S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

09 Apr, 2025

| US President Donald Trump announced new tariffs on imported goods from global trade partners, including the EU, on April 2, 2025. Source: The Washington Post via Getty Images |

EU banks' earnings power and loss-absorbing capacity will be severely tested as new sweeping US import tariffs take effect.

The tariff fallout could lead to higher loan losses, and resultant interest rate moves could hit lenders' revenue generation, analysts said. Banks in Germany, Italy and Ireland appear particularly exposed, but the impact will be felt across the continent.

Pressure will be on "pretty much all big European banks" due to the expected economic slowdown and shifts in global trade flows, independent bank analyst Sam Theodore said in an interview with S&P Global Market Intelligence.

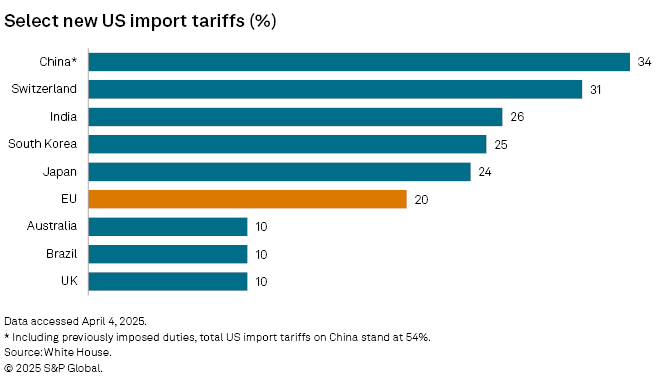

US President Donald Trump on April 2 announced a 10% baseline duty that took effect April 5. He also announced higher tariffs for select countries, which came into force April 9. The EU faces a new tariff rate of 20%.

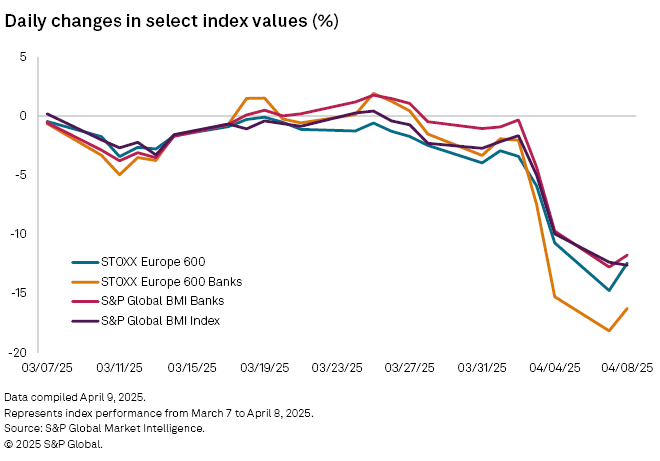

Markets have been absorbing the implications, with the STOXX Europe 600 Banks index falling 16.25% between March 7 and April 8.

Trade tension

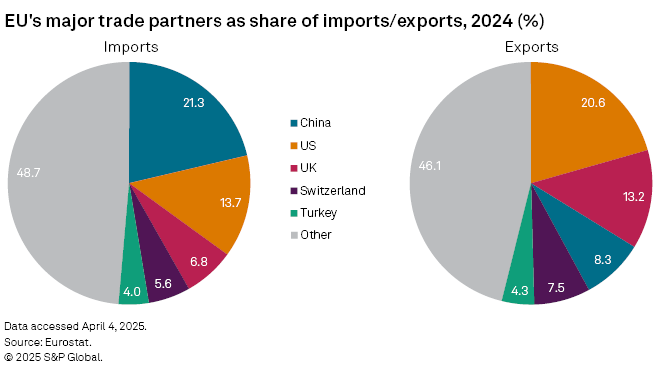

Tariffs and escalating trade tensions between the US and China could crimp economic growth in the EU and fuel uncertainty about the future path of inflation and interest rates. For banks, this could mean higher credit losses, lower-than-expected loan growth and additional revenue pressures, according to analysts.

"We view tariffs in general as a negative for the operating environment of banks, especially [those] with operations in countries that rely on key exports to the US," Jason Graffam, senior vice president, global sovereign and financial institution ratings, at Morningstar DBRS said via email.

