S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

24 Apr, 2025

By Beata Fojcik and David Hayes

Central Europe's top three commercial banks showcase strong capital levels as the region braces for the potential impact of US tariffs.

US President Donald Trump unveiled sweeping tariffs on global trading partners on April 2, but later postponed some of these for 90 days. As of April 23, the EU faces a 10% levy. In addition, a 25% tariff on certain goods and products, including vehicles, remains in place. The automotive sector is important for central and eastern Europe, accounting for approximately 5% to 10% of the region's GDP, with a gross value added of 4.1% in 2023, compared with 3.1% for the EU, S&P Global Ratings said in January.

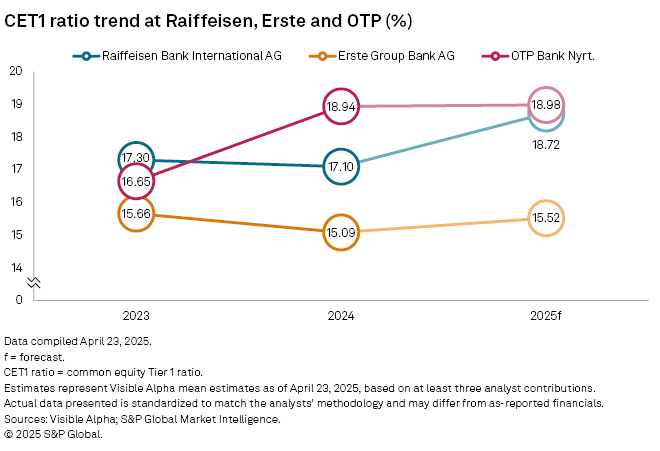

Erste Group Bank AG, Raiffeisen Bank International AG (RBI) and OTP Bank Nyrt., which have a significant presence in the region, are entering the turbulent trade friction era with common equity Tier 1 (CET1) ratios close to or significantly above the EU bank median of 15.28% for 2024. Their ratios are also set to increase further in 2025, according to consensus estimates data from Visible Alpha, a part of S&P Global Market Intelligence. The estimates were last updated on April 14 for Raiffeisen Bank International, April 16 for OTP Bank and April 23 for Erste Group Bank.

Erste, which saw a slight drop in its CET1 ratio in 2024, expects "a nice bump up" of up to 60 basis points in the first quarter of 2025 due to the introduction of Basel IV, CFO Stefan Dorfler said Feb. 28.

OTP Bank is committed to maintaining a strong capital position, in both absolute and relative terms, and will target CET1 and Tier 1 ratios comparable to regional peers, the Hungarian lender said during its 2024 earnings presentation.

Macroeconomic impact of tariffs

The 25% tariff on vehicles

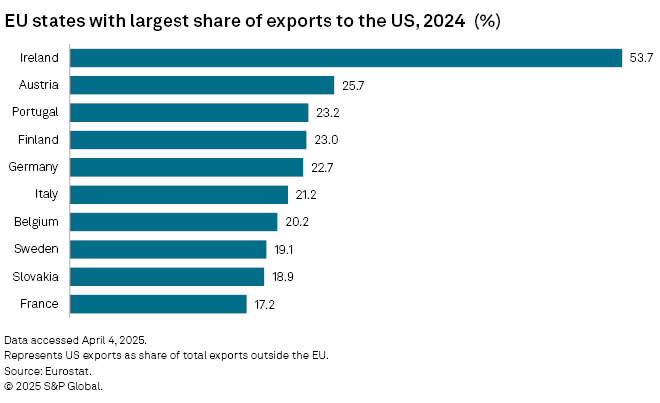

Both Austria and Slovakia are among EU countries with the highest share of US exports in their total exports outside the EU, at 25.7% and 18.9%, respectively.

The two countries, alongside Hungary — home to OTP Bank — and Czechia, are also among EU member states with the highest trade surpluses with the US in 2024. Erste and RBI also have a presence in both Hungary and Czechia.

Profit prospects

With profits growing in 2024, Erste and OTP Bank are projected to keep their 2025 profits similar to last year's levels, even as interest rates are expected to drop in some of the countries where they operate, according to Visible Alpha data.

RBI could see a significant improvement in its 2025 net profit after an €840 million provision for legal proceedings in Russia notably affected the 2024 results. The provision did not impact the group's CET1 ratio, which already reflects a potential full loss of the Russian business, CEO Johann Strobl said in February.

Overall, Austrian banks could benefit from certain macroeconomic factors, including Germany's fiscal stimulus and peace in Ukraine, while the challenges increased US tariffs pose will be manageable, HSBC analysts said in an April 8 research note.

Erste and RBI did not comment to Market Intelligence on the potential impact of US tariffs on their operations in the region, saying they would share any updates during first-quarter earnings calls, scheduled for April 30 and May 6, respectively.

OTP Bank did not respond to a request for comment, but CFO László Bencsik said during a March 7 earnings call that the bank's potential exposure to tariffs is reasonably low at the client level, as its client base does not include exporters to the US or large European multinationals.

NPL trends

Overall, banks in central Europe have limited direct credit exposure to the automotive sector, but a significant downturn related to tariffs and other challenges the sector faces could indirectly impact their asset quality due to the reliance of gross domestic product on the automotive industry and job market pressures, Ratings said in the January report.

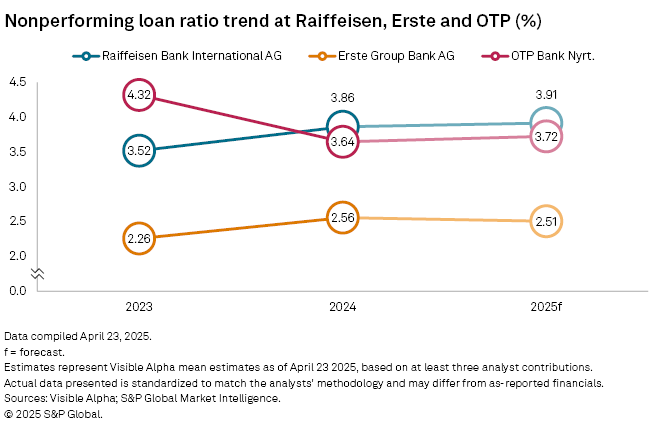

Analysts expect nonperforming loan (NPL) ratios at RBI and OTP Bank to increase to 3.91% and 3.72%, respectively, in 2025, while Erste's NPL ratio could improve on the back of an increase in 2024.

Erste executives attributed the 2024 increase to rising defaults in Austria, while asset quality in central Europe remained strong.