Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

23 Apr, 2025

By Brian Scheid

President Donald Trump's attempts to weaken the Federal Reserve's independence have sent the US dollar to its lowest level in more than three years as foreign investors increasingly move away from US financial assets and concerns about the further weakening of the greenback's global relevance grow.

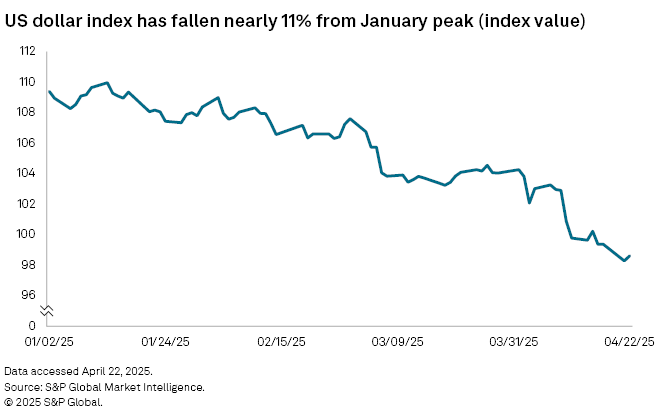

The US dollar index, a measure of the dollar against a basket of other widely traded international currencies, fell this week to its lowest point since 2022 in reaction to Trump threatening to replace Fed Chairman Jerome Powell, the president's newest effort to pressure the Fed to lower interest rates.

"These latest tirades simply serve as further encouragement, if any were required, for participants to reduce their exposure to US assets, and to the US dollar, resulting in the renewed selling pressure that we've seen to start the week," said Michael Brown, senior research strategist at Pepperstone.

The index has tumbled nearly 11% since its January peak, and foreign exchange strategists believe the dollar may be far from its bottom.

"This is turning into a dollar drop of historic proportions," said Derek Halpenny, managing director and head of research with MUFG Bank.

Since the dollar's significant decline after the Plaza Accord — the 1985 currency markets intervention agreement between the US and four allies to depreciate the dollar — it has only fallen steeper compared with this year's drop on three occasions: a dollar reversal from October 2022 to January 2023 due to global inflation shock; a US corporate confidence crisis from January to June in 2002; and the period following Black Monday from October to December 1987.

The dollar's descent to a more than three-year low began after Trump announced his sweeping tariff plan on April 2, and much of the dollar's weakness against its overseas peers is due to the substantial shift in trade policy. Trump's latest pressure campaign against Powell has exacerbated the declines, according to Joseph Wang, a former senior trader on the Fed's Open Markets Desk and the operator of Fedguy.com, a financial markets research blog.

"Threats to the Fed's independence make it worse of course," Wang said. "The dollar is within historical ranges, so it could easily fall 10% to 20% before it becomes historically weak."

Powell has warned that the Trump administration's plan to substantially increase tariffs on nearly all US trading partners will likely complicate the Fed's plans to cut rates this year, drawing stark criticism from Trump, who said Powell risks slowing the economy by delaying cuts. Trump has threatened to upend decades of central bank independence by replacing Powell before his term ends in May 2026.

When asked about Powell by reporters on April 22, however, Trump said he had "no intention of firing him."

Still, Trump’s prior threats have lessened the global strength of the dollar, raising fresh questions about the financial stability of the US.

"Centuries of experience have shown us that central banks are best able to achieve price stability when they are insulated against short-term political pressures," said Karl Schamotta, chief market strategist with Corpay Cross-Border Solutions. "If the Fed's independence were to fall, investors would ratchet long-term inflation expectations higher, demand higher returns for investing in the US, and reallocate money into jurisdictions with stronger institutional frameworks."

Skepticism soars

If the Fed were to bow to political pressures, it would likely weaken the perception of its commitment to price stability, a key within long-term faith in the dollar, Schamotta said. Despite its recent decline, the dollar remains historically overvalued and if US policy stays turbulent, the dollar could reasonably drop another 10%, according to Schamotta.

With tariffs expected to spike living costs for many Americans, policy uncertainty reaching unprecedented levels, a slowdown or complete stop in corporate hiring and investment plans, and expected retaliation from trading partners likely to dim the US' export outlook, investor skepticism of the US is soaring, Schamotta said.

"For now, at least, it makes sense for large institutional investors and other market participants to reduce exposure to the US," Schamotta said.

Fed independence is seen as one of the pillars of the dollar as a global reserve currency, which Trump is now undermining, said Francesco Pesole, a foreign exchange strategist at ING.

"It also sounds like a de facto admission by the Trump administration that the downturn caused by tariffs will be painful … and they are looking to blame the Fed," Pesole said.

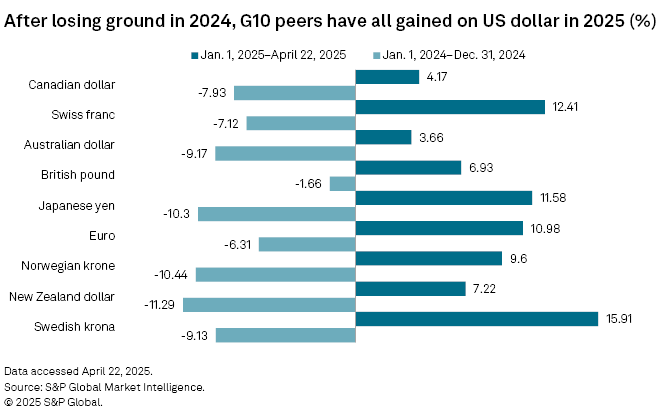

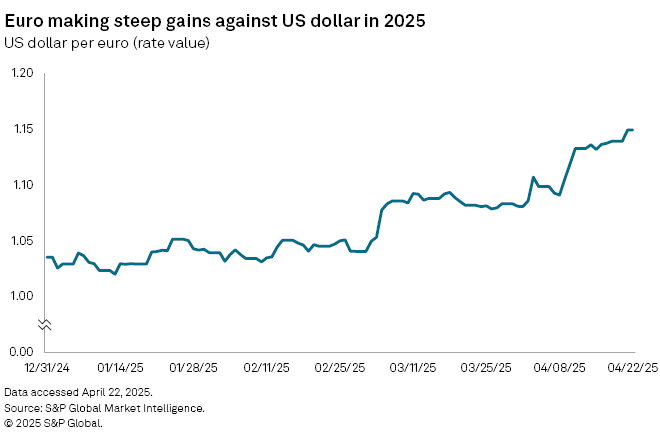

As the dollar continues its fall, Pesole said the worst-case scenario would be an emergency rate cut by the Fed, followed by Powell being replaced by a more dovish nominee before his term expires. Foreign currencies would then continue to gain significant ground on the dollar, with the euro, for example, reaching its highest level against the dollar since 2021, Pesole said.

As the unpredictability of Trump's policies continues to weigh on the dollar, there are few likelihoods that could lift the US currency in the near term, said Michael Hewson, an independent market analyst.

The dollar could rally if Trump were to tone down or even end his pressure on the Fed to cut rates and could climb if the US reaches new agreements to avoid imposition of many new tariffs. However, the risks for further declines are far higher as Trump risks undermining the Fed's ability to work free from political interference to guarantee global financial stability, Hewson said.

"The hope is that Trump is playing games and looking to use Powell as a scapegoat when the economy rolls over and that these comments are mere bluster. However, given his penchant for being unpredictable, who knows what he's thinking," Hewson said.