Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

09 Apr, 2025

By Nick Lazzaro

|

The share price increase for O'Reilly Auto Parts, a US automotive parts retailer and service provider, has been among the highest this year in the S&P 500's consumer discretionary sector. Automotive parts retailers make up a small group of S&P 500 consumer discretionary companies whose stocks have weathered an overall downturn in the sector this year. |

New US tariffs are likely to further aggravate consumers' fears surrounding the domestic economy, adding pressure to consumer discretionary stocks that are already lagging behind other sectors.

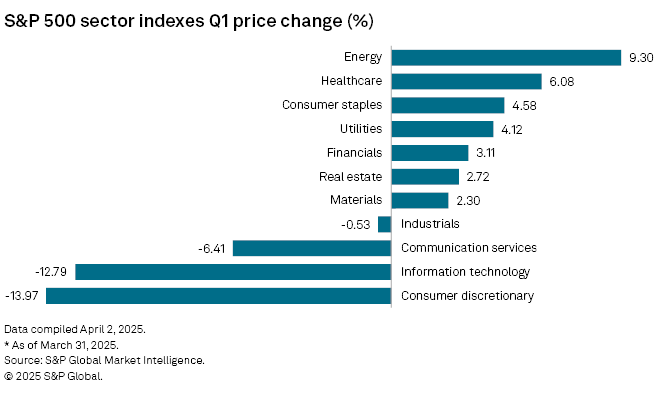

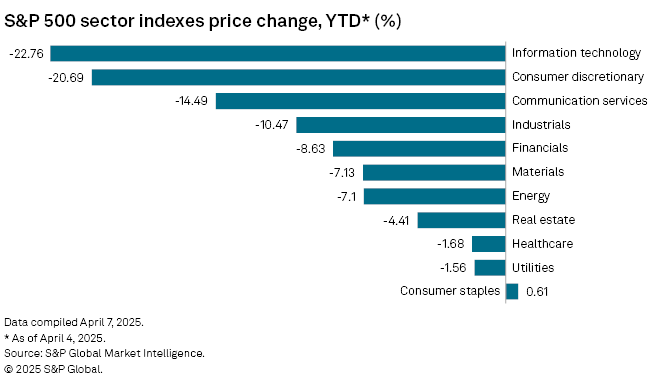

S&P 500 consumer discretionary stocks lost a collective 9% in March and were down about 14% in the first quarter, outpacing declines in all other sectors, according to S&P Global Market Intelligence data. The sector pushed down further to a year-to-date loss of almost 21% at market close April 4, two days after US President Donald Trump unleashed a new set of tariffs and triggered a global stock selloff. This follows a year when consumer discretionary companies already accounted for over 100 large US corporate bankruptcies.

Consumer sentiment began souring months before the US followed through on its tariff threats. In March, the University of Michigan Consumer Sentiment Index dropped for a third straight month while The Conference Board Consumer Confidence Index declined for a fourth straight month. Both indexes aggregate data from key benchmark surveys that measure consumer perception of economic conditions.

"There are a number of industries in the consumer discretionary sector that could face pressure from diminishing market confidence such as high-end clothing retailers, fine dining and others," Bryan Reilly, senior investment analyst for CIBC Private Wealth Management's proprietary investment team, told Market Intelligence. "During uncertain times, consumers may delay the purchase of large ticket items like new cars and expensive vacations, or they may seek out less expensive alternatives."

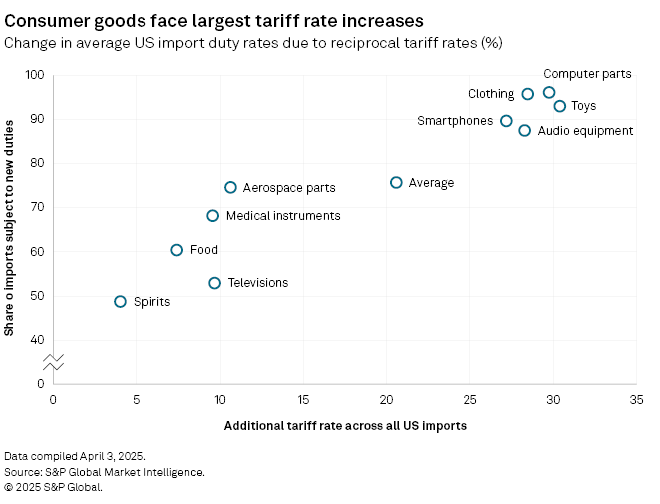

Many US discretionary consumer goods that are largely imported from heavily tariffed countries will disproportionately suffer from price increases in the new tariff landscape, further discouraging consumer spending.

Imports of toys and video games — sourced primarily from China — will be hit by tariffs that are, on average, 30.4 percentage points higher than the rates prior to Trump's April 2 announcement, according to Market Intelligence data. Other tariff increases will include percentage-point jumps of about 30 for computer parts, 27 for smartphones and up to 37 for clothing.

E-commerce sellers of these China-sourced products and other goods will face added pressure due to the US' elimination of duty-free treatment for low-value imports under $800 from the country, effective May 2. The tariff protection, known as the de minimis exemption, fueled the rise of discount e-commerce retailers over the last decade.

