Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

09 Apr, 2025

By Yuzo Yamaguchi and Cheska Lozano

Banks in mainland China continued to dominate an S&P Global Market Intelligence ranking of lenders in Asia-Pacific by assets.

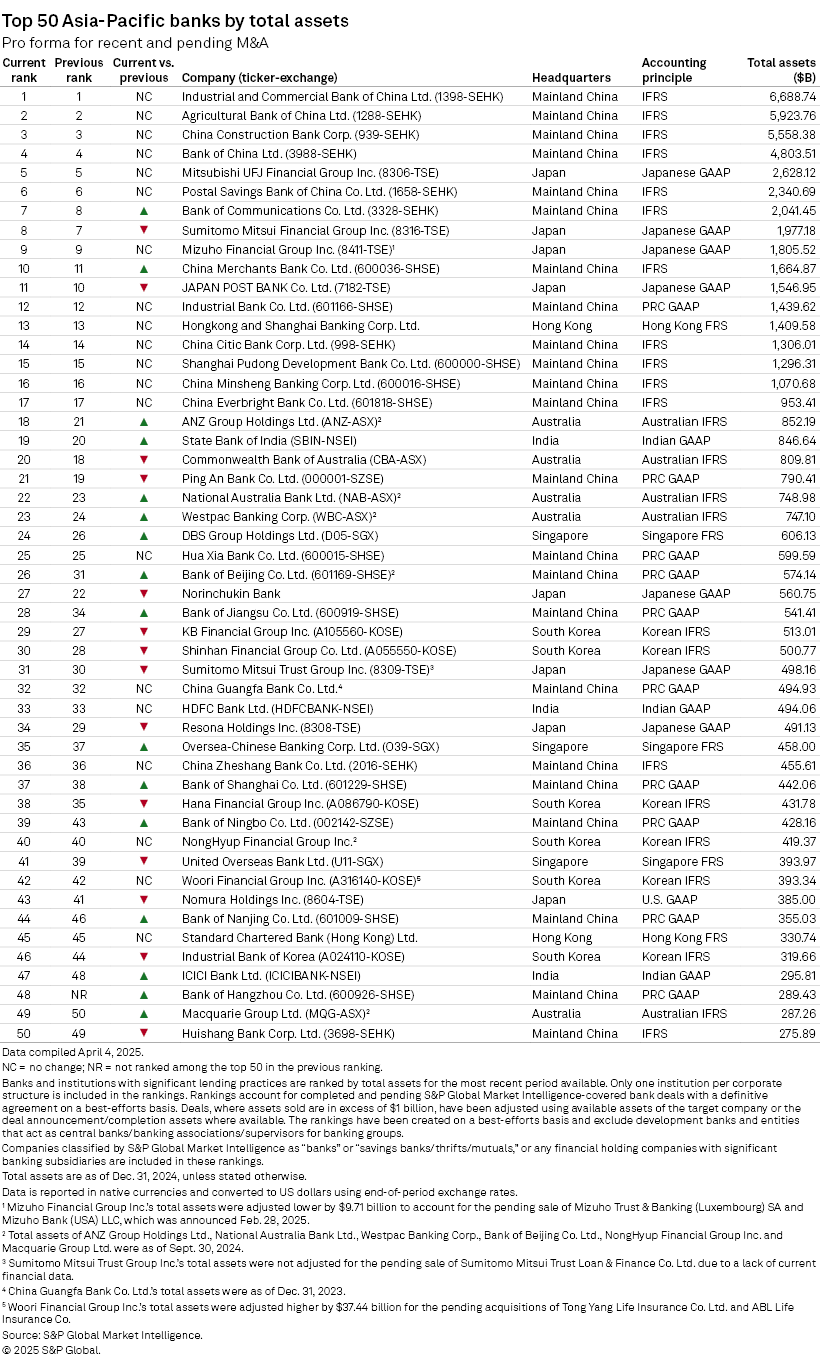

Twenty-three banks in mainland China were on a list of the region's Top 50 lenders by assets in 2024, Market Intelligence data show. These include Industrial and Commercial Bank of China Ltd., Agricultural Bank of China Ltd., China Construction Bank Corp. and Bank of China Ltd., which are also the biggest lenders by assets in the world.

