S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

04 Apr, 2025

By Nick Lazzaro

|

US President Donald Trump holds a chart showing duty rates while announcing new "reciprocal" tariffs during an event at the White House on April 2. The tariff announcement triggered a global stock sell-off the following day. |

Trade tensions will continue driving the sharp global stock market sell-off triggered in the wake of the US' aggressive new tariffs, but successful international negotiations could create pockets of relief in international markets.

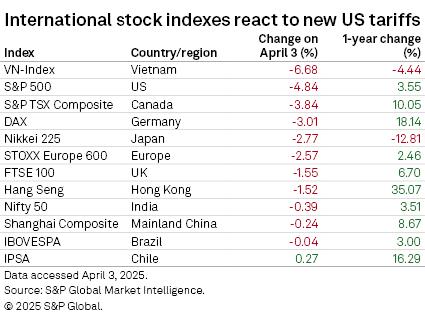

Major stock indexes worldwide fell April 3 after US President Donald Trump announced sweeping universal tariffs against most countries or territories. The sell-off included declines of about 4.84% for the S&P 500, 2.77% for the Nikkei 225, 2.57% for the Stoxx Europe 600, 1.55% for the FTSE 100, 1.5% for the Hang Seng Index and 0.24% for the Shanghai Composite, according to S&P Global Market Intelligence data. The non-US indexes extended a slide that began earlier in the week, eroding their strength relative to the S&P 500 seen during the first quarter.

Trump's newly announced tariffs include a 10% baseline duty starting on April 5 and higher "reciprocal" tariff rates for select countries or territories taking effect April 9. The higher rates will be calculated based on their current tariffs and trade barriers enforced against US products.

"Indexes in countries whose high tariff rates were somewhat surprising, such as Vietnam and Japan, underperformed the stock markets in China, where the levy of additional high tariffs was a foregone conclusion," Justin Zacks, North America vice president of strategy at global investment and trading platform Moomoo, told Market Intelligence. "Stock markets in countries with high tariff rates could remain under pressure if such tariffs remain in place for any considerable length of time."

In contrast, South American countries that were only hit with the 10% baseline tariff could fare better. For instance, Brazil's IBOVESPA Index saw modest gains during intraday trading on April 3 before closing at 0.04% lower, while Chile's IPSA gained 0.27%.

"The lower rates in Latin America could be a political move based on geography to create a trading bloc among countries in the Americas, but it may also be based on the types of goods that are imported from these regions to the US," Zacks said, adding that key products traded between the US and these countries include oil, automotive goods and agricultural products.

Impact of negotiations

Stock markets could stabilize if negotiations occur and succeed in scaling back tariff rates and averting trade retaliation against the US.

"This feels like a game of chicken; the US administration is betting somewhat that all other economies will be less resilient than the US," Kevin Philip, partner at Bel Air Investment Advisors, told Market Intelligence. "I believe the hoped-for goal is to drive every country to the negotiating table. If the market continues to tumble, I suspect 'deals' will be made with questionable materiality, but allow the administration to save face and back track on tariffs."

However, negotiations that improve market conditions for some countries or regions may increase pressure on others.

"Countries that do not make deals could be placed at an even bigger disadvantage if other neighboring countries that produce similar goods do come to an agreement with the US to lower their tariff rates," Zacks with Moomoo said.

Market fluctuations are likely in the coming days as new information on the US tariff program, potential negotiations and retaliatory measures are expected to emerge.

"Against this backdrop, diversification within and across asset classes is paramount, and we expect rising risks to economic growth which may lead to a decline in bond yields during bouts of volatility, thereby partly offsetting equity drawdowns," said John Canally, chief portfolio strategist with TIAA Wealth Management.

Pain points vary

Poorer export-driven countries or territories with fewer economic resources will likely face the sharpest sting of tariff headwinds.

"The first one to come to mind is Vietnam, a large production center of many products for the US," Bel Air Investment's Philip said. "Think shoes, like Nike… and furniture like Restoration Hardware… China and India will have more resources to throw at their economies to help support them."

The Vietnam Stock Index slid almost 7% by market close April 3 and is now down almost 3% year-to-date, according to Market Intelligence data. The index's year-to-date return peaked at over 5% on March 17.

Major European markets will likely experience differing long-term trends because of their varied economic makeup, according to One Eight Capital Managing Partner Alexander Bussenger.

"Given its export-driven economy, particularly in automobiles and industrial goods, [Germany's] DAX is susceptible to increased tariffs, which could hinder export volumes and corporate earnings," Bussenger told Market Intelligence. "While also affected, [the UK] FTSE 100's composition includes a significant proportion of energy and consumer staples companies. These sectors often exhibit resilience during trade tensions, potentially providing some buffer against tariff impacts."

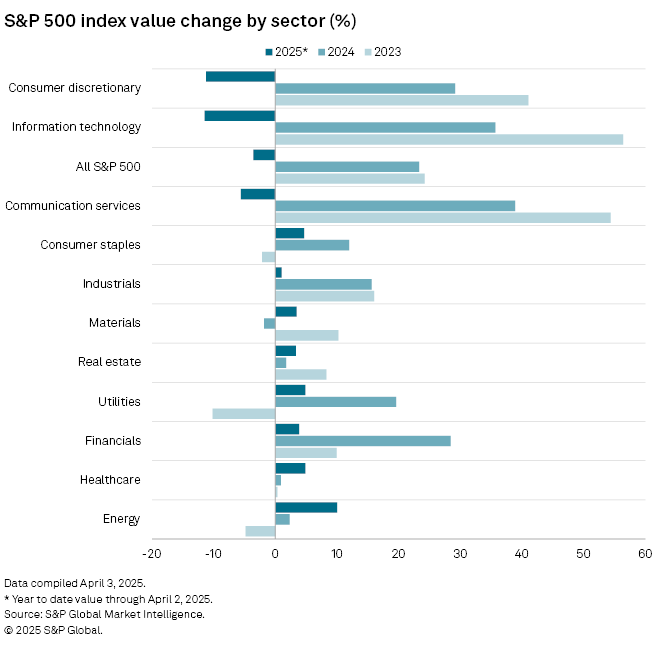

Meanwhile, in the US, there may prove to be fewer safe options for equities.

"Services-oriented and more domestic businesses could be relative winners, but if recession odds rise as more job losses come, and rates don't fall much because of tariff-driven increases in inflation expectations, even the most defensive, income-oriented areas of the equity market would be vulnerable," said Jeff Buchbinder, Chief Equity Strategist for LPL Financial, in an email.