Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

27 Apr, 2025

By Yuzo Yamaguchi and Marissa Ramos

Japanese banks are expected to raise loan-loss provisions as they expand support for domestic industries amid uncertainty related to US trade policy under President Donald Trump.

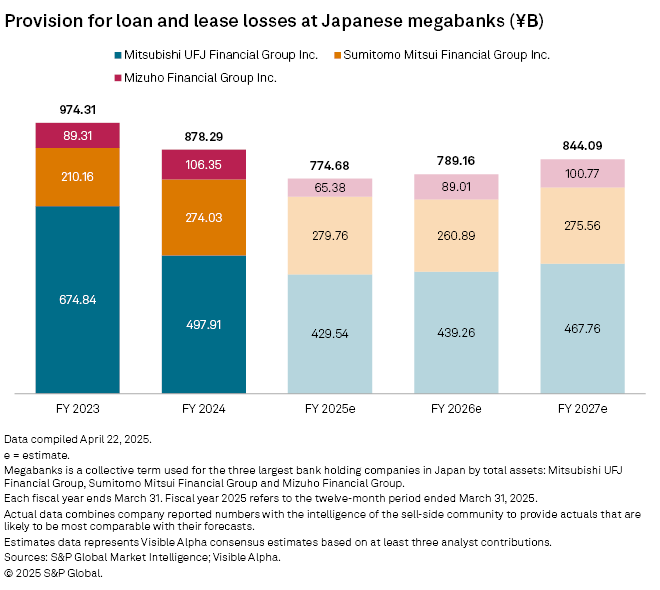

Mitsubishi UFJ Financial Group Inc. and Mizuho Financial Group Inc. are projected to boost provisions for loan and lease losses in the fiscal year from April 1, according to estimates from S&P Global's Visible Alpha. Both lenders had reduced provisions in recent years.

Sumitomo Mitsui Financial Group Inc. is projected to reduce provisions in 2025, following two years of higher reserves, according to Visible Alpha estimates from at least three analysts.

"It's reasonable to assume that the tariffs will increase banks' credit costs," said Michael Makdad, senior analyst at Morningstar.

Combined provisions at the three megabanks are expected to rise to ¥789.16 billion this fiscal year, up from ¥774.68 billion forecast for the previous year, according to Visible Alpha. Full-year earnings are scheduled for release in May.

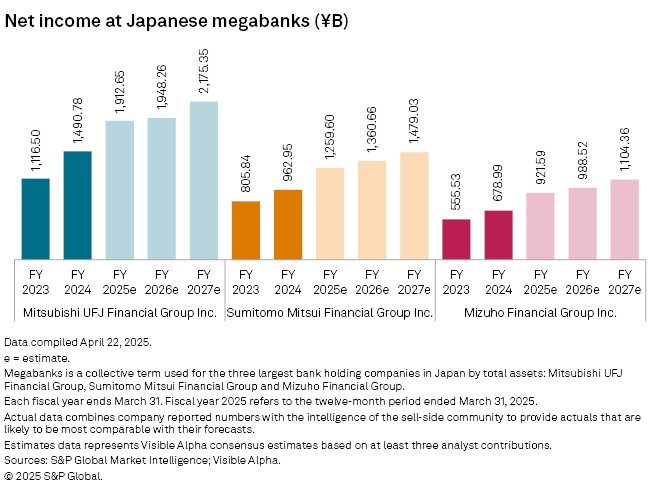

Higher rates

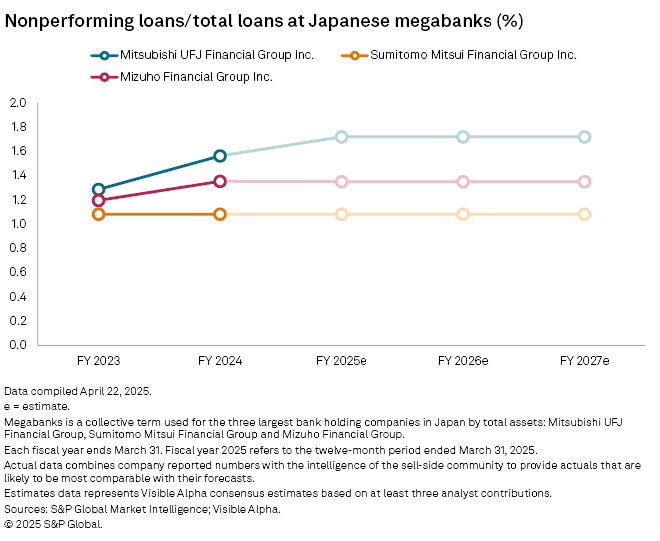

Japanese banks have benefited from rising interest rates since the nation's central bank ended its ultraloose monetary policy in March 2024. The Bank of Japan has gradually raised its benchmark rate to 0.50% as of January 2025, from negative 0.10% before normalization began. Higher rates have improved net interest margins and income, a trend expected to continue, according to Visible Alpha estimates.

Still, lenders are growing cautious about potential disruptions to global trade that could slow the pace of policy tightening.

Authorities have encouraged banks to continue supporting sectors that may be affected by trade-related challenges. On April 3, the Financial Services Agency said private lenders should adjust lending to help smaller businesses avoid cash shortages.

On April 9, the US government delayed planned tariff increases for 90 days while pursuing trade negotiations with Japan, India and other countries. However, ongoing uncertainty could still raise risks for banks expanding credit.

"The more banks lend, the more risk assets they may have," said Masahiro Ichikawa, chief market strategist at Mitsui DS Asset Management. "Increasing credit costs is a possible scenario for banks to buffer default risks."

Mizuho said on April 18 that it will begin offering unsecured loans in May to small businesses, backed by Orix Corp. The loans, up to ¥100 million each, will be available to more than 40,000 firms with annual sales of about ¥10 billion or less, a spokesperson said.

Regional banks

Some regional banks are also increasing support for local businesses. Kyoto Financial Group Inc. launched a special loan program April 7, offering up to ¥500 million per borrower to firms affected by US tariffs. The loans have terms of up to five years, with no principal repayment required in the first year.

Loans to high-tech parts manufacturers, which make up about 20% of Kyoto Financial's total lending, are particularly at risk. "We have to cooperate with local companies," a bank spokesperson said by phone. "However, this could increase our credit costs."

Annual loan growth eased slightly to 3.0% in March, from 3.3% in February, Bank of Japan data showed. "It's hard to predict whether loans will increase or decrease," a BOJ spokesperson said, citing potential supply chain shifts and delayed projects.

Teikoku Databank reported 875 bankruptcies in March, a 0.6% increase from the previous year and part of a continued upward trend in filings. The firm expects another 250 bankruptcies and a 0.3% hit to GDP if the US maintains a 10% reciprocal tariff on Japan.

A 24% import duty could reduce GDP by 0.5% and trigger 340 more bankruptcies, Teikoku Databank said.

As of April 25, US$1 was equivalent to ¥143.96.