While the big four banks retained their top ranks from the previous year, Bank of Communications Co. Ltd. climbed one rung to the seventh position in 2024. China Merchants Bank Co. Ltd. also improved a rank to claim the 10th spot. The government in China announced that it will infuse capital into six large state-owned lenders to boost liquidity, allowing the banks to chase growth.

"Capital infusion into Chinese banks will increase their net assets," said Yusuke Miura, a senior economist covering the Chinese economy at NLI Research Institute. "Thus, their assets will remain substantial."

Capital injection

China's Ministry of Finance said in a statement March 31 that it will issue the first batch of special treasury bonds of 500 billion Chinese yuan, and "actively support" four lenders — Bank of China, China Construction Bank, Bank of Communications and Postal Savings Bank of China Co. Ltd. — to replenish their core Tier 1 capital. The government will use the proceeds from the bond sale to buy new shares in these lenders.

The world's second-biggest economy is targeting growth at about 5.0% in 2025 after GDP grew 5.0% in 2024. Still, it faces challenges in 2025 from escalating global trade tensions.

"Even if profits at [mainland] Chinese banks face tariff pressure, their assets would be minimally impacted unless losses occur," Miura said. Overall, mainland Chinese banks typically hold larger assets than other Asian lenders as they extend loans in a market that relies less on direct finance, unlike Japan or the US, where businesses raise funds through the sale of new shares or bonds, Miura said.

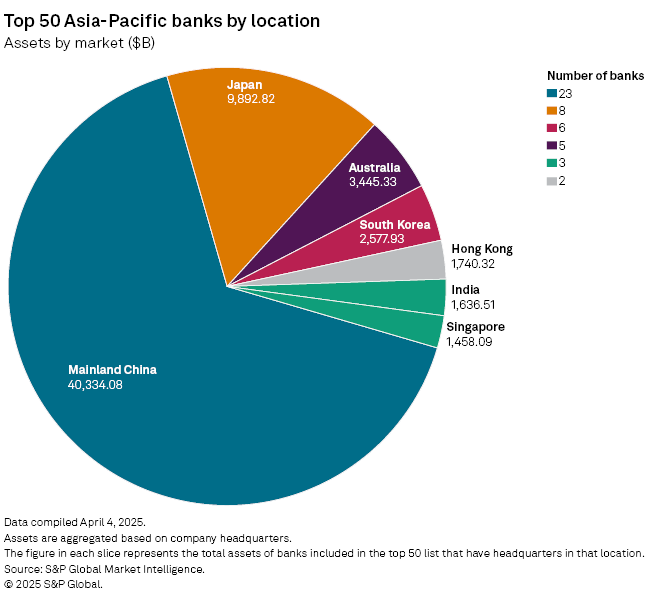

The 23 mainland Chinese lenders in the Market Intelligence ranking had aggregate assets of $40.334 trillion, as of Dec. 31, 2024, accounting for 66% of the total. Eight Japanese banks followed with an aggregate of $9.893 trillion in assets, and five banks in Australia accounted for $3.445 trillion. Twelve other banks from South Korea, India and Singapore held a total of $5.673 trillion in assets, data shows.

The rest

Mitsubishi UFJ Financial Group Inc., the largest lender in Japan with $2.628 trillion in assets, ranked fifth in Asia-Pacific, trailed by Sumitomo Mitsui Financial Group Inc. in eighth place with $1.977 trillion and Mizuho Financial Group Inc. in ninth place with $1.806 trillion. The Japanese lenders boosted their earnings from April to December, helped by the central bank's shift to a rate hike cycle after abandoning its negative rate policy in March 2024.

Lenders headquartered in Australia, Singapore, South Korea or India were not among the top 10 in the Market Intelligence rankings for 2024.

Melbourne-headquartered ANZ Group Holdings Ltd. climbed three ranks to claim the 18th position. The Australian lender's assets totaled $852.19 billion. Rival Commonwealth Bank of Australia slipped two rungs to the 20th position.

The State Bank of India, the South Asian nation's biggest lender by assets, climbed one rung to rank 19 with $846.64 billion in assets.

Singapore-based DBS Group Holdings Ltd. climbed two rungs to take the 24th position. The biggest lender in Southeast Asia had $606.13 billion in assets, as of Dec. 31, 2024.

Overall, 16 banks improved their ranks in 2024, 14 slipped, while the ranks for 20 banks remained unchanged.