Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

15 Apr, 2025

By Yuvraj Singh and Annie Sabater

Mergers and acquisitions activity in the Asia-Pacific region slowed in the first quarter of 2025 as the global uncertainty triggered by US President Donald Trump's tariffs policy likely clouded dealmaking.

The aggregate value of M&A activity in the January-to-March quarter fell 30% over the previous three months, while the number of deals was down 22%, according to S&P Global Market Intelligence data. The decline followed a period of heightened dealmaking last year, an indication that potential buyers and sellers prefer to wait out for greater clarity to emerge in geopolitics.

Still, March was the strongest month in the first quarter, with 886 deals worth $48.27 billion announced during the month, likely a culmination of deals that were already in the making before a wave of tariff announcements by the Trump administration dampened sentiment. The US paused the additional tariffs for 90 days, though the 145% levy on imports from China remains in effect, potentially upsetting global supply chains and trade.

The constantly evolving situation is likely to damp dealmaking activity and trigger increased due diligence and potential valuation gaps. Some analysts, however, expect the Asia-Pacific region to fare better than Europe and North America.

"We're cautiously optimistic about an uptick in APAC deal volume in 2025," McKinsey said in a Feb. 19 report. "Uncertainty remains high in China-US relations, which is driving more enterprises and investors to broaden their footprints and portfolios by making deals elsewhere in APAC."

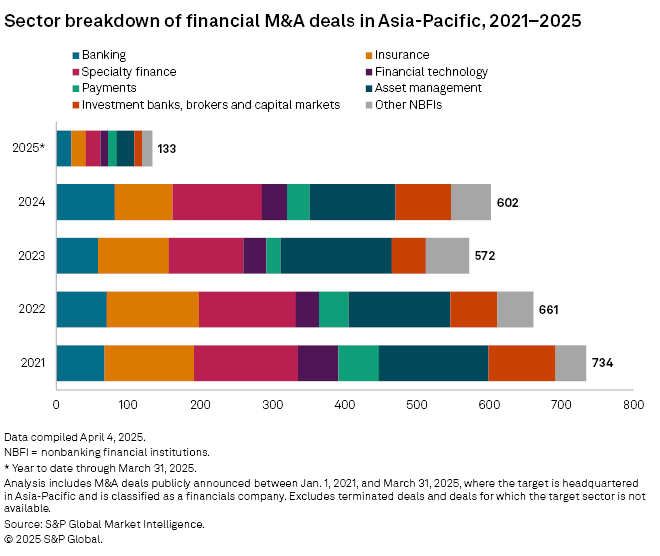

M&A activity in China's financial sector continues to decline. In the first quarter of 2025, India led with 25 financial sector deals, followed by Japan with 22. China came third with 21 deals, according to Market Intelligence data.

Bright spots

India continues to attract overseas interest, driven by strong economic fundamentals.

"Acquirers and investors overseas, especially in Japan, the Middle East and the United States, are taking a keen interest in Indian firms — a trend that's likely to continue on the subcontinent with its robust economic growth, increasingly strong manufacturing sector and supplier base, climbing quality of products, expanding engineering talent and rising consumer spending," according to the McKinsey report.

The biggest deal in the financial sector during the March-ending quarter was a $2.78 billion transaction involving Indian firms. An investor group comprising Bajaj Finserv Ltd., Bajaj Holdings & Investment Ltd. and Jamnalal Sons Private Limited agreed to acquire Allianz SE's 26% stake in two joint-venture companies — Bajaj Allianz General Insurance Company Ltd. and Bajaj Allianz Life Insurance Company Ltd.

Japan remains another key focus for investors, buoyed by favorable policy reforms and government support. "Japanese companies will continue to seek growth opportunities abroad, while private equity firms scan Japan for promising targets," McKinsey said.