S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

28 May, 2025

By Yuzo Yamaguchi and Beenish Bashir

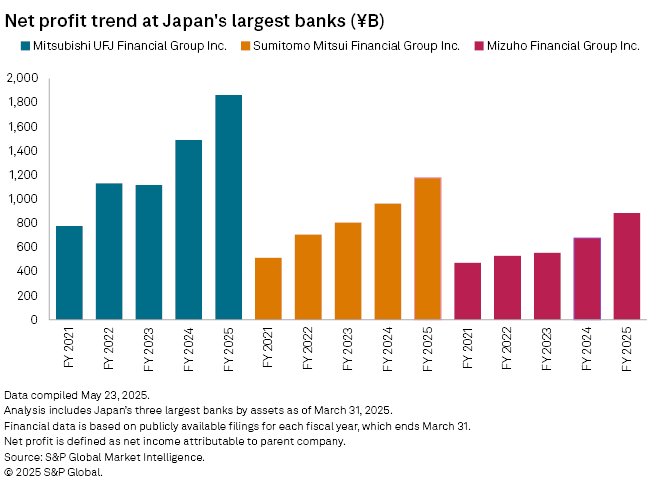

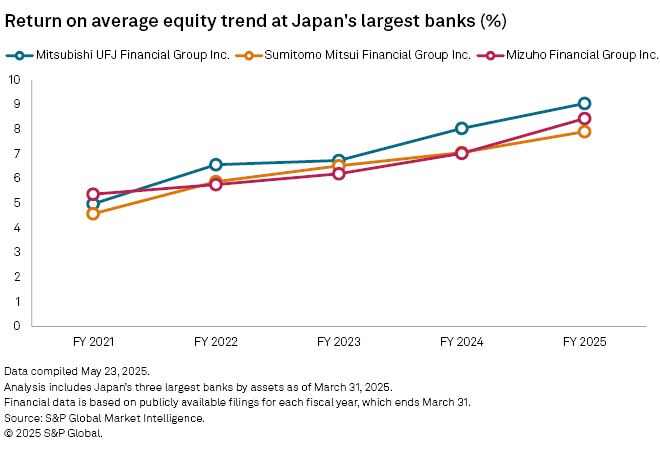

Japan's three megabanks are set to boost their lending profitability as they benefit from the Bank of Japan's monetary policy normalization.

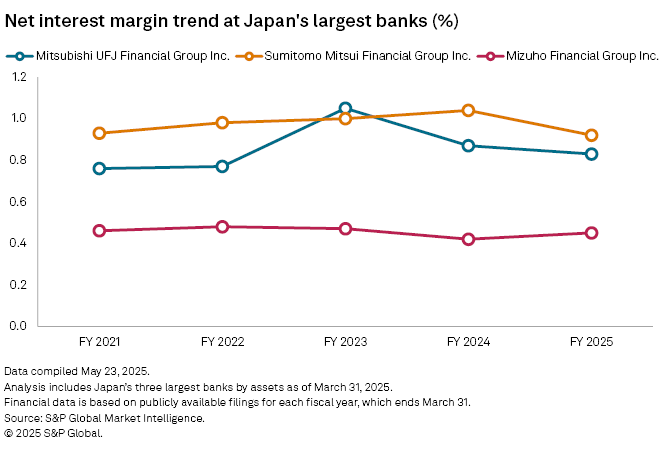

Net interest margin (NIM), a key metric of lending profitability, dropped at two of the megabanks — Mitsubishi UFJ Financial Group Inc. (MUFG) and Sumitomo Mitsui Financial Group Inc. (SMFG) — in the fiscal year ended March 31, according to S&P Global Market Intelligence data. MUFG's margin fell to 0.83% from 0.87%, and SMFG's margin declined to 0.92% from 1.04%. The NIM of Mizuho Financial Group Inc. improved to 0.45% from 0.42%.

"There is no doubt their NIMs will rise higher," said Toyoki Sameshima, a senior analyst at SBI Securities Co. "There is no way for Japan to cut interest rates."

Sameshima expects the spread between lending and deposit margins to widen at home, while forecasting the lending profitability overseas to shrink, coming under pressure from the US Federal Reserve's potential rate cut.

The Bank of Japan (BOJ) has raised its benchmark interest rate three times since ending its negative rate policy in March 2024. After raising its policy rate to 0.5% from 0.25% in January, the central bank is expected to stay on a path of monetary policy normalization. Most economists expect the BOJ to maintain the current rate for the rest of the year, as US President Donald Trump's tariff policy casts uncertainty for the global economy.

