Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

15 Apr, 2025

By Tom Jacobs and Noor Ul Ain Adeel

|

A view of homes at Malibu Beach that burned during the Palisades wildfire in Malibu, California, on Jan. 10. |

The fallout from the Southern California wildfires and the twists and turns of the tariff landscape will take center stage when US property and casualty insurers release first-quarter financial results.

Insurers are expected to detail the losses caused by and the response to wildfires that broke out on Jan. 7 and swept through the Los Angeles suburbs. The blazes, which were all 100% contained by Jan. 31, burned more than 57,000 acres, destroyed more than 16,000 structures, caused at least 30 deaths and generated estimated economic losses of between $250 billion and $275 billion.

Reciprocal tariffs announced by President Donald Trump earlier this month will also garner much attention. While Trump paused many of those tariffs for 90 days, personal auto carriers would face the same issues that plagued them during and after the COVID pandemic — disrupted supply chains, claims cost inflation from labor shortages and elevated new and used auto prices — if they eventually do go into effect.

While the pause was a welcome relief, CFRA Research analyst Cathy Seifert said Trump "is still hell-bent on tariffs."

"The uncertainty is if these tariffs stay long term, they'll be driving up [the cost of] everything, both cars and insurance," Insurtech Advisors analyst Kaenan Hertz added. "If new car prices go up, people will look for used, which will drive up the price and inventory will go down.

If tariffs end up being inflationary, the Federal Reserve could be forced to keep interest rates elevated and borrowing costs would move higher, Hertz said.

Wildfires send combined ratios soaring

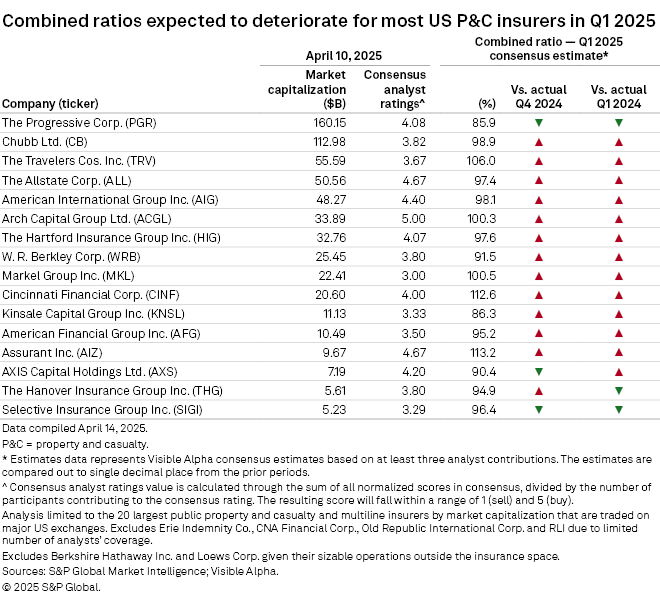

An S&P Global Market Intelligence analysis found that sell-side analysts expect combined ratios to deteriorate both sequentially and year over year for 13 of the 16 largest publicly traded US property and casualty and multiline insurers.

The five insurers in this analysis expected to see their ratios exceed 100%, which would indicate underwriting losses, were all hit hard by the Los Angeles wildfires. Assurant Inc.'s is projected to be 113.2%, Cincinnati Financial Corp. is set to post a combined ratio of 112.6%, The Travelers Cos. Inc.'s is projected to be 106.0%, Markel Group Inc. is set to record a combined ratio of 100.5% and Arch Capital Group Ltd. is projected to disclose a combined ratio of 100.3%.

State Farm General Insurance Co. bore the brunt of the losses from January at an estimated $7.6 billion, but Travelers had the second-highest estimate at $1.7 billion. Despite being a significant exposure, Piper Sandler analyst Paul Newsome in a note said "it is likely not large enough to materially affect Travelers' capital position."

The Allstate Corp. had an estimated $1.07 billion in wildfire losses, while Cincinnati Financial had $487.5 million. Assurant had an estimated $150 million in losses and Markel had $110 million.

The Progressive Corp. had the lowest projected combined ratio in the analysis at 85.9%, followed by Kinsale Capital Group Inc. at 86.3% and AXIS Capital Holdings Ltd. at 90.4%.

Progressive and Selective Insurance Group Inc. were the only insurers to estimated to post sequential and year-over-year improvement in their combined ratios.

