Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

17 Apr, 2025

By RJ Dumaual and Katherine Dela Cruz

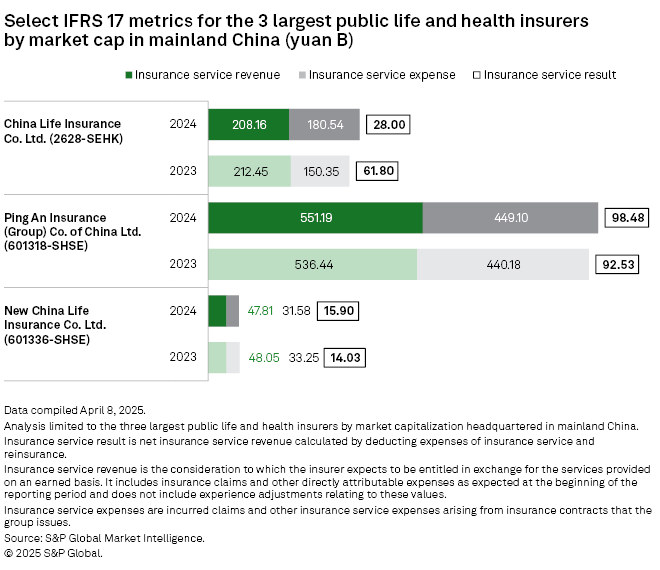

Ping An Insurance (Group) Co. of China Ltd. reported the largest increase in insurance service result among China's three biggest listed life insurers by market capitalization in 2024, according to an S&P Global Market Intelligence analysis.

Ping An's insurance service result, a key IFRS 17 metric, rose to 98.48 billion yuan from 92.53 billion yuan in 2023. The increase in insurance service revenue outpaced the growth in insurance service expense.

New China Life Insurance Co. Ltd. also recorded a higher insurance service result, rising to 15.90 billion yuan in 2024 from 14.03 billion yuan in 2023, even as its insurance service revenue fell to 47.81 billion yuan from 48.05 billion yuan, and its insurance service expenses decreased to 31.58 billion yuan from 33.25 billion yuan.

New China Life reported a 9.8% increase in its insurance service result for issued contracts, rising to 16.28 billion yuan in 2024 from 14.79 billion yuan in 2023.

Of the three insurers, only state-owned China Life Insurance Co. Ltd. saw insurance service results drop to 28.00 billion yuan from 61.80 billion yuan. Its insurance service revenue declined to 208.16 billion yuan from 212.45 billion yuan, while its insurance service expense jumped to 180.54 billion yuan from 150.35 billion yuan.

China Life expects to have sufficient capital to meet its insurance business expenditures and new general investment requirements in 2025. However, asset-liability interaction management needs to be "strengthened urgently."

– Use the screener to access financial results on the S&P Capital IQ Pro platform.

– Read an analysis of Japanese P&C insurers' earnings.

– Read about potential M&A activity in the global insurance sector on In Play Today, and a summary of recently announced deals on M&A Replay.

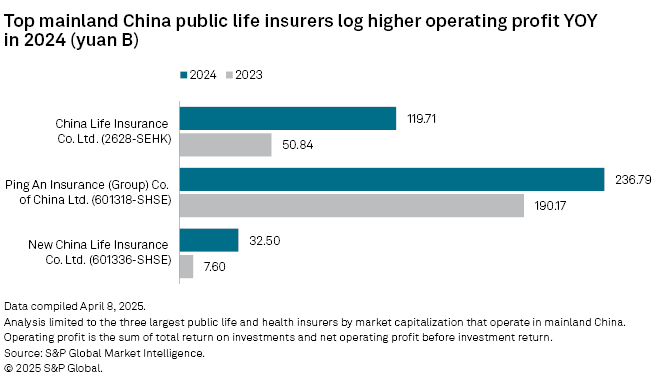

Surging operating profit

All three life insurers recorded big year-over-year gains in operating profit in 2024, with China Life reporting the biggest increase to 119.71 billion yuan from 50.84 billion.

Ping An Insurance's operating profit grew to 236.79 billion yuan from 190.17 billion yuan, while New China Life's operating profit surged to 32.50 billion yuan from 7.60 billion yuan.

"We do believe that life insurance has entered into the golden period of development," Ping An Insurance CFO Fu Xin said in an earnings call. "Life insurance is no longer an optionable product, and life insurance is indeed going to be a rich demand for the consumers in our society."