Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

10 Apr, 2025

By Cathal McElroy and Cheska Lozano

| President Trump's announcement on April 2 of import tariffs on every other country in the world is expected to have a negative impact on the US economy this year. Source: Chip Somodevilla/Getty Images |

Banco Santander SA's recently completed reset of its US business will encounter several unexpected challenges resulting from the disruption caused by the tariffs imposed on all US imports by President Trump.

The tariffs, which sank global banking stocks before April 9's recovery, threaten to slow growth in the US, spike inflation and may force a freeze in the Federal Reserve's interest rate easing cycle. Higher-than-expected US interest rates would negatively impact Santander's consumer lending business in the country, which is primarily focused on auto financing and generates most of the bank's US profits.

The negative surprise of the larger-than-expected tariffs comes months after the Spanish banking giant installed the final piece of its new US strategy with the launch of online savings platform OpenBank in October. The four pillars of the strategy — OpenBank, consumer lending, corporate and investment banking (CIB), and wealth management — aim to boost profitability in a market in which Santander has long-struggled to generate significant returns.

"The prospects for Santander's US business this year will depend a lot on inflation and how things will evolve based on the challenges that are coming from these trade barriers," Carola Saldias, senior director, financial institutions at Scope Ratings, said in an interview.

US inflation could rise to between 4% and 5% by the end of 2025 depending on President Trump's willingness to compromise on the level of tariffs, an April 6 report by U.K.-based consultancy Capital Economics said. With inflation spiking, the US Federal Reserve is only likely to make further cuts in its current interest-rate easing cycle this year, "but probably only grudgingly," if President Trump persists and the US economy plunges into recession, it added.

Traders have trimmed bets that the Fed would cut rates this year since President Trump announced a 90-day pause on reciprocal tariffs on April 9, now forecasting around 75 basis points by December rather than the 100 bps predicted before the U-turn.

Santander's main US operating unit is Santander Holdings USA Inc. Santander's US business was predicted to be "one of the biggest beneficiaries of lower rates" and "one of the biggest upsides in our [profit and loss statement in 2025]," Santander chair Santander Ana Botín said during the bank's full-year 2024 earnings call in February. Return on tangible equity — a key measure of bank profitability — in the US was forecast to reach 10%, CEO Héctor Grisi said during the call, compared to ROTE of 7.5% in 2024, company filings data shows.

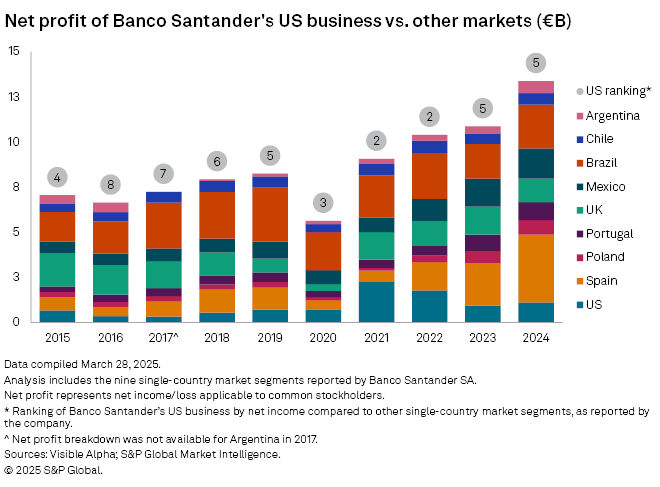

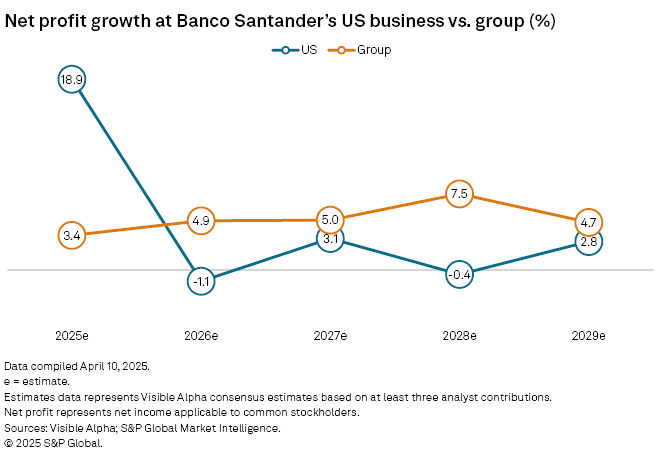

Santander's US business was expected to record an almost 19% increase in net profit in 2025 compared to a 3.4% rise for the group, according to analyst consensus estimates from Visible Alpha, a part of S&P Global Market Intelligence.

