S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

21 Apr, 2025

By Meerub Anjum, Karl Angelo Vidal, and Neel Hiteshbhai Bharucha

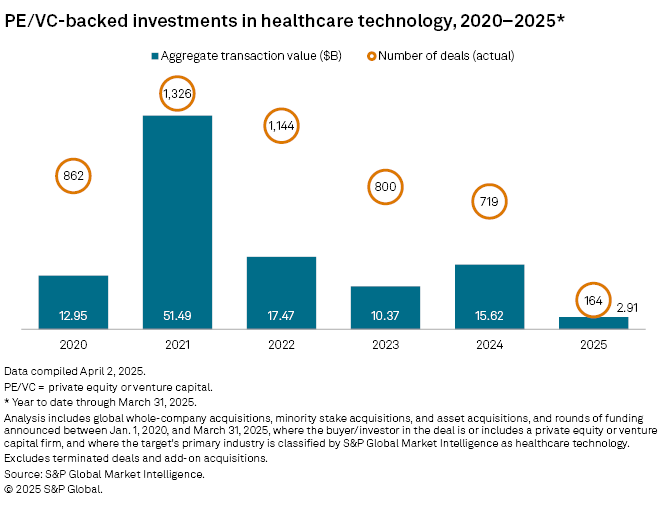

The value of private equity and venture capital deals in healthcare technology climbed about 50% year over year to $15.62 billion in 2024, according to S&P Global Market Intelligence data.

The aggregate transaction value in 2024 was the highest in two years.

In 2025, first-quarter results showed continued momentum. Total deal value in healthcare technology reached $2.91 billion, up nearly 22% from the same period in 2024.

"Healthcare technology remains a bright spot in the dealmaking landscape, buoyed by strong demand for digital health, AI-driven diagnostics and care delivery innovation," Nick Donkar, US health services deals leader at PwC, told Market Intelligence.

"We're seeing increased interest from both strategic and financial investors, particularly in solutions that drive efficiency and improve outcomes."

The healthcare technology sector is undergoing rapid change as companies adopt AI, aiming for cost-saving innovation that is expected to make "transformative and disruptive advances in healthcare," according to the National Academy of Medicine.

Echoing the same view, the Centers for Disease Control and Prevention said, "AI's potential to transform health is immense, from improving diagnostic accuracy to personalizing treatment plans and predicting disease trends."

– Download a spreadsheet with data featured in this article.

– Read about venture capital rounds of funding in March.

– Check out more private equity coverage.

Private equity strategies

Private equity has been active in healthcare deals by adopting effective strategies for the sector, said Roel van den Akker, pharmaceutical and life sciences deal leader at PwC. They are creating specialized investment vehicles to manage specific risks by partnering with biopharma and healthcare organizations while monitoring corporate carve-out opportunities, he said.

"They're very interested in picking up underperforming assets that healthcare companies are shedding," van den Akker said.

However, the changing US trade policies, such as the return of tariffs that affect imports, create difficulties for supply chains and could increase costs for manufacturers that rely on parts from other countries. Because of this, investors will focus on companies that are good at handling these regulatory changes and are using technology to improve healthcare software solutions while reducing costs, Donkar added.

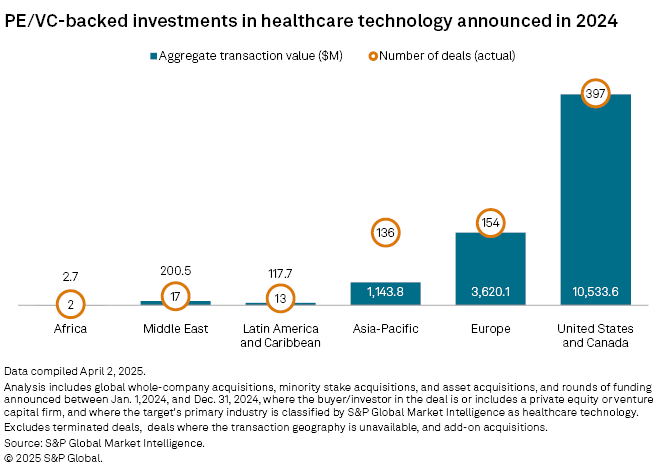

Regionally, companies in the US and Canada received the most investment in 2024, attracting $10.53 billion across 397 deals, followed by Europe with $3.62 billion across 154 deals.

Top deals in 2024

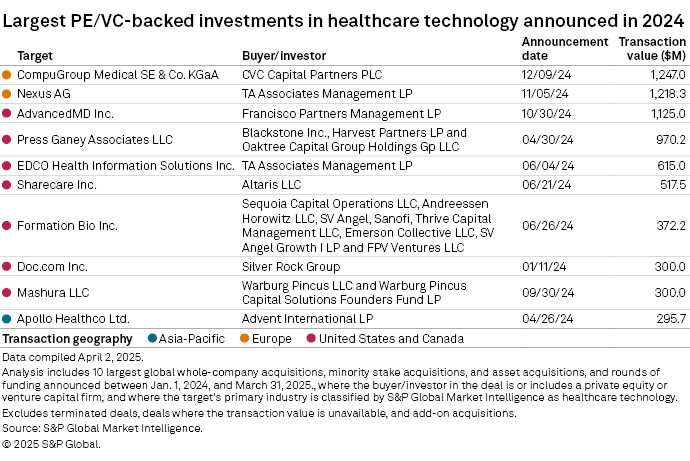

In 2024, the healthcare technology sector recorded three private equity-backed transactions with at least $1 billion in value.

In the largest deal, CVC Capital Partners PLC offered to buy German e-health services provider CompuGroup Medical SE & Co. KGaA for 1.25 billion.

TA Associates Management LP's tender offer to acquire Germany-based e-health software company Nexus AG for $1.22 billion was the second-largest transaction. TA completed the tender offer on Jan. 3.

The third-largest transaction was Francisco Partners Management LP's $1.13 billion acquisition of cloud medical office software provider AdvancedMD Inc. from Global Payments Inc.

Healthcare tech-focused fundraising

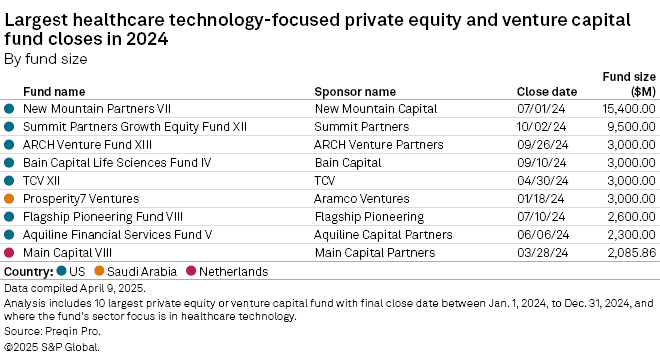

New Mountain Capital LLC raised $15.4 billion for New Mountain Partners VII LP, the largest private equity fund focused on healthcare technology to reach final close in 2024, according to Preqin Pro data.

So far in 2025, the buyout fund has invested in funding rounds for Office Ally Inc., Access Healthcare Services USA LLC and Union Healthcare Insight LLC, Market Intelligence data shows.

The second-largest healthcare technology-focused fund was Summit Partners LP's Summit Partners Growth Equity Fund XII LP, which closed on $9.5 billion in October 2024.