Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

24 Apr, 2025

By Nick Lazzaro

|

US Vice President JD Vance delivers remarks focused on shared economic priorities between the US and India at the Rajasthan International Centre on April 22 in Jaipur, India. While in India, Vance met with Indian Prime Minister Narendra Modi to discuss a potential trade deal. US imports from India face a pending tariff from the larger US "reciprocal" tariff program. The pending tariff program and ongoing negotiations between the US and trade partners have complicated long-term supply chain planning for businesses. |

US companies exposed to higher costs from the Trump administration's global tariffs are quickly pivoting supply chain strategies in the near term while long-term options remain murky amid a fluid policy outlook.

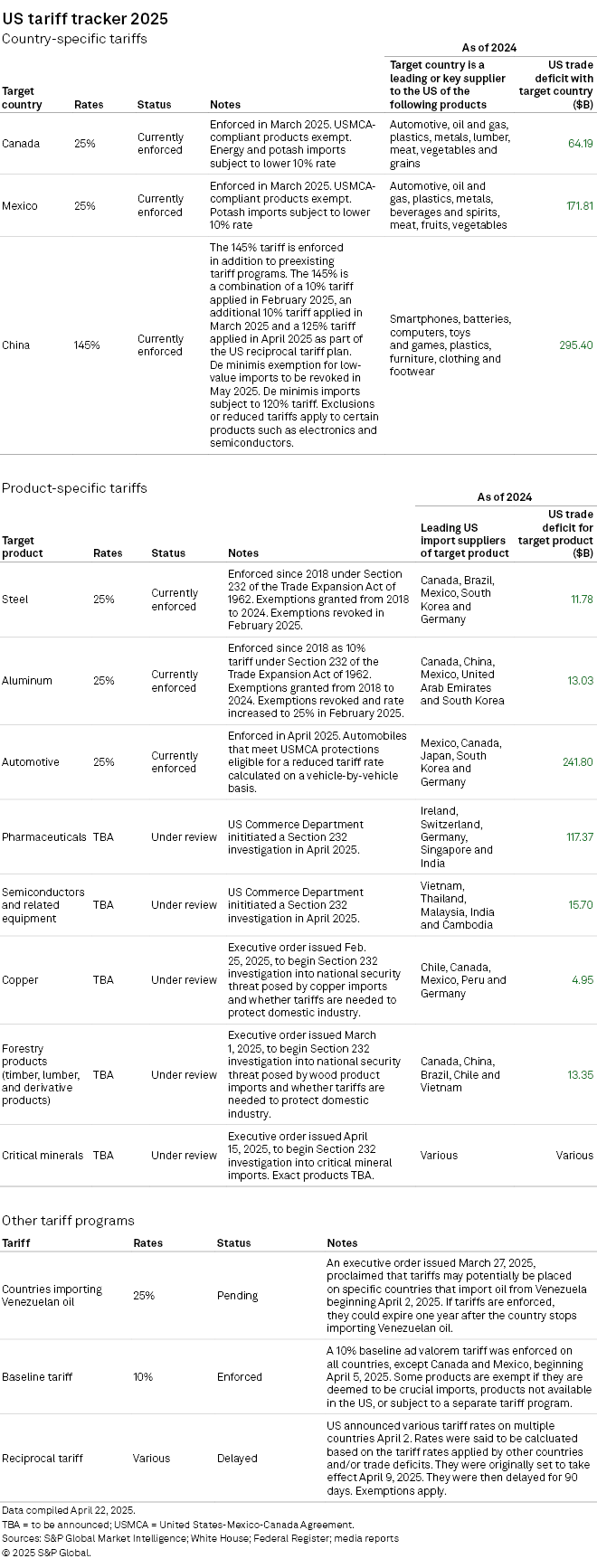

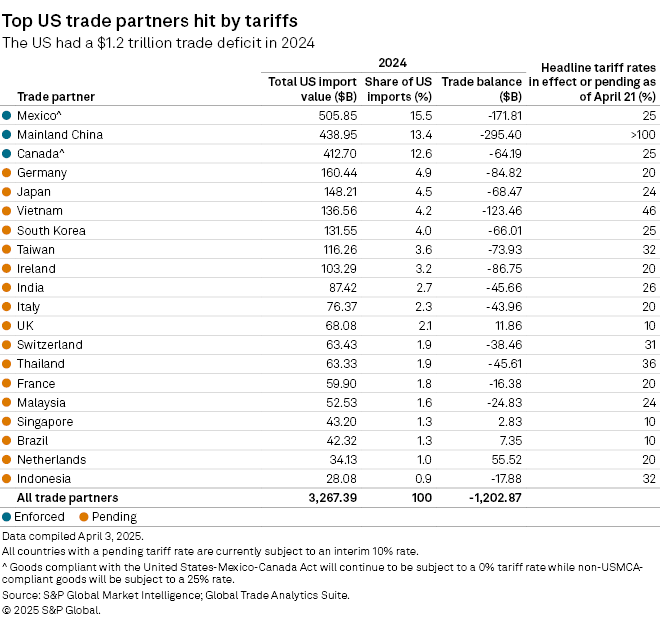

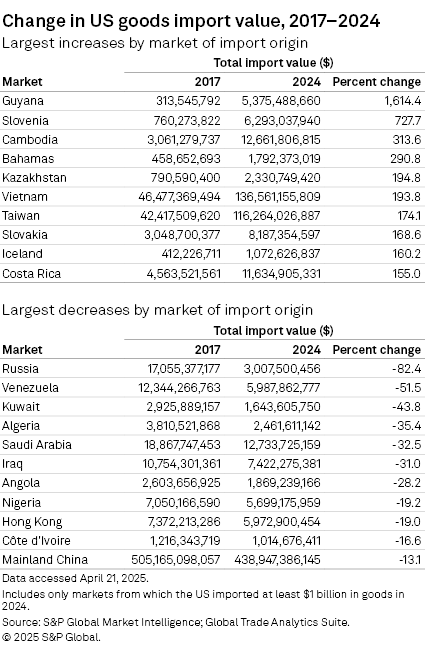

In the months since President Donald Trump took office, imports from most countries are now either subject to new US tariffs or face the prospect of new tariffs by July. This includes rates of 20% or more on the US' top five trading partners — Mexico, mainland China, Canada, Germany and Japan — which together accounted for about half of all US imports with a cumulative trade value of $1.666 trillion in 2024, according to S&P Global Market Intelligence data.

The rush of trade actions has forced companies to implement quick strategies such as inventory repositioning and changes to export flows. Yet details regarding the timing and longevity of the tariffs remain uncertain, creating a difficult environment for long-term supply chain planning that could include costly investments to build new manufacturing hubs in the US or elsewhere. For instance, 25% tariff rates were applied to most imports from Canada and Mexico in February, then later delayed until March with several exemptions. A 10% rate was