Offsetting overseas declines

While the megabanks' overseas margins may come under pressure, improvements in domestic margins are likely to more than offset any negative impact.

"Although I project Japanese banks' margins on overseas lending would narrow somewhat, my forecast for widening margins on domestic lending offsets it or more than offsets it," said Michael Makdad, a senior analyst at Morningstar.

Meanwhile, the megabanks have been bullish about the benefits of BOJ's rate hikes.

MUFG projected in February that the BOJ's January rate hike would contribute an additional ¥20 billion in net interest income for the fiscal year ended March 2025, and ¥100 billion annually starting from the fiscal year beginning April 1. Additionally, the bank expanded total loans in and outside Japan to ¥122.9 trillion for the year ended March 31, up from ¥118.4 trillion in the previous fiscal year.

SMFG expects the January rate increase to contribute about ¥100 billion to its net interest income per year, complementing the ¥100 billion already added from prior rate hikes in July and March 2024. The lender indicated that a 25-basis-point rate increase will generate an additional ¥100 billion. Additionally, loans at the bank rose to ¥104.5 trillion, up from ¥101.1 trillion during the same period.

Mizuho stated that the three rate hikes implemented thus far are expected to contribute approximately ¥105 billion to net interest income for the fiscal year ended March 31, with projections indicating this figure could rise to ¥225 billion in the next fiscal year. Additionally, the lender has increased its loans to ¥94 trillion, up from ¥92.7 trillion.

Still, Trump's tariff policy could create uncertainties for the banks' loan growth.

"It's hard to predict loans will grow [for the current fiscal year] as Trump's tariff policy is unpredictable," said Mizuho CEO Masahiro Kihara at a May 20 press conference.

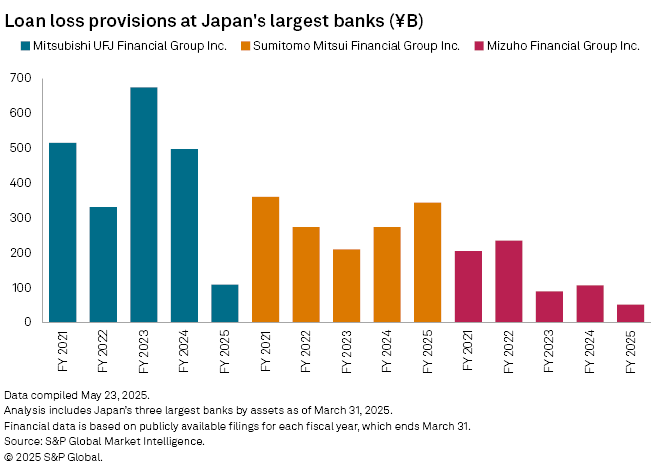

Credit costs

The megabanks are cautious about credit risks as uncertainties grow.

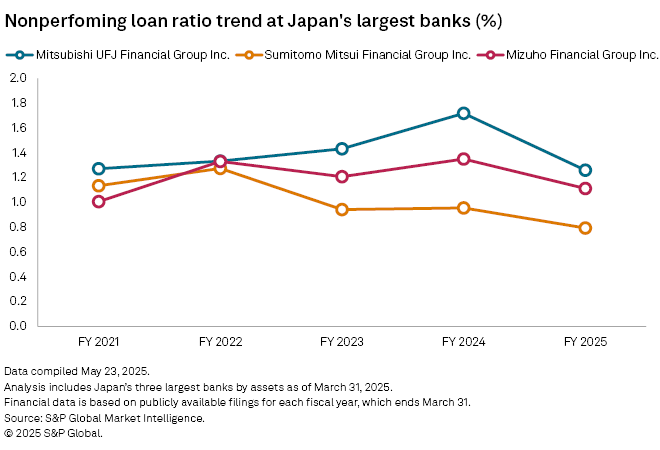

MUFG raised its loan loss provision to ¥350 billion from ¥108.7 billion in the previous fiscal year, while Mizuho's credit costs nearly tripled to ¥140 billion from ¥51.6 billion.

SMFG established a loan loss provision of ¥300 billion, down from the ¥344.5 billion recorded in the previous fiscal year. The bank added ¥90 billion in forward-looking credit costs in the fourth quarter of that fiscal year, raising the provisions to ¥344.5 billion from an initial estimate of ¥260 billion.

As of May 27, US$1 was equivalent to ¥144.24.