S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

21 Apr, 2025

By Eugene Gerden, Drew Wilson, and Neel Hiteshbhai Bharucha

Russia’s private equity and venture capital industry has turned to alternative capital-raising methods to offset the exit of international investors following Western sanctions imposed after the Russia-Ukraine War began in February 2022.

Russia has seen “minimal activity by foreign investors, while US and European investors avoid financing Russian PE/VC funds, fearing legal and financial consequences,” said Elena Vologodskaya, managing director of Moscow-based Softline Venture Partners.

Chinese and Middle East investors have not filled the funding gap, added Elizaveta Tikher, partner at early-stage venture capital firm Startech.vc.

Domestic family offices and high-net-worth individuals have scaled back startup investments,

"Deals without clear potential for returns exceeding 30% per annum are unattractive to investors," Tikher said.

New capital sources

Last year, Russian venture capital funds raised $177 million, up from $84 million in 2023, but still far from the $2.4 billion raised in 2021, Vologodskaya said, citing data from Dsight, a Moscow-based business intelligence firm.

Private capital firms in response are reorienting their approach to raising and deploying capital. Some venture capital funds, for example, adopt a dividend model that reduces investment risk by targeting companies expected to reach break-even within months.

“Return on investment occurs not only with a successful sale of shares, but consistently due to dividend payments,” Tikher said.

Private funds have also pivoted to non-standard funding sources, such as retail investors.

“One of the key trends is a large influx of liquidity from retail investors, including business angels, especially at the early stages of company development,” said Ruslan Sarkisov, managing partner of Moscow-based Voskhod Management Co. LLC.

Investment platforms, often set up by Russian banks, target tech startups and provide retail investors with liquidity, Sarkisov said. “To some extent, investment platforms are beginning to compete with traditional venture funds.”

Crowdfunding mechanisms are also increasingly playing a role in funding small and medium-sized businesses, he added.

Shift to tech startups

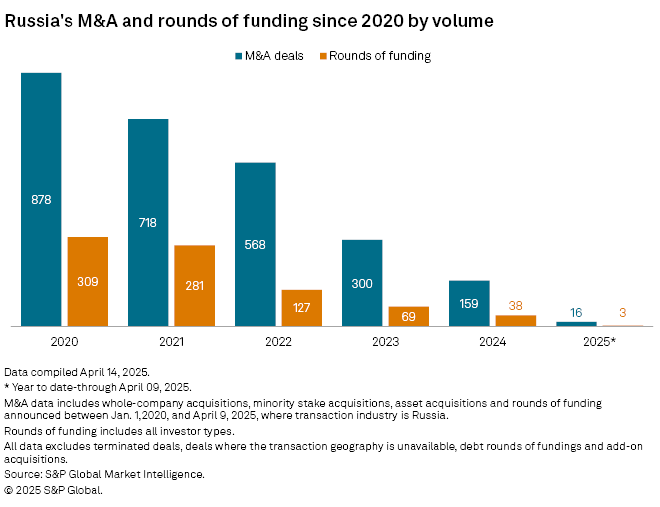

The departure of international investors also impacted the number and size of deals, with a decline in overall M&A as well as rounds of funding volume accelerating after 2022.

The last two large private equity deals in Russia were in 2023 and involved asset acquisitions of foreign companies exiting the country.

Both deals were led by Moscow-based private equity firm Kismet Capital Group, which acquired the assets of Heineken's Russian business in a $660 million deal and the assets of Germany's Henkel AG & Co. KGaA, a chemical and consumer goods company, in a $661 million acquisition, S&P Global Market Intelligence data shows.

Since the war began, private capital has shifted away from large deals to smaller investments primarily targeting technology startups.

The government provides support for tech startups by easing regulatory barriers, introducing tax incentives and providing funding in partnership with private investors. “Investors are reorienting towards sectors that are key to the national economy and have high import substitution potential, such as IT, agrotechnology and medicine,” Tikher said.

Attractive investment targets are tech companies scaling their operations, Tikher said. Established startups pursuing growth through M&A include Motorika Ooo, Ultimate Education, OOO Genotek and Skyeng.

Tech companies are also proliferating because the departure of foreign IT companies from the Russian market has significantly increased the demand for home-grown IT services and products, according to Sarkisov.

The demand for domestic goods and services “is stimulated by the state, in particular through subsidies for the implementation of Russian solutions. For example, in robotics and in software,” he said.

Technology companies drove the IPO market to a record high last year, when Russia had 19 public offerings, a 10-year record, according to Russia’s Central Bank.

“This opens up new opportunities for exits, and investors are increasingly interested in investing in companies at earlier stages of development, before the stock exchange [debut],” Sarkisov said.

________________________________________________________________

To view S&P Global's ongoing list of sanctions issued against Russia, click here.