Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

25 Apr, 2025

Editor's note: This article is published quarterly with current data available at that time.

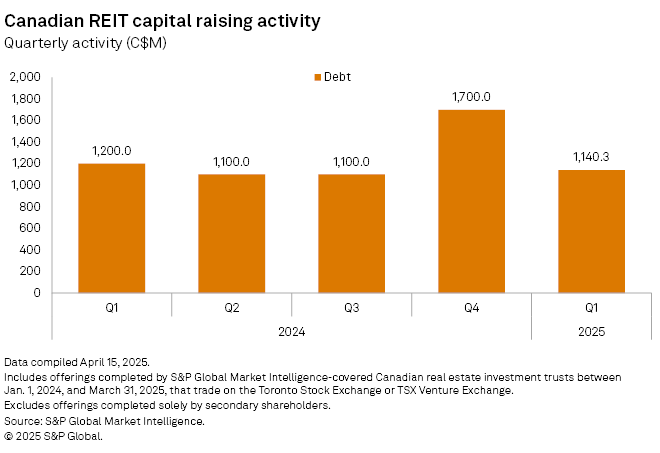

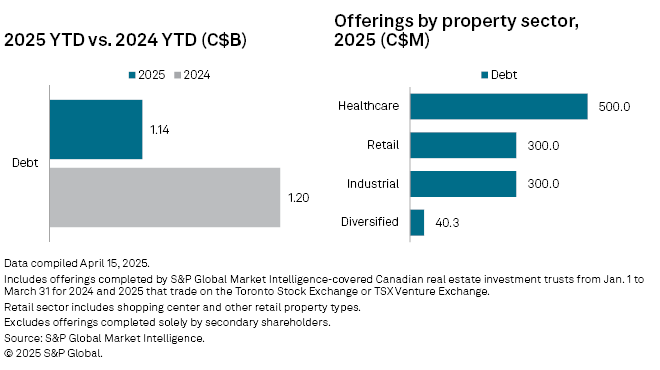

Publicly traded Canadian real estate investment trusts collected C$1.14 billion through capital offerings in the first quarter of 2025, a 32.9% decline from the C$1.70 billion raised in the fourth quarter of 2024.

The first-quarter total was also down by about 5.0% from the C$1.20 billion raised in the same period a year earlier. All the capital raised in the first quarter of 2025 came from debt offerings.

Healthcare sector get largest share of total capital

Only four property sectors pulled in capital during the first quarter. The healthcare sector led the list, collecting 43.9% of the total capital in the first quarter, amounting to C$500.0 million. The retail sector, which consists of shopping centers and other retail properties, and the industrial sector followed, each raising C$300.0 million during the same period. Lastly, the diversified segment pulled in about C$40.3 million.

– Set email alerts for future Data Dispatch articles.

– Access a spreadsheet listing the offerings completed year to date in 2025 by publicly traded Canadian real estate investment trusts.

– For further capital offerings research, try the Global Real Estate Capital Offerings Activity template.

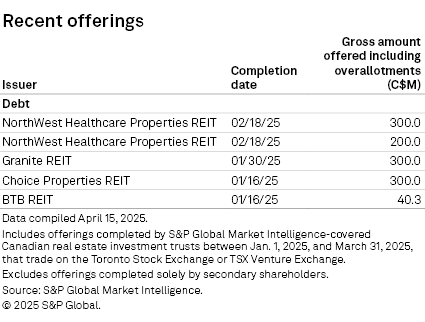

NorthWest Healthcare Properties REIT pulls in the most capital

Healthcare-focused NorthWest Healthcare Properties REIT attracted the most capital in the first quarter, raising a total of C$500.0 million after selling C$300.0 million of 5.514% series B senior unsecured debentures due Feb. 18, 2030, and C$200.0 million of 5.019% series A senior unsecured debentures due on Feb. 18, 2028. The healthcare REIT intends to use the net proceeds from the offerings to repay outstanding indebtedness, including the 10.0% convertible unsecured subordinated debentures due March 31, 2025.

Industrial REIT Granite REIT sold C$300 million of series 10 senior unsecured debentures that will bear interest at Daily Compounded Canadian Overnight Repo Rate Average (CORRA) plus 0.77% per annum, payable quarterly in arrears, and will mature on Dec. 11, 2026. The company intends to use the offering's net proceeds to repay in full its C$300 million senior unsecured non-revolving term facility, maturing on Dec. 11, 2026.

Choice Properties REIT pulled in C$300 million through an offering of 4.293% series V senior unsecured debentures due Jan. 16, 2030. The company plans to use the net proceeds to repay certain amounts drawn on its revolving credit facility, which were utilized to repay upon maturity its C$350 million aggregate principal amount of 3.546% series J senior unsecured debentures, and for general business purposes.

Diversified REIT BTB REIT followed, pulling in C$40.3 million through an offering of subordinated debt due Feb. 28, 2030.