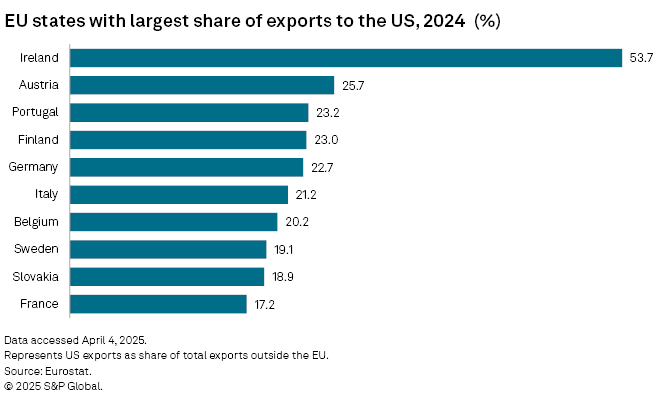

Germany, Ireland and Italy had by far the highest trade surplus with the US compared to other EU countries in 2024, meaning the value of their net exports to the US is greater than the value of their imports, Eurostat data shows.

Banks with exposure to industries with higher levels of exports to the US — such as medical and pharmaceutical products, motor vehicles, and other machinery goods — will come under particular pressure, Graffam said.

Slower economic growth would likely push the European Central Bank to cut interest rates more than it would have otherwise, which would weigh on bank revenues, Suvi Platerink Kosonen, senior financial sector strategist at Dutch bank ING, said in an April 4 analysis. Higher rates are a key driver of banks' net interest income and, thus, their profits.

Higher US tariffs on China would also inevitably result in a diversion of some cheap goods to Europe, Deutsche Bank's chief economist, Robin Winkler, said in an April 3 note. This would compound the EU's economic pain as domestic manufacturers face stiffer price competition in the bloc and in other non-US markets.

"European economies face weaker growth and lower inflation, compounded by currency appreciation and potential diversion of Asian exports to local markets," UBS analysts said in an April 7 note. Declining interest rates in this environment would be a key drag on banks' earnings per share (EPS), they said.

The economic hit on EU companies and households would likely result in higher loan losses for banks, which are expected to also increase their loan loss provisions in anticipation of future asset quality pressures — which are further downside risks to banks' EPS, UBS analysts said.

Not all bad news

Despite the added pressures from tariffs, European banks are in the best shape they have been in years, with higher profitability and solid capital levels providing a "significant cushion" against potential credit risks, Morningstar DBRS' Graffam said.

"Our view is that European banks, in general, confront the current uncertainty from a position of strength," he said.

The UBS analysts said the macro shock to European nominal GDP could end up being "less traumatic to bank earnings than feared," similar to the smaller-than-anticipated impact on banks' asset quality observed during recent shocks such as COVID-19, the war in Ukraine and the more recent inflation surge that triggered rapid interest rate shifts.

The full impact of tariffs is hard to estimate given that the size, scope and duration of the tariffs is not clear yet and there are various factors to consider when evaluating, risks and opportunities for banks, the analysts said.

Gauging exposures

ING assessed the sensitivity of individual banks to negative tariff effects by looking at their exposure to EU states with the largest US exports, their exposure to non-EU countries facing higher tariffs, their links to sectors most likely to be affected by tariffs, and their direct exposure to the US, Platerink Kosonen said.

On an EU basis, banks with high exposure to Germany, Italy, Ireland, Sweden and Austria, are likely to be more affected than lenders exposed to countries with smaller US exports like France, the Netherlands and Spain, according to ING's analysis.

Exposure to non-EU countries facing higher tariffs could create risks for some of the bloc's biggest banks. For example, Deutsche Bank AG, BNP Paribas SA, Groupe BPCE, Société Générale SA (SocGen), Crédit Agricole SA, UniCredit SpA and Intesa Sanpaolo SpA have high exposure to Chinese government debt, while big Spanish banks like Banco Santander SA and Banco Bilbao Vizcaya Argentaria SA (BBVA) have high exposures to Mexico, the analysis shows.

When it comes to links to the US economy, Deutsche Bank has the highest total credit exposure. Banco Santander, BBVA, BNP Paribas and SocGen also have substantial exposure to the country.

Smaller banks with a high share of US loans in their portfolios — including Germany's Aareal Bank AG, Hamburg Commercial Bank AG, Deutsche Pfandbriefbank AG and Landesbank Baden-Württemberg, and Nordic lenders DNB Bank ASA, Skandinaviska Enskilda Banken AB (publ) and Svenska Handelsbanken AB (publ) — could also face risks as tariffs are expected to result in "near-term pain for the US economy," Platerink Kosonen said.

Sectors facing the highest tariff-related impact include transport, manufacturing, food and agriculture, energy and oil, pharmaceuticals and wholesale trade, according to ING economists. On the other hand, retail trade, services, construction, real estate, healthcare, and technology, media and telecommunications (TMT), could be less affected.

Based on that, some Greek and Italian banks, as well as Germany's Commerzbank AG, could face risks due to the higher share of manufacturing sector loans in their portfolios. Dutch lender Rabobank is considered vulnerable due to its high agriculture sector exposure, according to ING's analysis.