Earnings set to slide

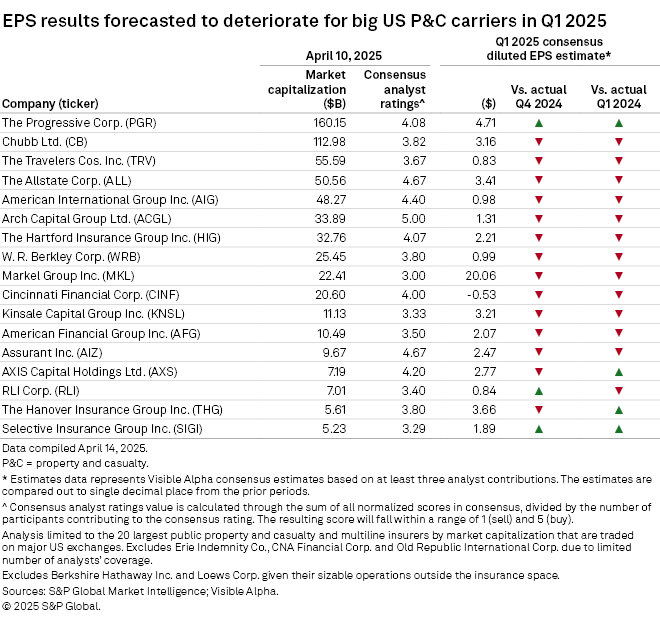

Sell-side analysts expect EPS to decrease quarter over quarter for 14 of the 17 companies in the analysis, while 13 will report lower earnings compared to the first quarter of 2024.

Travelers had the most precipitous drop among the companies in the analysis with an estimated EPS of 83 cents. That is a 90.9% decline from $9.15 in the fourth quarter of 2024 and an 82.2% drop from $4.69 in the prior-year quarter. Markel's EPS is set to tumble 52.9% sequentially and 74.3% year over year to to $20.06

UBS analyst Brian Meredith in a note lowered his estimate for Travelers to 37 cents from $3.85 due to the California wildfires. He said the estimated $1.7 billion in catastrophe losses from the event comes from the insurer's personal and commercial segments, which includes its Fidelis Insurance Holdings Ltd. quota share, as well as estimated assessments from the California FAIR Plan and recoveries from reinsurance.

Revenues to rise YOY

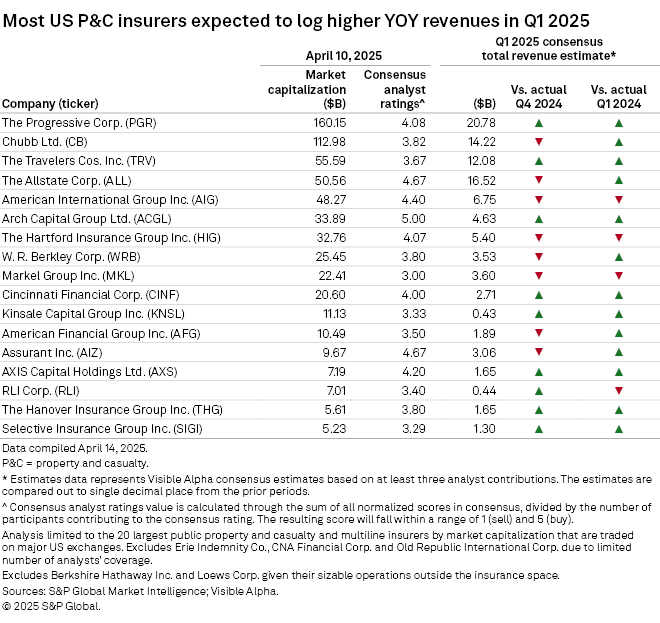

A majority of the companies in this analysis are projected to show revenue increases on both sequential and year-over-year bases.

Progressive had the highest estimate for the first quarter at $20.78 billion and is one of four companies expected to have revenues of more than $10 billion. Allstate was second with a $16.52 billion estimate, followed by Chubb Ltd. at $14.22 billion and Travelers at $12.08 billion.

The Hartford Insurance Group Inc., American International Group Inc. and Markel are the only companies expected to show declines in revenue from both last quarter and a year ago.

Earnings season calls kick off with Travelers reporting in the morning of April 16.

Location

Segment