Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

15 Apr, 2025

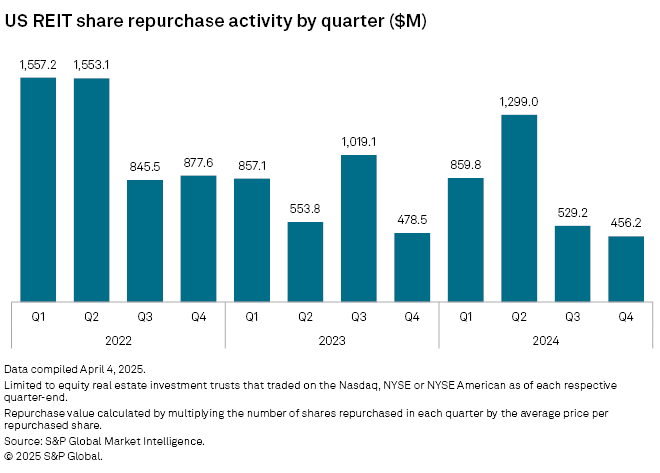

Share repurchase activity by US equity real estate investment trusts decreased in the fourth quarter of 2024 after a significant decline in the previous quarter, according to an analysis by S&P Global Market Intelligence.

The US REIT sector repurchased $456.2 million in common stock in the fourth quarter, marking a 13.8% decline from the previous quarter and a 4.7% year-over-year decrease.

The analysis included equity REITs that traded on the Nasdaq, NYSE or NYSE American as of each respective quarter-end.

Largest common stock repurchases

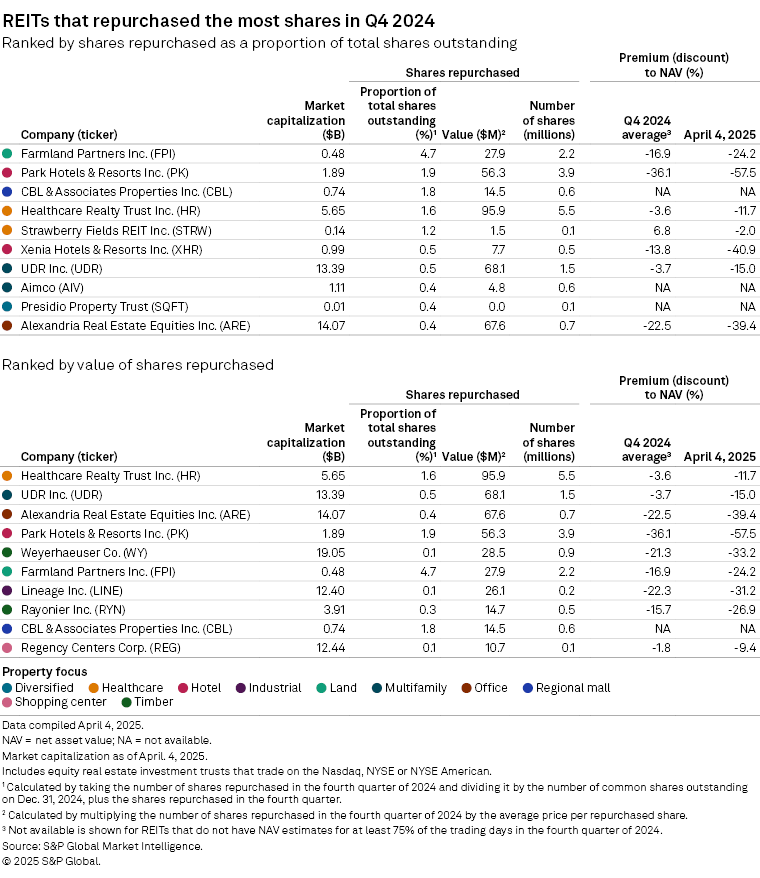

Farmland Partners Inc. repurchased 2.2 million common shares during the quarter for approximately $27.9 million. The shares represented about 4.7% of the farmland-focused REIT's total common stock outstanding, marking the largest proportion repurchased by any REIT in the quarter.

Hotel REIT Park Hotels & Resorts Inc. repurchased $56.3 million in common stock, representing 1.9% of its total common shares outstanding.

Meanwhile, Healthcare Realty Trust Inc. repurchased $95.9 million in common stock during the quarter, the highest amount among equity REITs. The 5.5 million shares it repurchased represented approximately 1.6% of its total shares outstanding.

