Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

15 Apr, 2025

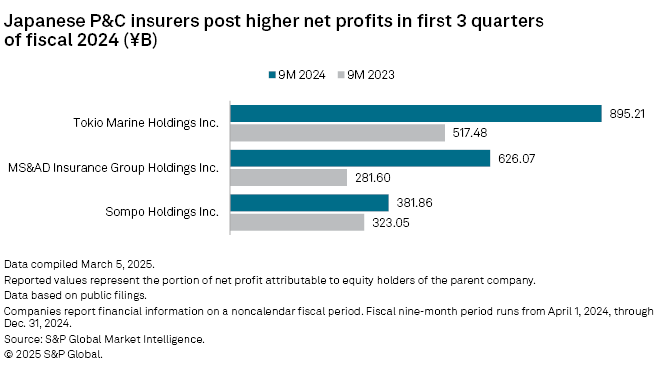

The largest property and casualty insurers in Japan saw higher net profits in the first nine months of fiscal 2024, with each recording at least double-digit percentage growth.

Tokio Marine Holdings Inc.'s net profit jumped 73% to ¥895.21 billion compared with ¥517.48 billion during the same nine-month period in fiscal 2023. The insurer attributed the increase to accelerated sales of business-related equities, which amounted to ¥781.0 billion during the period.

As part of its midterm plan, Tokio Marine intends to reduce its business-related equities by half from ¥3.5 trillion through fiscal 2026, and to reduce it to zero by the end of fiscal 2029. This will exclude unlisted shares and holdings through capital and business alliances. The sale of the strategic equity holdings will enable Tokio Marine to reform its risk portfolio and allocate the group's capital to growth areas.

MS&AD Insurance Group Holdings Inc. recorded the biggest year-over-year growth in net profit of 122.3% among the three insurers. The company's net profit was ¥626.07 billion during the period, up from ¥281.60 billion a year ago.

The insurer said the growth was mainly due to higher investment income at its domestic non-life insurance business, driven by a sharp increase in gains on sales of strategic equity holdings and higher profit across all segments at its overseas insurance subsidiaries. Mitsui Sumitomo Insurance Co. Ltd. was the biggest contributor to the consolidated result, with 197.4% year-over-year growth in net profit during the period.

Sompo Holdings Inc. booked net income of ¥381.86 billion in the first nine months of fiscal 2024, up 18.2% from ¥323.05 billion in the prior-year period. This was primarily due to the accelerated reduction of strategic holdings, which totaled ¥328.50 billion during the period.

The sale of these stocks resulted in pretax gains of ¥223.40 billion, according to Sompo Holdings. The insurer said it is on track to achieve its full-year target to divest ¥400 billion of strategic holdings in fiscal 2024.

– Use the screener to access financial results on the S&P Capital IQ Pro platform.

– Read an analysis of Japanese insurers' M&A activity since 2020.

– Read about potential M&A activity in the global insurance sector on In Play Today and a summary of recently announced deals on M&A Replay.

Sustained growth in domestic, international premiums

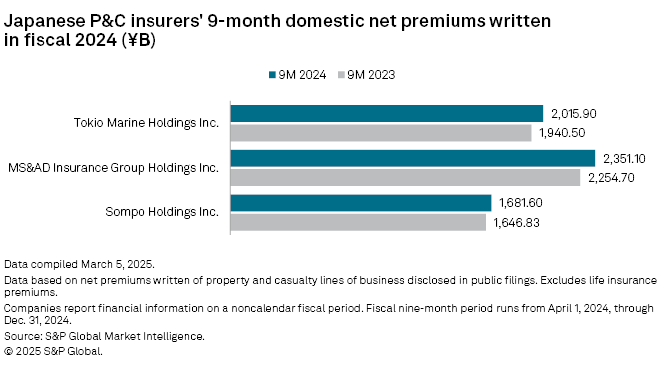

All three insurers recorded growth in net premiums written from their domestic businesses, with MS&AD Insurance reporting the largest net premiums written from its domestic non-life insurance business at ¥2.351 trillion in the first nine months of fiscal 2024. MS&AD attributed the increase from ¥2.255 trillion to higher automobile and fire insurance premiums.

Net premiums written at Tokio Marine's domestic business amounted to ¥2.016 trillion, up 3.9% from ¥1.941 trillion in the prior-year period. Tokio Marine said this was mostly in line with its projections and was the result of product and rate revisions for auto and fire insurance lines. Tokio Marine & Nichido Fire Insurance Co. Ltd. accounted for ¥1.873 trillion of net premiums written during the period alone.

Sompo Japan Insurance Inc., comprising Sompo's domestic property and casualty business, booked net premiums written of ¥1.682 trillion in the nine-month period, up from ¥1.647 trillion in the year-ago period. Sompo attributed the increase to the optimization of insurance rates, an increase in renewed insurance policies in the fire segment and strong sales in the casualty segment.

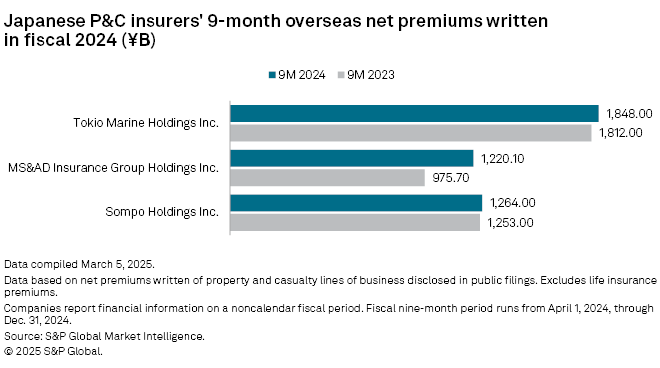

In terms of net premiums written from their international businesses, Tokio Marine booked the largest at ¥1.848 trillion. Tokio Marine credited the 6.4% year-over-year increase in net premiums written to the steady implementation of growth measures by the group's international entities.

Net premiums written at MS&AD Insurance's overseas subsidiaries rose to ¥1.220 trillion from ¥975.70 billion in the previous year. This was driven by an increase in new businesses and shares at MS Amlin AG and the impact of foreign exchange.

Sompo's overseas consolidated subsidiaries recorded ¥1.264 trillion of net premiums written during the period, up from ¥1.253 trillion in the same nine-month period in fiscal 2023.