S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

07 Apr, 2025

By Arpita Banerjee and Ronamil Portes

This Data Dispatch is updated monthly and was last published March 5. The analysis includes US equity real estate investment trusts that trade on the Nasdaq, NYSE or NYSE American with market capitalizations of at least $200 million and can offer insight into how the Street is valuing different property sectors. While valuations within the portfolio of publicly traded REITs might not match all privately owned properties, the public markets can often be a leading indicator for potential future property pricing. That insight is particularly helpful when there is little price discovery in the market due to a lack of transactions.

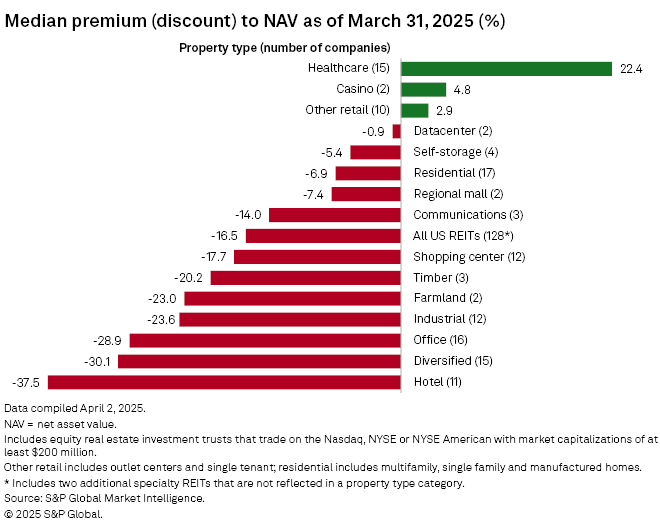

Publicly listed US equity real estate investment trusts ended March 31 at a median 16.5% discount to their consensus net asset value (NAV) per share estimates, compared with a median discount of 13.7% as of Feb. 28, according to S&P Global Market Intelligence data.

The hotel sector traded at the largest discount to NAV at 37.5%, an increase of 6.5 percentage points from 31.0% in the previous month. Diversified REITs traded at a median discount of 30.1%, up from 19.8% the previous month. The office sector followed with a 28.9% median discount to NAV, rising from 23.7% as of Feb. 28.

Healthcare REITs continued to trade at the highest premium at 22.4%, an increase of 6.4 percentage points from the previous month. With only two REITs in the analysis, the casino sector traded at a 4.8% premium, rising from 3.7% in February.

Datacenter REITs, which traded at an 8.5% premium last month, closed March 31 at a 0.9% median discount to NAV.

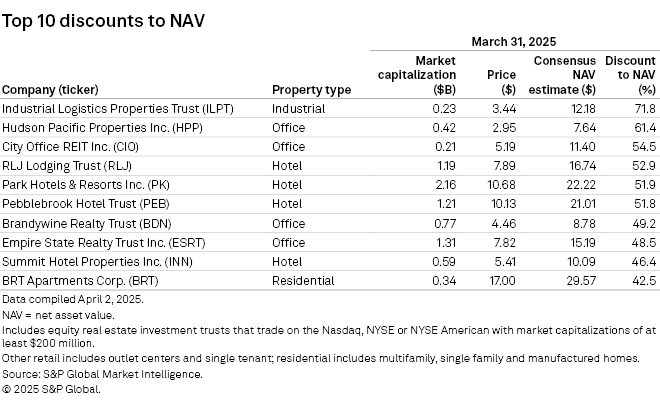

Largest discounts

Industrial REIT Industrial Logistics Properties Trust traded at the largest discount to NAV among all US REITs with at least $200 million in market capitalization. The REIT closed March 31 at $3.44 per share, 71.8% below the consensus NAV estimate of $12.18 per share.

Office REIT Hudson Pacific Properties Inc. traded at $2.95 per share on March 31, 61.4% below the consensus NAV estimate of $7.64 per share. Among the 10 public REITs analyzed that traded at the largest discounts, four were from the hotel sector and four from the office sector.

City Office REIT Inc., Brandywine Realty Trust and Empire State Realty Trust Inc. were the other office REITs, trading at discounts of 54.5%, 49.2% and 48.5%, respectively.

The four hotel REITs on the list are RLJ Lodging Trust, Park Hotels & Resorts Inc., Pebblebrook Hotel Trust and Summit Hotel Properties Inc., which traded at discounts to NAV of 52.9%, 51.9%, 51.8% and 46.4%, respectively.

– Download an Excel template with data featured in this story.

– Set email alerts for future Data Dispatch articles.

– Read some of the day's top real estate news and insights from S&P Global Market Intelligence.

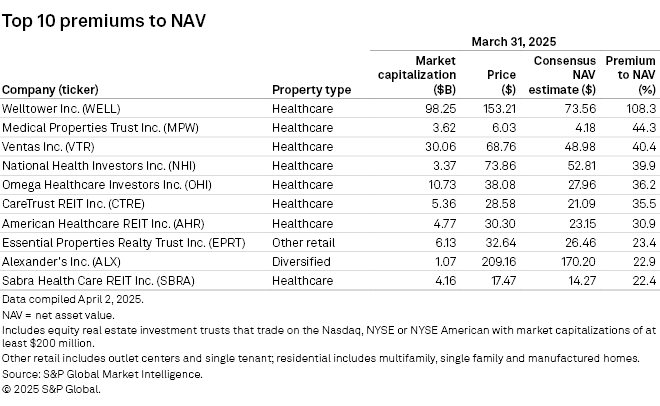

Largest premiums

Healthcare REITs dominated the list of 10 public REITs that traded at the largest premium to NAV among all US REITs with at least $200 million in market capitalization.

Welltower Inc. traded at the highest premium to NAV. The REIT closed March 31 at $153.21 per share, which was 108.3% above the consensus NAV estimate of $73.56 per share. Medical Properties Trust Inc. followed, trading at $6.03 per share on March 31, 44.3% above its consensus NAV estimate of $4.18 per share.

Ventas Inc., National Health Investors Inc. and Omega Healthcare Investors Inc. were in the third, fourth and fifth positions, trading at a 40.4%, 39.9% and 36.2% premium to NAV, respectively.

The other healthcare REITs on the list are CareTrust REIT Inc., American Healthcare REIT Inc. and Sabra Health Care REIT Inc.

Single-tenant retail REIT Essential Properties Realty Trust Inc. traded at a 23.4% premium to the consensus NAV estimate, while diversified REIT Alexander's Inc. traded at a 22.9% premium during the same period.