Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

21 Apr, 2025

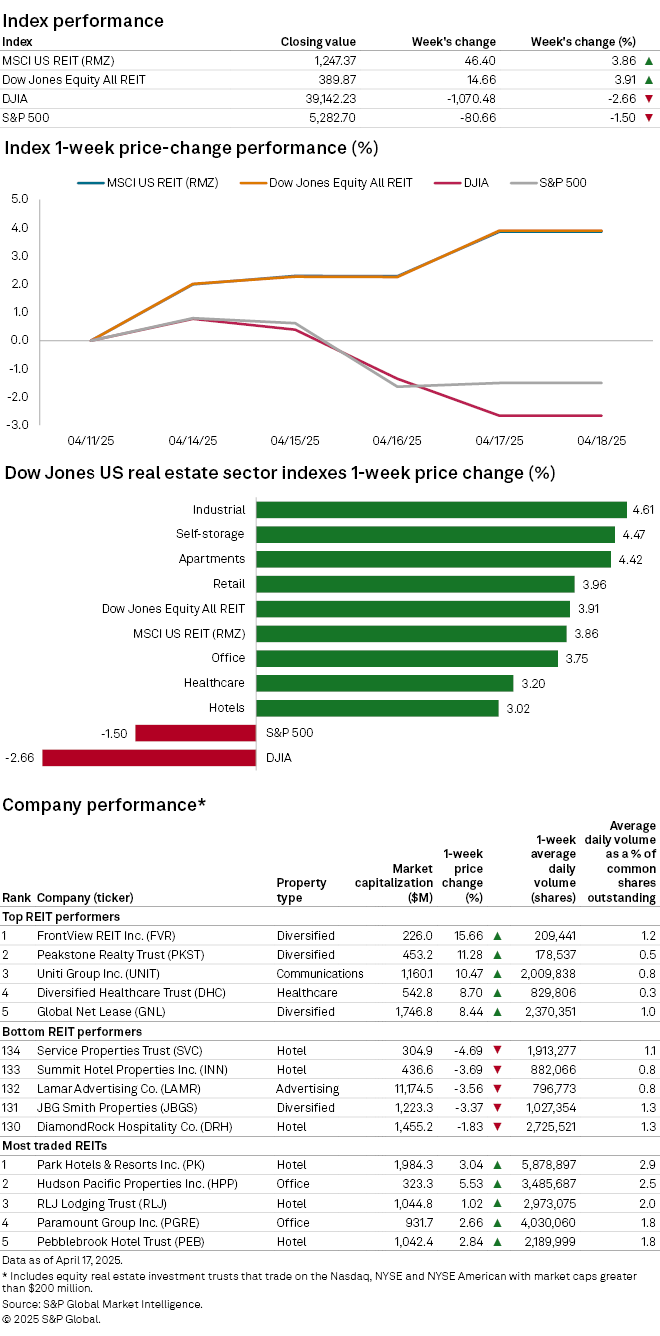

Share prices for US equity real estate investment trusts rose during the week leading up to the Easter holiday.

The Dow Jones Equity All REIT index closed the recent week up 3.91%, outperforming the 1.50% decline for the S&P 500 and the 2.66 drop for the Dow Jones Industrial Average.

All Dow Jones US real estate property sector indexes closed the past week in the black, with the industrial and self-storage indexes logging the largest increases, up 4.61% and 4.47%, respectively. The apartment and retail REIT indexes followed next with gains of 4.42% and 3.96%, respectively.

Among US REITs with at least $200 million in market capitalization, FrontView REIT Inc., a net lease REIT with a diversified group of tenants, closed the recent week with the largest share-price gain, up 15.66%. Peakstone Realty Trust, which owns a mix of office and industrial properties, followed next with a share-price increase of 11.28%. Communications REIT Uniti Group Inc. ranked third with an increase of 10.47%.

On the other hand, hotel-focused Service Properties Trust's share price fell 4.69% over the week, the largest share-price drop within the US REIT sector. Hotel REIT Summit Hotel Properties Inc. and advertising REIT Lamar Advertising Co. followed next with share-price declines of 3.69% and 3.56%, respectively.