Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

28 Apr, 2025

By Iuri Struta

Corporate intent to spend on technology continued to rise in the first quarter, but future spending is likely to depend on tariff policies.

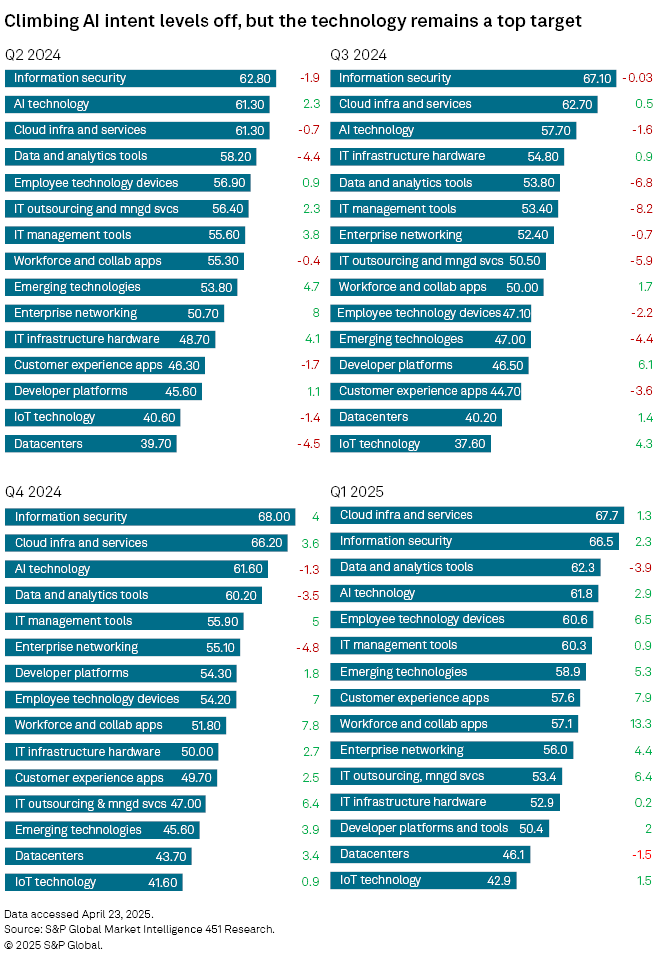

S&P Global Market Intelligence 451 Research's US Technology Demand Indicator (TDI) jumped to 55.11, the highest level in three years. A reading above 50 indicates spending expansion, while a figure below 50 shows contraction.

The increase was driven by a broadening of demand into non-AI tech categories. Cloud infrastructure services was the top spending category in the quarter, surpassing information security. Data and analytics tools also saw growth in spending intent and continued to be among organizations' top priorities.

Tariffs, however, represent an ongoing threat to continued growth in tech spending.

"The impact of tariffs is a major factor, even though many businesses don't feel they can be certain what that impact will be," said Liam Eagle, research director at 451 Research and author of the report.

"Evening out"

In the first-quarter survey, tech spending appeared to be broadening into categories beyond artificial intelligence and cybersecurity. Strong growth in spending intent has been noted in emerging technologies and employee technology devices. Only two tech spending categories out of 15 saw spending intent decline.

By comparison, spending intent dropped in three categories in the fourth quarter of 2024 and in nine the quarter before that.

"The gentle evening out of intent across multiple categories may also be a natural follow-on to the recent intensive focus we've seen among businesses in adopting AI technology," Eagle said. "Spending on AI can be sort of disguised as spending on AI-capable employee devices or spending on switching on the AI functionality of productivity software."

Tariff impact

Tariffs in the US could derail tech spending and sales bullishness on both sides of the ledger.

"We expect both costs and demand to be disrupted in the months to come, and we expect businesses to be cautious with spending," the 451 report stated. "Concerns about these disruptions are widespread, and tariffs have overtaken inflation as a perceived threat to sales in our surveys."

Tariffs could lead to higher costs for IT acquisitions, especially hardware. Semiconductors and other electronics are currently exempted from the tariff increases on mainland Chinese imports, though they are still subject to a 20% rate that US President Donald Trump has tied to the international drug trade, particularly fentanyl. US Commerce Secretary Howard Lutnick has said chips and other electronics will be covered under new sector-specific tariffs that will be announced in the coming weeks and months.

Technology areas that are immune to tariff demand shocks include cloud infrastructure and information security, Eagle said, as are employee productivity tools.

"AI and automation technologies generally fit into this case," Eagle said.

Cloud demand

Organizations have been ramping up spending on cloud infrastructure and data and analytics solutions, both of which have grown in priority. Many have realized that to fully take advantage of AI technologies, they need to prepare by ramping up their IT infrastructure, which often means investments in cloud, data and information security. Cost, privacy and trust are the three key impediments cited by organizations to adopting AI technologies, according to a recent survey by 451 Research.

Alphabet Inc. reported for the second consecutive quarter that demand for its cloud infrastructure services outstripped capacity, with the company confirming its commitment to about $75 billion in capital expenditures this year.

"Today, cloud customers consume more than 8x the compute capacity for training and inferencing compared to 18 months ago," Alphabet CEO Sundar Pichai said. "We'll continue to invest in our cloud business to ensure we can address the increase in customer demand."