UDR Inc. recorded the second-largest share repurchase value in the fourth quarter, with the multifamily REIT buying back 1.5 million common shares for approximately $68.1 million, representing about 0.5% of its total common shares outstanding.

– Set email alerts for future Data Dispatch articles.

– Read other Data Dispatch articles by S&P Global Market Intelligence.

– Explore more real estate coverage.

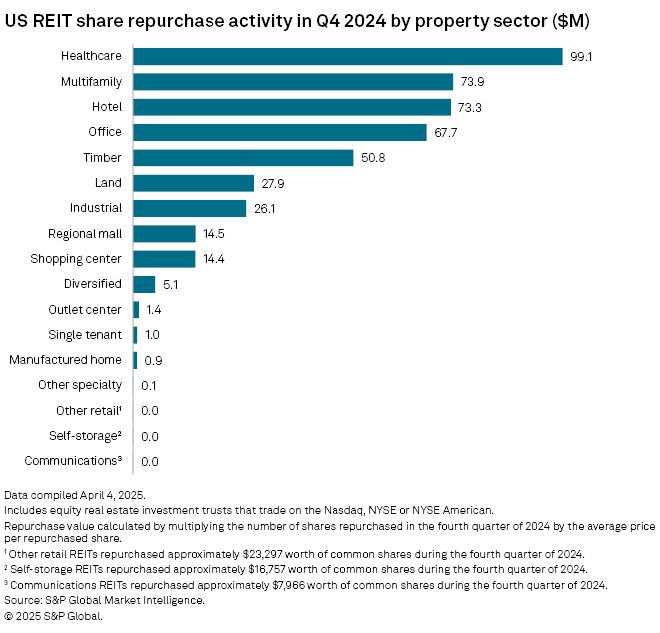

Healthcare REITs led in common stock repurchases by property sector during the fourth quarter, totaling $99.1 million. Healthcare Realty Trust accounted for 96.8% of this total, while Strawberry Fields REIT Inc. repurchased nearly $1.5 million in common shares.

The multifamily and hotel sectors followed, repurchasing $73.9 million and $73.3 million in common shares, respectively.

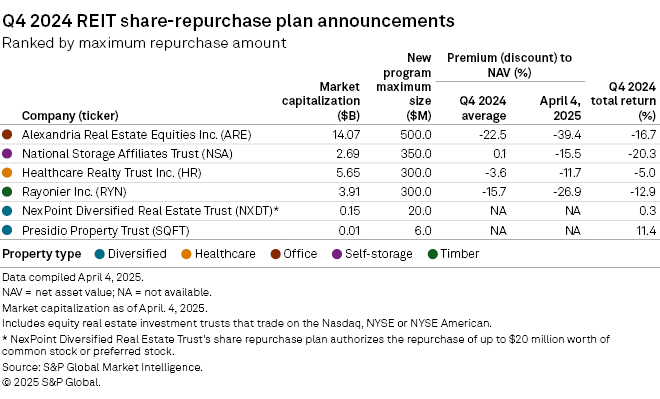

New share repurchase plans

Six REITs announced new share repurchase programs during the fourth quarter.

The board of office landlord Alexandria Real Estate Equities Inc. approved a new share repurchase plan on Dec. 9, 2024, authorizing the buyback of up to $500 million in common stock through Dec. 31, 2025. As of Dec. 31, 2024, 496,276 shares valued at $50.1 million had been repurchased under this program.

On Nov. 14, 2024, National Storage Affiliates Trust's board approved a new share repurchase program, authorizing the self-storage REIT to repurchase up to $350 million in common stock.

Healthcare Realty Trust's board of directors authorized the repurchase of up to $300 million in common shares on Oct. 29, 2024, superseding the REIT's previous stock repurchase authorization.

Timber REIT Rayonier Inc.'s board approved a new stock buyback plan in December 2024, allowing for the repurchase of up to $300 million in common stock.

On Oct. 29, 2024, diversified REIT NexPoint Diversified Real Estate Trust's board of trustees authorized the repurchase of up to $20 million of its common shares and its 5.50% series A cumulative preferred shares through Oct. 28. 2026.

Diversified REIT Presidio Property Trust's board of directors authorized a stock repurchase program of up to $6.0 million of outstanding shares of its series A common stock in December 2024.