The turbulence caused by the tariffs should not prevent Santander from recording an increase in group profitability in 2025, Botín said in a press statement released as part of the bank's annual general meeting presentation on April 4. The bank maintained all its targets for 2025 without specifying if this included market-specific targets or group targets generally.

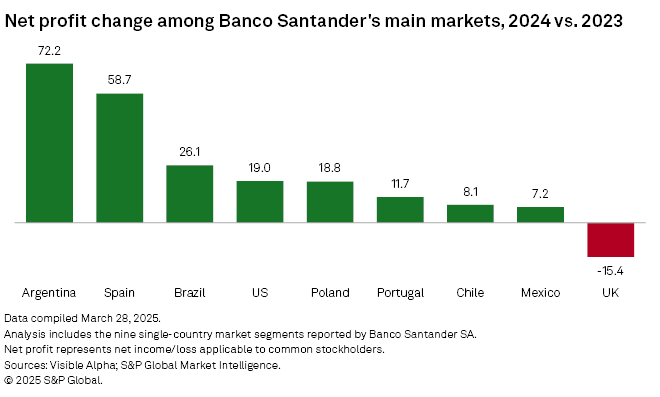

"It is in challenging times when the value of our diversification is most apparent," Botín said. "Our diversification acts as stabilizer in an uncertain global environment."

Santander's auto-focused consumer finance business in the US is particularly vulnerable to the economic turbulence expected from the tariffs. The business, which generated more than half of the bank's US profit before tax in 2024, could see loan losses increase if interest rates remain high to tackle a rise in inflation or unemployment starts to rise due to an economic downturn in the US.

"Santander is exposed to car loans in the US., especially the sub-prime part of the auto loans market," Filippo Alloatti, head of financials, credit at global investment manager Federated Hermes, said in an interview. "I'm expecting the cost of risk for this part of the market to increase."

Santander, which gradually reduced its exposure to sub-prime auto borrowers, still had more than half of its auto loan book comprised of sub-prime lenders as of the end of December.

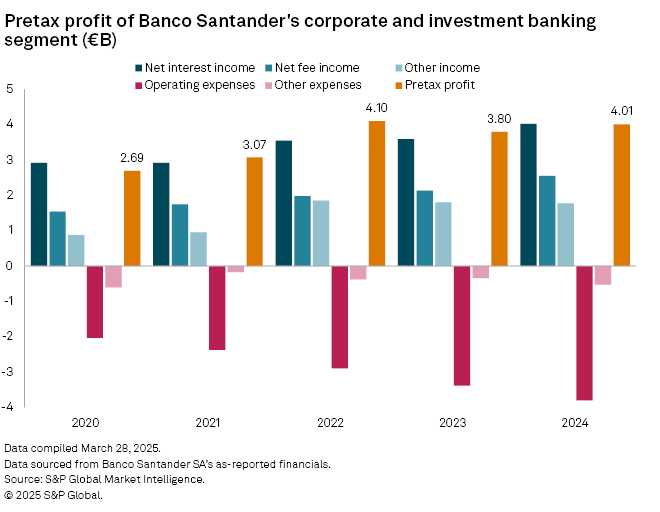

The tariffs come as Santander continues to invest in developing its CIB banking business in the US to complement its operations in Spain and Latin America.

"Investors and analysts were not fully convinced by the movement on CIB for Santander," Javier Beldarrain, equity research analyst at Madrid-based Bestinver Securities, said in an interview. "Investment banking in general in the US is pretty expensive and they are still going to be a very small player compared to the other big banks in the US"

The spike in uncertainty caused by the tariffs is likely to weaken the uplift in US CIB income expected by Santander this year as companies delay investment decisions. US corporate bond market issuances have dried up since the announcement of the tariffs, Market Intelligence data shows.

The deterioration of trade relations between the current US administration and the Mexican government — the US continues to place a 25% tariff on goods it imports from Mexico that are not covered under the USMCA trade pact following its 90-day pause on higher tariffs against most other countries — particularly threatens the US CIB's prospects.

"The dynamic that we will see between Mexico and the US in terms of potential economic growth and how this will evolve will be important in determining the success of the US CIB," said Saldias.