S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

28 May, 2025

By Ronamil Portes

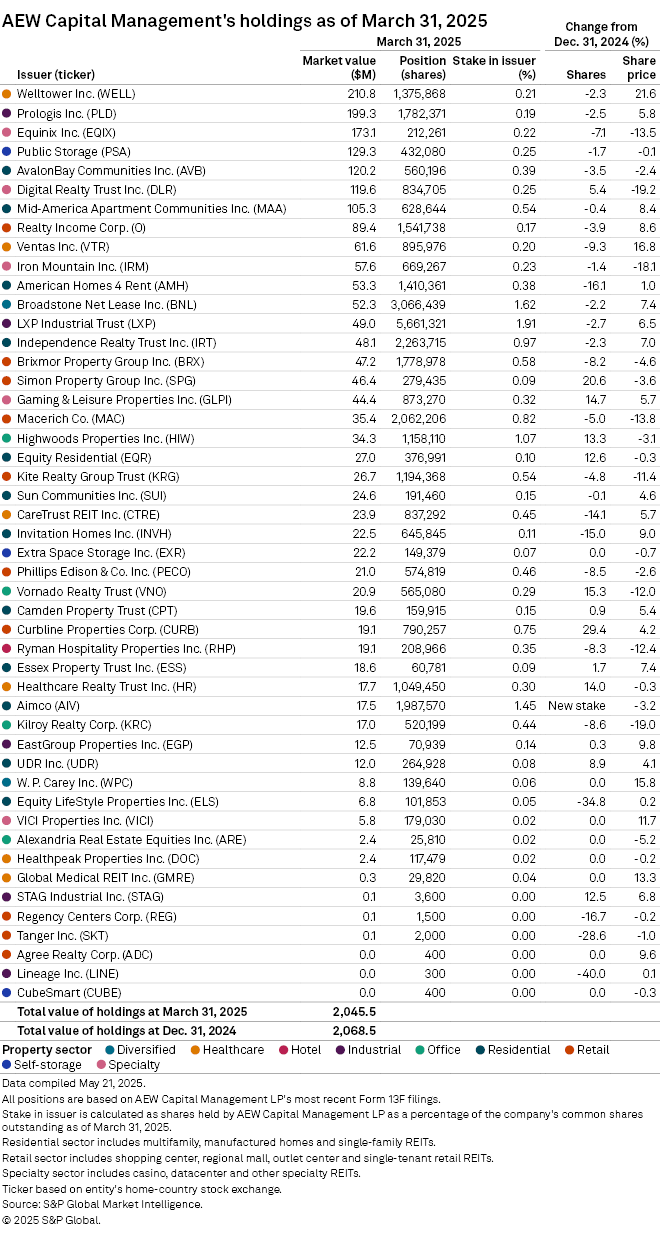

AEW Capital Management LP reduced its share count in 26 of its US real estate investment trust holdings during the first quarter.

The investor's total REIT holdings decreased 1.1% to $2.05 billion as of March 31 from $2.07 billion as of year-end 2024, according to AEW's latest Form 13F filing.

Double-digit cuts in Lineage, 6 other REITs

The Boston-based money manager's largest cut during the first quarter was the sale of a 40% stake in industrial REIT Lineage Inc. AEW now holds 300 shares, valued at $17,589 as of March 31, in the healthcare REIT, making it the firm's second-smallest holding by market value.

The investor also pared share counts in 25 of its other REIT holdings, six of which were down by more than 10%.

AEW sold 34.8% of its stake in manufactured home-focused Equity LifeStyle Properties Inc. and 28.6% in outlet center REIT Tanger Inc.

The four other REITs in which AEW dropped over 10% of its stake were shopping center-focused Regency Centers Corp., single-family REITs American Homes 4 Rent and Invitation Homes Inc., and healthcare-focused CareTrust REIT Inc.

– Set email alerts for future Data Dispatch articles.

– For further institutional investor research, try the Investor Targeting tool.

– View AEW Capital's holdings history here.

AEW adds Aimco

AEW added multifamily-focused Aimco to its REIT portfolio in the first quarter. The investment firm bought over 1.9 million common shares in the multifamily REIT, a position valued at $17.5 million as of March 31.

Additionally, AEW increased its shares in 13 existing REIT holdings.

The firm increased its shares in retail-focused Curbline Properties Corp. by 29.4%, valued at $19.1 million as of March 31. AEW also upped its stake in regional mall landlord Simon Property Group Inc. by 20.6%, valued at $46.4 million at quarter-end.

AEW boosted its share counts in six other REITs by more than 10%: office REIT Vornado Realty Trust at 15.3%, casino-focused Gaming & Leisure Properties Inc. at 14.7%, healthcare REIT Healthcare Realty Trust Inc. at 14.0%, office landlord Highwoods Properties Inc. at 13.3%, multifamily-focused Equity Residential at 12.6% and industrial REIT STAG Industrial Inc. at 12.5%.

Top holdings

Healthcare REIT Welltower Inc. topped AEW's holdings as of March 31, at $210.8 million, even as the asset manager sold off 2.3% of its shares. Industrial-focused Prologis Inc. ranked second, valued at $199.3 million. Datacenter REIT Equinix Inc., which was the asset manager's top holding in the previous quarter, was ranked as the third-largest holding, valued at $173.1 million as of March 31.

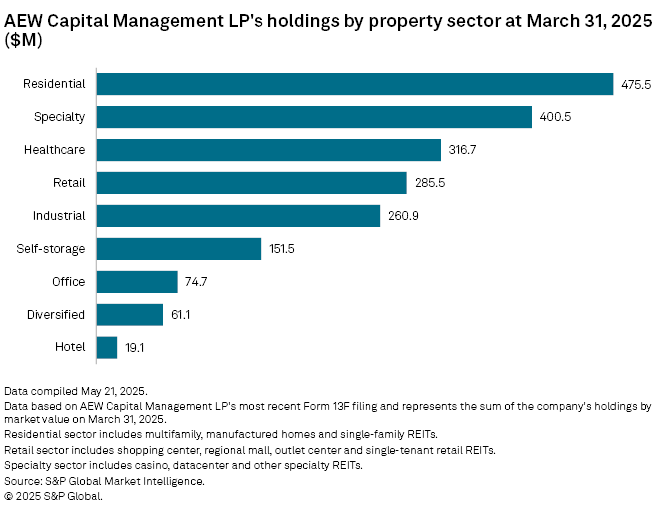

AEW's holdings in residential REITs totaled $475.5 million, or about 23.2% of the asset manager's total REIT holdings, the largest of any property sector.

Specialty REITs — which include casino, datacenter and information storage REITs — were collectively valued at $400.5 million, while the firm's holdings in healthcare REITs totaled $316.7 million.