imposed on mainland China in February and progressively raised to over 100% by mid-April, adding to preexisting tariffs. The US also announced what it called a reciprocal tariff plan in April, including duties of 20% on the EU and 24% on Japan, which were set to take effect the same month but were later delayed until July.

"Companies can't afford to sit still right now when it comes to navigating tariffs," Martin Balaam, CEO and founder of product information management platform Pimberly, told Market Intelligence. "Even if the long-term picture isn't clear, they need to be looking at what can be done in the short term. For many, that means reevaluating supply chains to minimize the impact of tariffs while continuing to serve customers well."

Near-term strategies

Companies with international operations have the near-term optionality to redirect product flow, Balaam said. For instance, producers that manufacture products for the US market in mainland China, now subject to the highest US tariff rate, can instead export the product to other markets. The US market can then be supplied by manufacturing facilities in other countries subject to lower tariffs.

"It's a real-time reshuffle to keep things moving, but the reality is, we just don't know yet if these tariffs are here to stay," Balaam said.

Heineken Holding NV, for example, shipped extra beer to US warehouses ahead of tariff announcements, executives said during an April 16 investor call. Consumer goods producer Kimberly-Clark Corp. is exploring switching the sources of its products in certain markets to mitigate the effect of tariffs, Chairman and CEO Michael Hsu said during an April 22 earnings call.

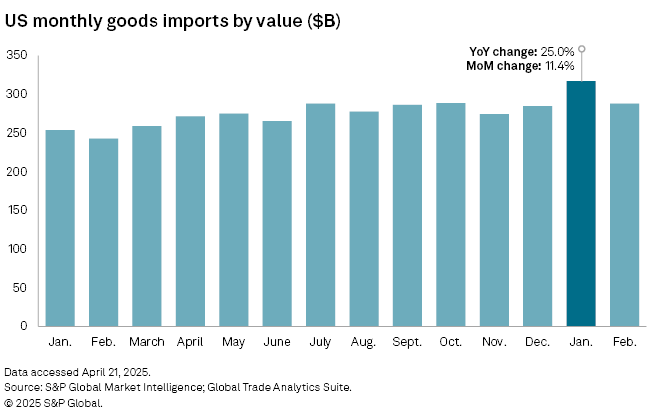

Other short-term strategies include pre-positioning materials and inventory across borders before tariffs officially take effect, according to John Lash, group vice president of product strategy at connected supply chain platform e2open.

