S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

16 Apr, 2025

The market and economic disruption triggered by the announcement of tariffs on all US imports will be a major distraction for the handful of European banks engaged in mergers and acquisitions and could complicate the execution of deals underway.

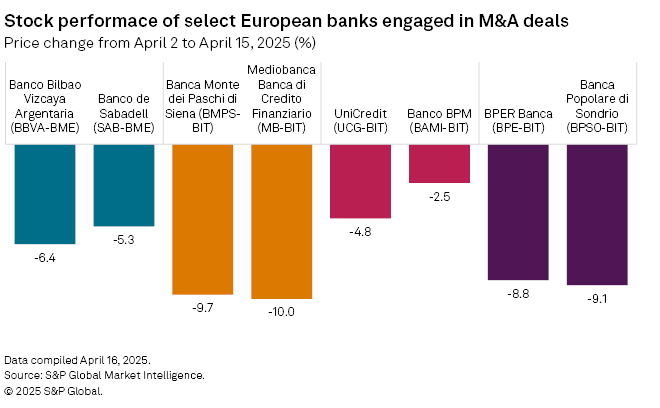

Spanish bank Banco Bilbao Vizcaya Argentaria SA's €12.3 billion move for domestic rival Banco de Sabadell SA and three deals in Italy — Banca Monte dei Paschi di Siena SpA's €13.3 billion bid for Mediobanca Banca di Credito Finanziario SpA, UniCredit SpA's €14 billion offer for Banco BPM, and BPER Banca's €4.3 billion acquisition of Banca Popolare di Sondrio — could be impacted.

"If I were running a bank, I would have other fish to fry than think about merging with other banks right now," Sam Theodore, independent bank analyst, said in an interview. "I would make sure that I keep the business I already have under control."

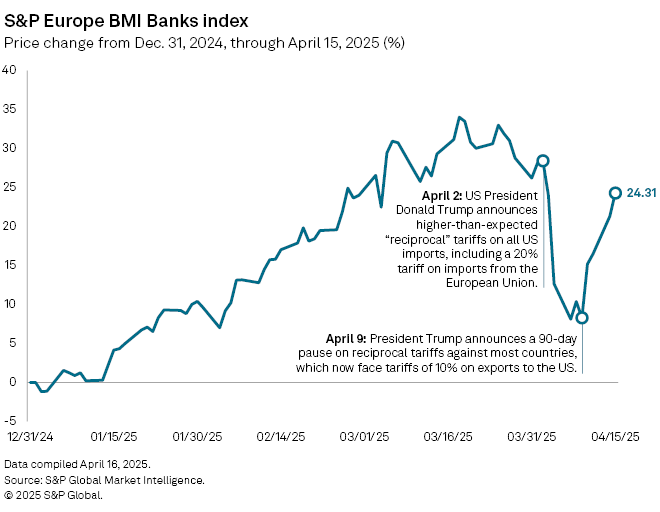

The tariffs announced on April 2 by US President Donald Trump caused a massive sell-off in European bank stocks and upended economic projections for the eurozone and other markets in which European banks operate. European bank stocks fell nearly 16% in the days after Trump's tariff announcement before recovering some of those losses after his April 9 partial U-turn, according to S&P Europe BMI Banks Index data.

The sharp sell-off in European bank stocks reflected investor concerns about the potentially negative impact tariffs could have on lenders' profitability and asset quality.

Increased caution

The worries sparked by the tariffs are likely to impact how banks view recently announced transactions and other potential opportunities for inorganic growth, Marco Troiano, head of financial institutions at Scope Ratings, said in an email.

"With the outlook for asset quality worsening and uncertainty broadening, bank management teams may become more cautious [about M&A deals]," said Troiano.

Some of the banks targeted in the deals underway have cited the uncertainty generated by the tariffs as further justification for their resistance to a takeover. Mediobanca CEO Alberto Nagel said the worsening macroeconomic conditions created by the tariffs made the disadvantages of a merger with Monte dei Paschi more evident, according to a Reuters report.

Italian bank stocks were among the hardest hit during the recent sell-off. Italy was the European Union's third-largest exporter to the US by volume in 2024 at €64.76 billion. Prime Minister Georgia Meloni and the country's top business lobby warned earlier in the month that US tariffs would severely impact Italy's exports and already struggling economy.

'Enhanced scrutiny'

Fresh analysis of the basis of ongoing offers is likely to be underway by bidders, targets and shareholders, Benoit Gérard, EMEIA financial services strategy and transactions leader at EY, said in an email.

"As the US tariff announcements continue to impact market and investor sentiment, increased caution when it comes to M&A is expected, at least in the short term, with enhanced scrutiny of deal rationale and value creation potential," said Gérard.

Proceed as planned

Still, the ongoing deals in Europe should have a sound enough basis to survive the current volatility in markets and doubts about the trajectory of eurozone growth, Andrea Costanzo, vice president, financial institutions at rating agency Morningstar DBRS, said in an interview.

"The performance of the financial markets after the announcement makes the environment extremely uncertain," said Costanzo. "But our view is that, provided that these offers have been announced with a sort of strategic and industrial rationale, the potential buyers would likely continue and proceed with the transaction."

The all-share structure of the proposed deals in Italy and Spain should also mitigate the impact of the sell-off in European bank stocks on the proposed deals, Costanzo added.

"If you look at the performance of European banks and especially Italian banks in this M&A, you don't see material differences between movement of the banks' share prices since the announcement of the tariffs," said Costanzo. "Given that this has affected all the banks' shares, we would expect the exchange ratio of the offer share versus share to have a not very material impact."

Some changes to the structure of the proposed deals are possible if bank stocks incur further losses. "If share prices continue to drop but banks remain confident in their fundamentals, it could make cash deals more attractive," said Troiano.

Significant drops could even open up the possibility of other M&A deals, Nuria Álvarez, bank equity analyst at Madrid-based investment services firm Renta 4 Banco, said in an email.

"I don't see the collapse in the share prices as a problem for M&A," said Álvarez. "The decline in the share prices could be an opportunity more than a drag."

Q1 highs

European bank share prices enjoyed a bumper start to 2025 before the tariff announcement. The S&P Europe BMI Banks Index rose by more than a third at its peak in the first quarter as investors responded to positive forecasts for the eurozone economy amid a proposed loosening of German fiscal policy and improved returns for lenders.

The eurozone faces a 10% tariff on most exports to the US following Trump's decision to pause his original 20% reciprocal tariffs on the bloc for 90 days. Sectors including automotives, steel and aluminum face higher tariffs of 25%. The US has also placed a 10% tariff on UK imports.

A 10% tariff on most EU exports to the US would reduce eurozone GDP by about 0.2%, according to UK-based consultancy Capital Economics. But the damage could be greater due to the US administration's "flip-flopping," which is adding to the already high level of uncertainty, it added.

A lack of visibility for European banks and investors makes any additional M&A moves by European banks beyond those currently underway highly unlikely, said Costanzo.

"I don't expect to see an increase in these kinds of transactions until we get some additional clarity on the tariffs and the reaction from the European Union," he said. "As long as this uncertainty remains, it's usually not very good for investments."