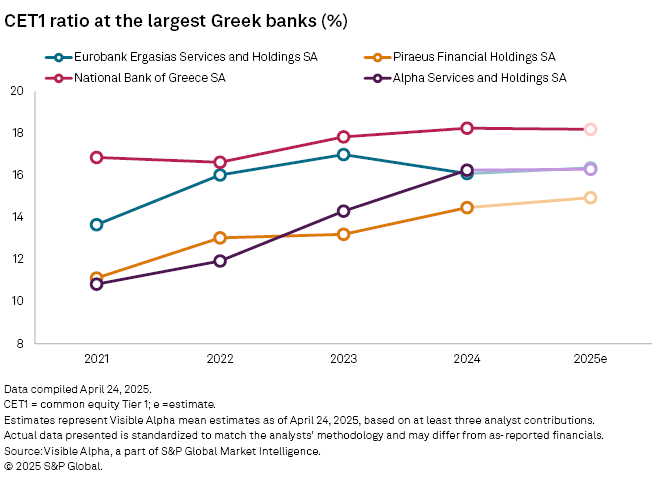

Lenders such as Piraeus Financial Holdings SA and Alpha Services and Holdings SA have multiple acquisitions in the works and have signaled their desire to pursue further M&A, fueled by excess capital accrued through balance sheet improvements.

While global trade tensions have increased execution risks for M&A, these are expected to be manageable for Greek banks due to the size of the deals and their track record in completing acquisitions, said Andrea Costanzo, vice president of European financial institutions at Morningstar DBRS.

Greek banks' M&A activity is primarily driven by "long-term strategic goals rather than short-term geopolitical volatility," said Eleni Ismailou, vice president of the research division at Axia Ventures Group. Therefore, US tariffs have not materially affected any ongoing or planned transactions, she added.

Greece is not among the top 10 EU countries in exports to the US, making it relatively insulated to tariff volatility compared to its neighbors.

The tariff uncertainty could, in fact, boost Greek banks' M&A prospects if it leads to greater financial autonomy within the EU, according to Ismailou. Not only could they attract increased interest if regional consolidation becomes more important, but their recent restructurings have also positioned them to be active participants in M&A rather than passive targets, said Ismailou.

Deals in motion

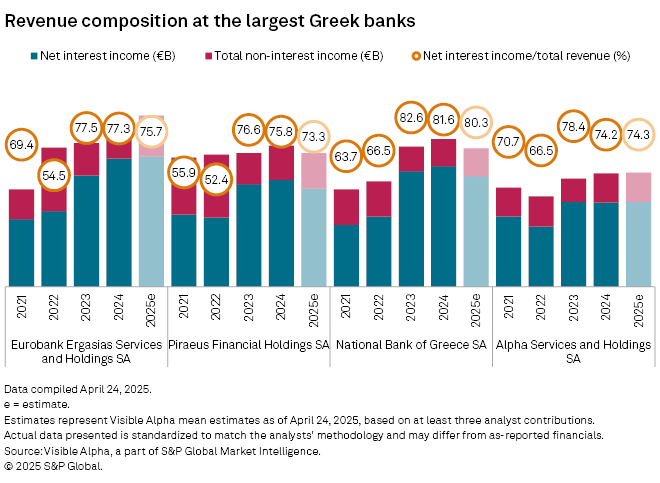

While the deals announced recently by Greek banks are not transformational, they represent initial steps to increase scale, enhance geographic diversification and expand product offerings, Costanzo said. Growth in fee-generating areas such as asset management, insurance and investment banking is a key theme, said Giannoulis.

Alpha Bank has announced four deals so far in 2025, including the acquisitions of Cypriot lender AstroBank PCL, investment banking group Axia Ventures Group Ltd. and invoice factoring platform Flexfin.

For Alpha Bank, any M&A must be earnings accretive, generate a minimum return on investment of 15% and not affect ordinary shareholder distributions, CEO Vassilios Psaltis said during a Feb. 28 earnings call.

"We are not going to sit idle if there are opportunities that can create value for our shareholders," said Psaltis. "And trust me, in the current environment, there are plentiful opportunities around."

Eurobank Ergasias Services and Holdings SA in February moved to take full control of Cyprus-based Hellenic Bank PCL. In April, it completed the acquisition of CNP CYPRUS Insurance Holdings Ltd. through Hellenic Bank, a deal that "creates the largest insurance provider in the country and the ability to explore the untapped bancassurance potential," Eurobank CEO Fokion Karavias said during a Feb. 27 earnings call.

The bank has more than €1.5 bilion of capacity for M&A, Karavias said. Any deals would likely take place in Greece, Cyprus, Bulgaria or Luxembourg, and in the banking, insurance or asset management segments, he said.

Eurobank is also keen to see if it could benefit from the Danish compromise, which enables lenders to make acquisitions through their insurance operations on favorable capital terms.

"If the Danish compromise can also be applied for a bank of our size, this is going to be something positive, and we're going to consider that quite seriously," Karavias said.

In March Piraeus announced the acquisition of insurance brokerage Ethniki Insurance (Cyprus) Ltd. from private equity firm CVC Capital Partners PLC for €600 million. Piraeus has also said any future M&A will not come at the expense of shareholder distributions.

Steady outlook

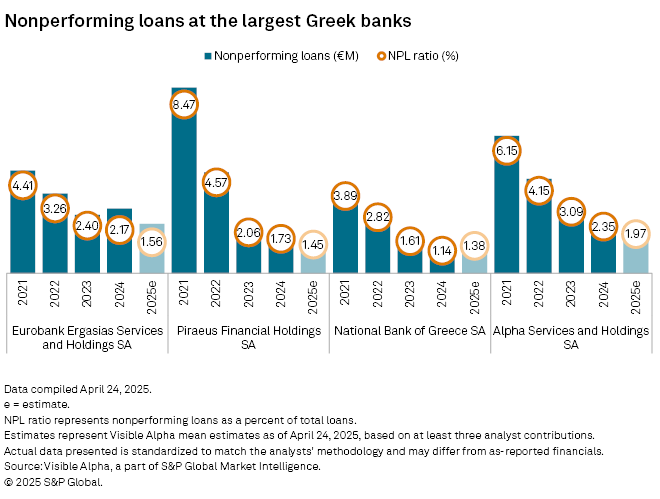

Greek banks' asset quality is projected to remain healthy in 2025, with nonperforming loans ratios declining further for three of the four largest banks, according to estimates from Visible Alpha, part of S&P Global Market Intelligence.

The banks' CET1 ratio is also set to increase at all of the largest Greek banks bar National Bank of Greece SA.

The main risks would be second-order effects caused by a recession in Europe or Greece specifically, which could impact the business plans of potential targets and put pressure on banks' liquidity and asset quality, said Giannoulis.