Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

06 Apr, 2025

By Taylor Kuykendall and Kip Keen

China's retaliation against the broad tariffs announced by US President Donald Trump could hurt coal and copper, two of the top mining and metal imports into China.

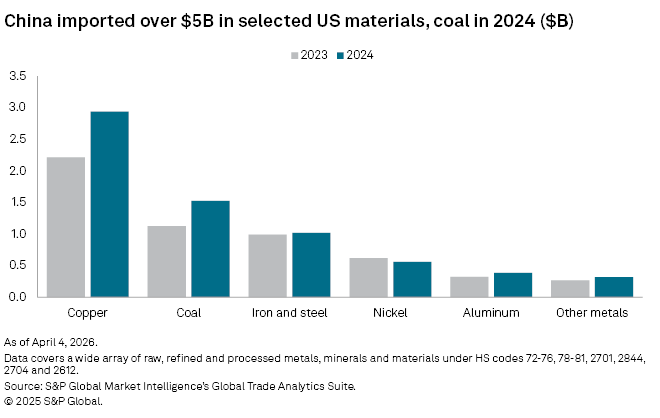

China imported $5 billion in select US mining and metals products in 2024, including $2.93 billion worth of copper and $1.52 billion worth of coal, according to S&P Global Market Intelligence's Global Trade Analytics Suite data. On April 4, the country responded to tariffs imposed two days earlier by the US with a mirrored 34% tariff on all US imports, effective April 10.

"Beijing's escalating retaliation against US efforts to level the playing field for American industry ... underscores the urgency to build secure, domestic mineral supply chains that reach from the mine to the assembly line," said Conor Bernstein, a spokesman for the National Mining Association trade group.

"Retaliatory tariffs also, however, underscore the stakes of this moment and reinforce the need to try and minimize disruptions and market access for US industry," Bernstein said.

Much of the impact remains uncertain. The US tariffs were scheduled to go into effect April 5, and the Trump administration has indicated that it will negotiate the varied rates with individual countries.

"[The counter-tariff] signals China's willingness to be combative with the current administration, which implies that that relationship could get worse in the short term," Matt Warder told Platts, part of S&P Global Commodity Insights. Warder is the CEO of Seawolf Research, a management consultancy and financial analytics firm, and the publisher of the Coal Trader website.

"The [Trump administration's] underlying goal of reshoring US manufacturing is greater than the desire to look into the granular details of how all of these policies are affecting individual sectors or businesses or those sorts of things," Warder said. "Do I think that will change over time? Probably. But the pace of that is completely unknown still."

Trump reacted to China's tariffs on Truth Social, saying, "China played it wrong, they panicked."

US coal, already vulnerable, could take a hit

That leaves a lot of uncertainty for a number of sectors, including the US coal miners Trump has often lavished praise upon. The industry leans heavily on exports, as its domestic customer base has dwindled in the past decade. Additionally, producers are already locked in a battle to thwart the administration's proposed port fees on Chinese ships that threaten to reduce US coal exports.

China's April 4 tariffs are in addition to 15% tariffs already imposed on US coal coming into the country, which were in response to Trump's previous round of trade actions in February. The increased costs eliminate the possibility of US coal exports to China at current prices, particularly for metallurgical coal producers, Warder said.

"All we can say for sure is that US exporters are moving up the cost curve to some degree," Warder said.

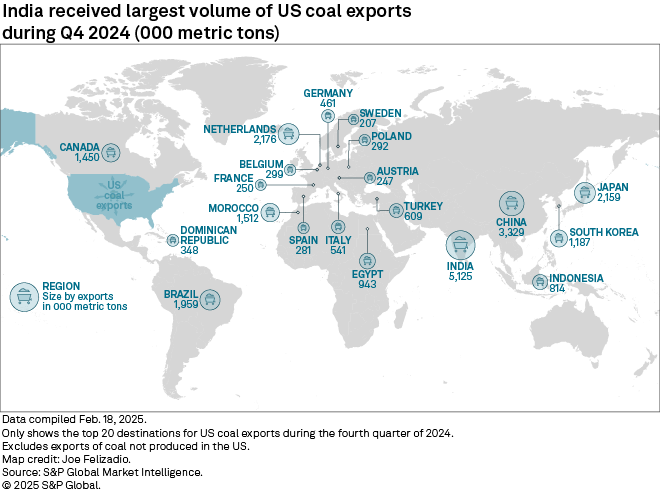

China is the second-largest buyer of US coal, behind India, according to Market Intelligence data for the fourth quarter of 2024. US coal exports to China in the December 2024 quarter swelled 137.7% year over year.

The situation could become even more dire for coal if the European Union retaliates in a way that affects the sector. Warder noted that China and Europe are key to the industry, not only as coal buyers but also as equipment suppliers.

"It's certainly having an impact on coal equities at the moment," Randall Atkins, founder, chairman and CEO of US metallurgical coal producer Ramaco Resources Inc., said during an interview.

Ramaco's stock price was down 19.8% as of 2 p.m. ET on April 4, compared to the start of the week. A similar story unfolded across the sector, with the stock prices of US coal giants Peabody Energy Corp. and Core Natural Resources Inc. falling 23.6% and 19.1%, respectively. The stocks underperformed even a major down week for the market, with the S&P 500 falling 9.3% in the same period.

Atkins said he expects market conditions to eventually stabilize as negotiations occur with various countries.

"It's important not to try to judge what the whole [trade] war is going to look like from the first shot on the first day of battle," Atkins said. "The first shot out of the gate is always going to be something that spooks everybody. How that eventually plays itself out is going to usually be a little bit more nuanced."

Downstream copper markets exposed

The Chinese counter-tariffs will likely have a more significant impact on downstream copper markets than on miners, Patricia Barreto, an analyst at Commodity Insights, said in an email. China imported $2.9 billion of US copper in 2024, including value-added, refined and raw materials, according to the Global Trade Analytics Suite data. The value of Chinese imports of US copper concentrate and ore, not including those value-add products, was $465.5 million in 2024.

"Overall, I would expect the concentrate market to have a redirection of trade flows in case tariffs continue to intensify, but with little effect besides the initial instability and overall tightness," Barreto said. "Other downstream copper products should feel a higher impact."

Rio Tinto PLC, a large diversified miner with US copper operations, said it does not currently comment on tariffs. The largest copper producer in the US, Freeport-McMoRan Inc., did not respond to a request for comment.