Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

25 Apr, 2025

By Dylan Thomas and Karl Angelo Vidal

S&P Global Market Intelligence offers our top picks of global private equity news stories and more published throughout the week.

Private equity dealmaking had a strong start in 2025, culminating in March with announcements of two private equity-backed megadeals valued at $40 billion or more. Exits were another story.

Private equity-backed exits totaled $80.81 billion across 473 deals globally, according to an S&P Global Market Intelligence analysis of Preqin Pro data, the lowest quarterly totals recorded since the first quarter of 2023.

Entry and exit trend lines are expected to move apart even further following President Donald Trump's April 2 "Liberation Day" announcement, as sweeping tariffs roiled markets and injected new uncertainty into the economic outlook.

Market turbulence tends to weaken asset values, and private equity firms tend to seek bargains during a dislocation. But firms do not want to sell their own portfolio companies at a bargain, and are focused on gauging their tariff exposure.

Read more about declining private equity exit activity.

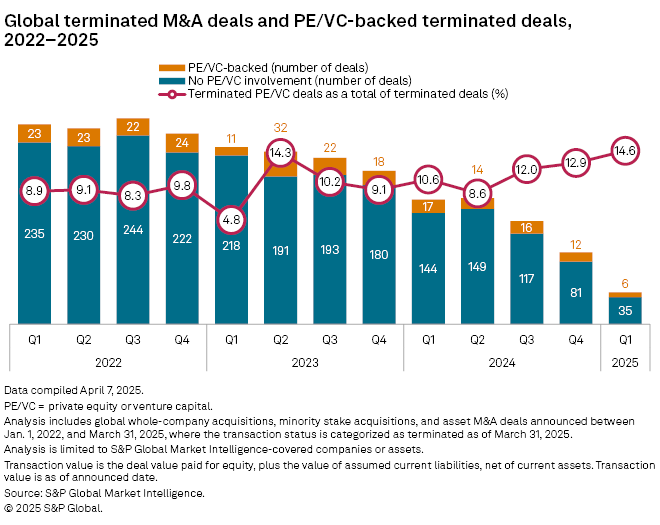

CHART OF THE WEEK: Private equity's share of terminated deals climbs

⮞ Just six private equity- or venture capital-backed deals were terminated between Jan. 1 and March 31, the lowest quarterly total in at least three years, according to Market Intelligence data.

⮞ Still, private equity's share of all terminated deals climbed to 14.6% in the first quarter from 12.9% in the preceding quarter.

⮞ Private equity's share of terminated deals has steadily risen for three consecutive quarters.

TOP DEALS

– Thoma Bravo LP agreed to buy portions of The Boeing Co.'s digital aviation solutions business in an all-cash deal valued at $10.55 billion.

– KKR & Co. Inc. offered to acquire Sweden-based Biotage AB (publ). The offer values the drug development company at about 11.61 billion Swedish kronor.

– Investindustrial agreed to buy Dublin-based DCC Healthcare Ltd., the healthcare unit of DCC PLC. The deal values DCC Healthcare at a total enterprise value of £1.05 billion.

TOP FUNDRAISING

– GCM Grosvenor Inc. raised $1.3 billion at the final close of Infrastructure Advantage Fund II. The fund will acquire assets in sectors including transportation, energy transition and digital infrastructure.

– Venture Guides Management LP reached a $262.5 million final close for its second fund, up 21% over its $216.5 million Fund I.

– P101 SGR SpA raked in €250 million at the final close of Programma 103 Fund. The fund will make early and growth-stage investments.

MIDDLE-MARKET HIGHLIGHTS

– LLR Partners Inc. raised $2.45 billion at the final close of LLR Equity Partners VII LP. The firm invests in lower-middle-market growth companies.

– MPE Partners invested an undisclosed sum in Intermatic, which makes energy management control solutions.

– MidOcean Partners LLP acquired Destination Media Inc., doing business as GSTV. Rockbridge Growth Equity LLC will keep a minority stake in the advertising company.

FOCUS ON: PRIVATE EQUITY INTEREST IN ASSET MANAGEMENT

Brokerage firm Altruist LLC raised $152 million in a series F funding round. Private equity firms, including Salesforce Ventures LLC, Geodesic Capital and Iconiq Growth, participated in the round.

Private equity-backed investments in asset management companies surged in the first four months of 2025. In the year through April 24, total deal value stood at $6.38 billion, compared with $2.97 billion in the same period in 2024, according to Market Intelligence data.

The median deal value in 2025 climbed to $62.7 million, compared with $15.8 million during the same period in 2024. Deal count rose to 53 from 52 a year earlier.

Between Jan. 1 and April 24, there were three private equity investments in asset management with at least $1 billion in deal value. In the biggest transaction, CC Capital Management LLC offered to acquire Australia-based Insignia Financial Ltd. for $2.15 billion.

______________________________________________

For further private equity deals, read our latest "In Play" report, which looks at potential private equity-backed M&A, including rumored transactions, each week.

For private credit news, see our latest private credit newsletter