Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

07 Apr, 2025

By Brian Scheid and Umer Khan

The US labor market remains relatively robust, but the latest government data may be remembered as the last snapshot of a healthy jobs market before President Donald Trump's new tariff program took root in April.

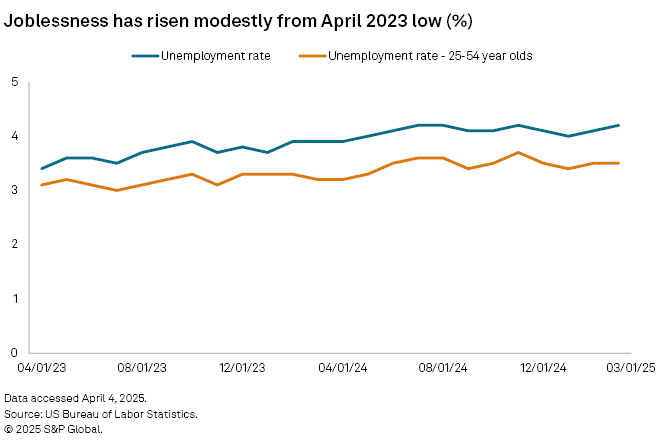

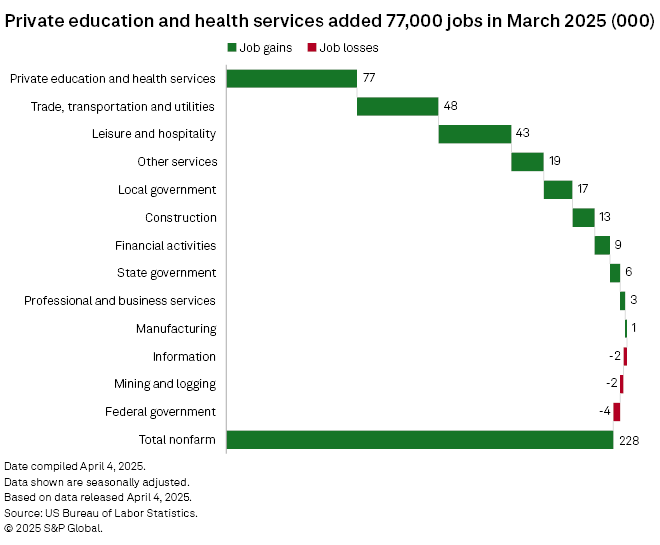

Employers added 228,000 jobs in March, almost 100,000 more than economists were projecting. Unemployment remains at 4.2%, roughly where it has been since crossing above 4% in May 2024, according to Bureau of Labor Statistics data released April 4.

With the Trump administration's wave of new tariffs sending the stock market and government bond yields tumbling, souring consumer sentiment and likely pushing stubbornly high inflation even higher, the comparative strength of the jobs market has offered a glimmer of hope — one that may ultimately prove fleeting.

"If investors can cling to one silver lining right now, it's that the labor market appears to be holding up," said Bret Kenwell, a US investment and options analyst at eToro. "Recent escalations around trade policy and an enormous spike in economic policy uncertainty are weighing on investor sentiment, as well as business and consumer confidence. It's less a question of if this will weigh on growth, but rather how much will growth slow in the face of increasing uncertainty."

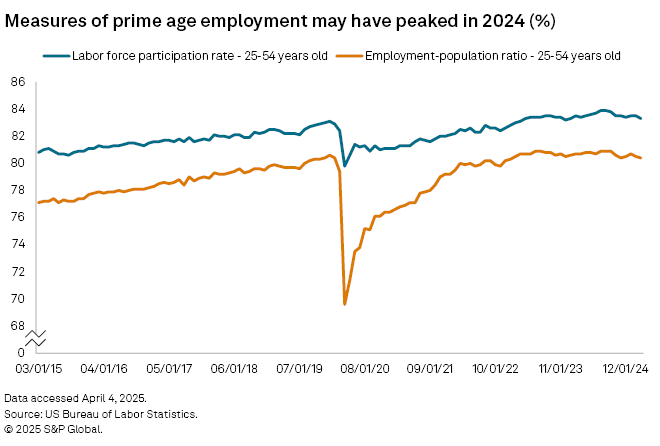

While largely stable, US joblessness is creeping higher, and key employment measures for "prime-age" workers — those between 25 and 54 years old — may be months beyond their peaks.

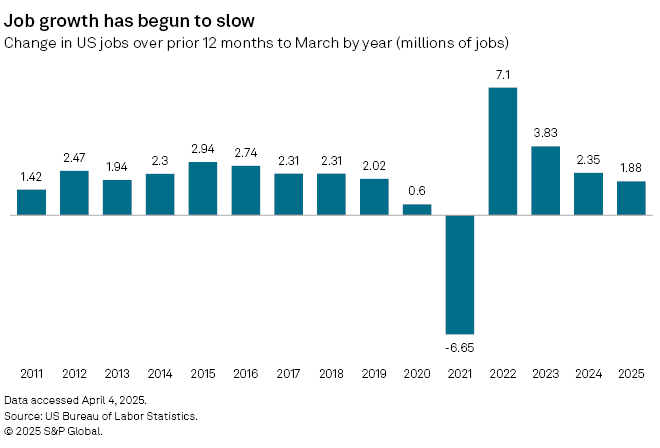

The labor market and overall economy have shown signs of cooling, but signs of stability emerged in the second half of 2024 as job posting and other employment indicators largely moved sideways, said Cory Stahle, an economist at Indeed Hiring Lab.

But the American jobs market is likely at an inflection point.

"Between peaking labor force participation and major policy shifts from the Trump administration, it's likely that we will see things break one way or the other soon," Stahle said. "Right now, it seems like there is a general agreement that the economy is expected to cool further in the near term, which would likely manifest first in job opening declines and fewer jobs being added."

Much depends on the ultimate impacts of Trump's tariffs, how much they will increase prices, and how much they compel employers to slow hiring and potentially lay off workers.

"While uncertainty remains elevated, it is now becoming clear that the tariff increases will be significantly larger than expected," Federal Reserve Chairman Jerome Powell said during an April 4 speech. "The same is likely to be true of the economic effects, which will include higher inflation and slower growth."

Still, the March data shows that the jobs market remains solid and indicates few signs of deterioration yet as layoff activity remains minimal, said Thomas Simons, chief US economist at Jefferies.

"Although the uncertainty caused by tariffs, taxes, and other aspects of economic policy coming from the administration will likely dampen job creation to some extent in the coming months, the data today shows that the labor market is entering this period of uncertainty in a strong position," Simons said. "Momentum can change on a dime, especially when policy expectations shift drastically, but this data shows we have a very long way to go between current conditions and those consistent with a recession."