"When you can't manufacture it fast enough, but you have it somewhere else in another country, move it in and pay for extra shipping charges because that's going to be cheaper to pay for shipping charges and replenish to those other countries than it is going to be to pay a big tariff once those are in force," Lash said in an interview.

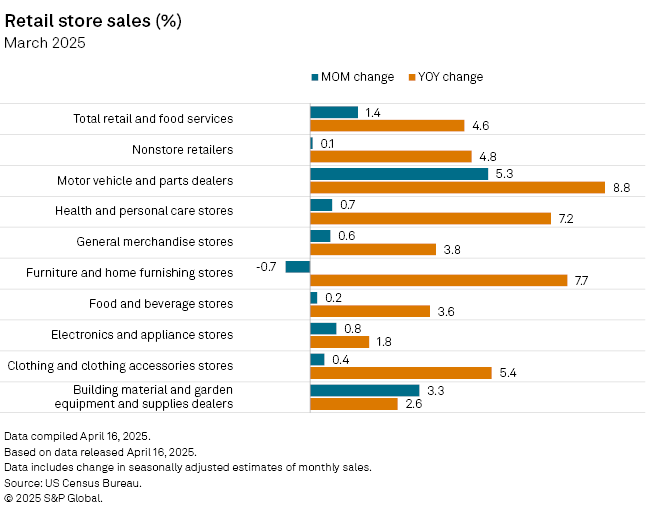

Similarly, consumers have seemingly moved to rush purchases before tariffs trigger potential price increases. In March, US retail sales of automotives and parts, an industry that may be particularly sensitive to tariff-related price increases, surged 5.3% month over month and 8.8% year over year. Total retail sales, excluding automotive and gasoline receipts, climbed 0.8% to beat consensus expectations of a 0.4% increase.

"Tariffs have pulled demand forward as consumers race to beat price increases," Scott Tillman, senior vice president of innovation at supply chain management solutions provider Logility, told Market Intelligence. "You saw that in the retail numbers for March, which came in strong, but there is skepticism if that rate is sustainable."

Long-term prospects

The introduction of the US reciprocal tariff plan and dynamic policymaking may have dismantled the prospects of predictable supply chain planning and stable trade frameworks, pushing businesses to "embed resilience and flexibility into their DNA," said Matt Lekstutis, director at procurement and supply chain consultancy Efficio, in an email.

"President Trump's 'Liberation Day' tariff announcement isn't just a political headline — it's a seismic shift for global trade, supply chains and consumer prices," Lekstutis said. "Uncertainty is the enemy of low-cost, high-performing supply chains and uncertainty, volatility and risk all escalated dramatically for supply chains overnight."

Evolving tariff policy could likely upend many long-term supply chain moves that companies pursued over the past eight years to diversify manufacturing throughout Southeast Asia in response to Trump's mainland China-focused tariff policy enacted during his first presidential term from 2017 to 2021.

"Companies relying on Asian manufacturing are suddenly exposed to serious cost and continuity risk," Lekstutis said. "Most companies were already thinking about and acting on adjustments to their mainland China exposure. These announcements expand the scope to the entire region and raise the stakes considerably."

The US imported $438.95 billion in goods from mainland China in 2024, down about 13% from the beginning of Trump's first term in 2017, according to Market Intelligence data. Import values from Southeast Asian countries such as Cambodia and Vietnam have climbed 314% and 194%, respectively, in that period. Starting in July, Vietnam could face a 46% tariff, while Cambodia could face a 49% rate.

Trump has signaled that certain countries could reduce or avoid a prospective tariff by making a deal with the US. This has added another layer of uncertainty for future tariff policy that could further cloud company decisions to onshore manufacturing in the US, a move that would reduce reliance on tariffed imports but require considerable time and investment.

"How can you make that decision with this level of volatility and uncertainty?" e2open's Lash said. "If you had confidence that the tariffs were going to be permanent, going to be here for 10 years and that the objective was to bring back manufacturing to the US … then you could start to make some of those decisions."