S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

25 Apr, 2025

By Tom Jacobs

UnitedHealth Group Inc.'s stock plummeted following its disappointing April 17 first-quarter earnings announcement, which detailed lower-than-expected revenue and higher-than-anticipated Medicare Advantage payouts.

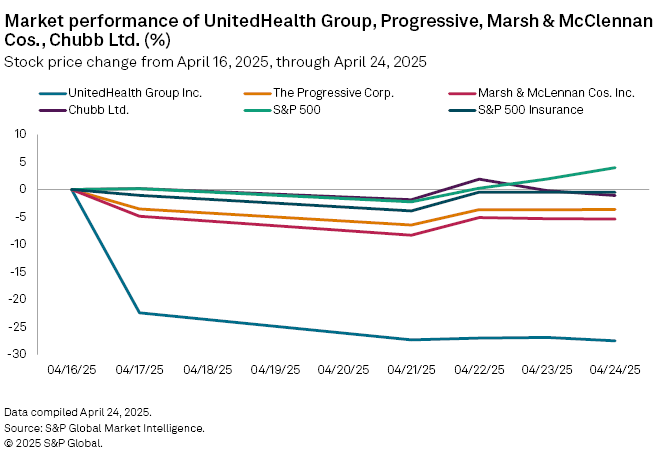

Stock in the company, which is the largest US insurer by market cap, fell 27.48% between April 16 and April 24, from $585.04 to $424.25. This is the lowest price for the company since it closed at $421.25 on Oct. 21, 2021.

While United's total revenue and earnings per share rose year over year, they missed analysts' estimates, and it lowered its full-year EPS guidance. The results were both "surprising and disappointing," which is a "bad combination" in a market roiled by factors such as the Trump administration's unclear trade policy, UBS Global Research analyst A.J. Rice said in a research note.

Stock in other large-cap US insurers also declined following earnings reports, but considerably less than UnitedHealth. The Progressive Corp. was down 3.61%, while Marsh & McLennan Cos. Inc. and Chubb Ltd. fell 5.34% and 1.08%, respectively, over the same period. The S&P 500 Insurance Index fell 0.51%, while the S&P 500 improved 3.96%,

'Unusual and unacceptable'

UnitedHealth booked total revenue of $109.56 million for the quarter, up 9.8% from $99.80 million in 2024, while EPS rose 4.2% to $7.20 from $6.91. Those totals were below many analysts' expectations, including the S&P Capital IQ consensus estimates of $111.60 million for revenue and $7.29 for EPS.

UnitedHealth Group did not respond to a request for comment.

The company "continued strong growth across our businesses and that employees were providing more health benefits and services to more members and patients," CEO Andrew Witty said during the conference call. Unfortunately, underneath that was "an overall performance that was frankly unusual and unacceptable," he said.

UnitedHealth reduced its full-year 2025 EPS guidance to a $26.25 midpoint from a $29.75 midpoint as of the 2024 fourth quarter, CFRA Research analyst Paige Meyer said in a note. This was influenced by "heightened Medicare Advantage utilization, particularly within physician and outpatient services," as well as unexpected changes in Optum Health members' profiles that "should negatively impact reimbursement."

Meyer maintained her "sell" opinion on UnitedHealth and lowered her 12-month target price to $379 from $393.

Piper Sandler analyst Jessica Tassan maintained her "overweight" rating for the company and her target price of $592. Tassan said that UnitedHealth's MA plans have been remarkably stable despite industry pressure, while its delivery assets "democratize high-quality care and bend the cost curve over time.

She said that the CY 2026 MA rate announcement on April 7 "can support a return to durable, double-digit earnings growth at UNH."