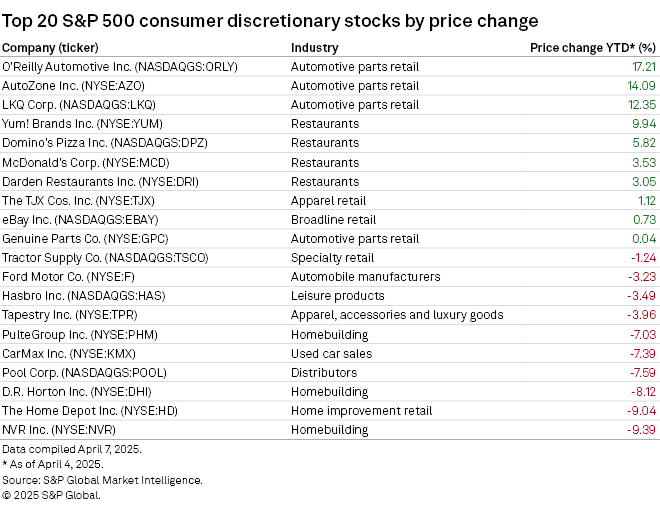

Bright spots

Of the 51 company stocks that comprise the S&P 500's consumer discretionary sector, only 17 yielded positive returns year to date through the end of the first quarter. That number narrowed by market close April 4 to only 10 stocks: four automotive parts retailers and distributors, four value-oriented restaurant brands and two discount-focused retail companies.

"In the downturns where consumers are typically shifting towards more of the value-oriented options and essential goods, discount retailers and fast-food chains will likely see increased business as people seek more affordability," Alexander Bussenger, managing partner of One Eight Capital, told Market Intelligence. "I believe we'll also see small indulgences and the 'lipstick effect' where some of the affordable luxury items will probably maintain steady sales during this period."

Automotive parts retailers may particularly benefit if vehicle price increases push consumers to focus more on the maintenance of their existing vehicles.

"It's a very defensive space that performs well regardless of what is going on in the consumer backdrop," said Phillip Blee, a consumer research analyst with advisory firm William Blair, in an interview.

"As prices have gone up so much over the past few years, buying a new car or used car is a big deal, and it's becoming an even bigger deal. Extending the longevity of existing vehicles is a way for consumers to stretch their dollar a little bit further."

Consumer staples

Consumer staples was the only sector in the S&P 500 to achieve a year-to-date gain through April 4, albeit with a return of less than 1%.

Unlike consumer discretionary sellers, larger portions of consumer staples company sales are linked to necessities such as groceries. Though these companies may collectively fare better in an economic downturn, many still have sizable exposures to discretionary spending trends. Some, such as membership-based wholesale retailers, may be better positioned than others in protecting their bottom lines.

"Membership clubs provide quite a bit of stability because [membership fees are] a recurring part of revenue," Blee said. "Then there is a bigger component that is discretionary that is very much value-based, so the consumer is still feeling like they're getting a deal on anything discretionary, and then there's still a very large chunk of their sales that are related to [consumer staples]."

Consumer staples retailers that are able to leverage online sales platforms and AI tools may also more successfully navigate tariff-related price pressures and competition for dwindling consumer purchasing power.

"Retailers should aggressively adopt AI-powered tools to better forecast demand fluctuations and consider strategies such as product bundling or the expansion of private label offerings to maintain competitive pricing and consumer value," Dilan Mehta, CEO and co-founder of food commerce platform Sizzle, told Market Intelligence.

"Using online grocery platforms can provide consumers with valuable tools such as price tracking, substitution alerts and real-time inventory updates, empowering them to make more informed purchasing decisions during periods of uncertainty."

Wealth effect

Weak consumer sentiment in recent months may signal a looming shift away from strong spending trends in recent years.

The robust spending activity has likely been propped up by higher-income consumers encouraged by the "wealth effect" while lower-income consumers feel increasing pressure and less purchasing power due to persistent inflation. The wealth effect refers to the perception of stable spending power among consumers with assets such as property and investment portfolios that are experiencing rising values.

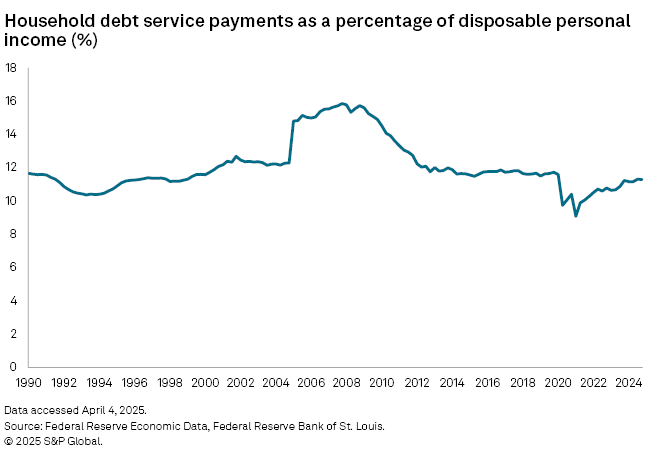

Higher income across the US consumer base has partially offset concerns over rising debt and credit card delinquency rates. Total US household debt hit a record $18.036 trillion in the fourth quarter of 2024, according to Federal Reserve Bank of New York data. However, household debt service payments as a percent of disposable personal income stood at 11.28% in the quarter, up from an all-time low in 2021 but otherwise hovering at the lowest level in over 25 years, according to Federal Reserve Economic Data.

If the wealth effect does begin to wane, early signals could include faltering sales for furniture, membership wholesale retailers, luxury products, travel, home improvement products or home appliances, according to Blee at William Blair.

"If we start to get that segment of high-income consumer fearful and concerned around the wealth effect if the stock market continues to decline, and that consumer starts to really pull back or go into hiding, that will have a pretty big impact on the overall numbers around the health of the consumer," Blee said.