S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

07 Apr, 2025

By Chris Hudgins

Share prices for US equity real estate investment trusts plummeted alongside the broader stock market following President Donald Trump's tariff announcements on April 2.

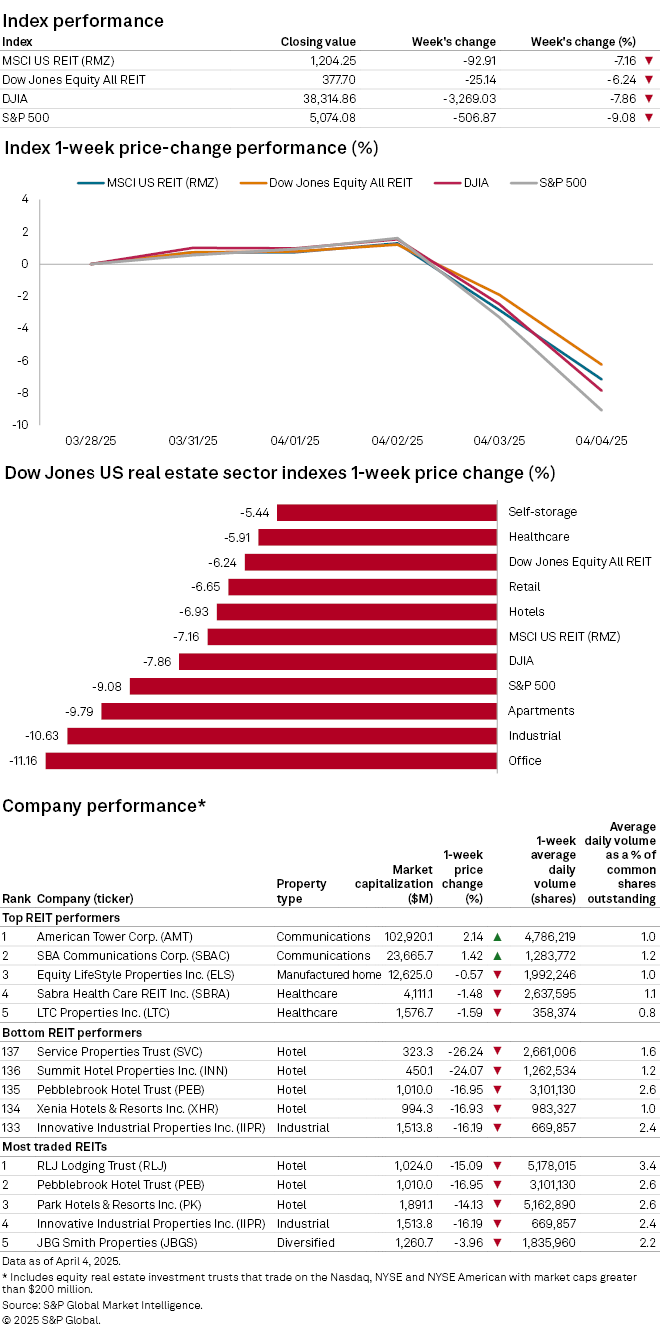

The Dow Jones Equity All REIT index closed the week down 6.24%, compared to a fall of 9.08% for the S&P 500 and a 7.86% drop for the Dow Jones Industrial Average.

All Dow Jones US real estate sector indexes closed the week in the red, with the office index falling the furthest, down 11.16%. The industrial and apartment REIT indexes followed next with drops of 10.63% and 9.79%, respectively.

The hotel sector included the bottom four performing US REITs with at least $200 million in market capitalization. Service Properties Trust logged the largest share-price drop during the week, down 26.24%. Summit Hotel Properties Inc. and Pebblebrook Hotel Trust followed next, with share-price drops of 24.07% and 16.95%, respectively.

Only two REITs above $200 million market capitalization ended the recent week in the black and both are in the communications sector. American Tower Corp.'s share price increased 2.14% during the week, while SBA Communications Corp.'s share price grew by 1.42%.

Self-storage REIT SmartStop Self Storage REIT Inc. began trading on the NYSE on April 2 following its IPO. While the REIT was excluded from the chart since it did not trade for the full week, its share price closed April 4 at $32.89 per share, 9.6% above its IPO price of $30 per share.