Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

15 Apr, 2025

By Iuri Struta

| Sales of iPhones and other Apple products stand to be impacted by the Trump administration's tariffs Source: Timothy A. Clary/Contributor/AFP via Getty Images. |

Despite almost daily updates as to which items will be tariffed at what rates, analysts continue to view Apple Inc. as among the Big Tech companies most vulnerable to the escalating trade tensions between the US and mainland China.

During President Donald Trump's first administration, Apple produced most of its products in mainland China. Over the last eight years, the company has taken steps to diversify its supply chain. Notably, Apple has been moving production to countries such as Vietnam and India — countries initially set to see levies of 35% and 26% on US imports, respectively, based on Trump's April 2 announcement. Those rates were later dropped to 10% as part of a 90-day pause to allow negotiations, while tariffs on mainland Chinese imports have since been increased to 145%.

The White House on April 11 exempted smartphones and other electronics from the tariff increases on mainland Chinese imports, though they are still subject to a 20% rate that Trump has tied to the international drug trade, particularly fentanyl. US Commerce Secretary Howard Lutnick said smartphones and other electronics will be covered under new sector-specific tariffs that will be announced in the next month or two.

"Semiconductors and pharmaceuticals will have a tariff model in order to encourage them to reshore, to be built in America," Lutnick said on ABC News' "This Week." "We need our medicines, and we need semiconductors and our electronics to be built in America."

Made not in America

While Apple significantly shifted its production out of mainland China in recent years, it has not invested in domestic manufacturing plants for its consumer products.

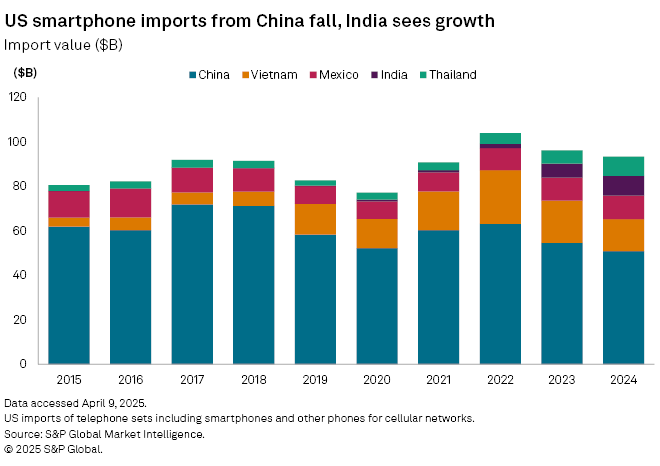

According to data from S&P Global Market Intelligence, US imports of smartphones and telephone sets from mainland China declined to $50.8 billion in 2024 from a 2017 peak of $71.9 billion. Meanwhile, imports increased from markets such as Vietnam, India, Thailand and Taiwan. The figures include all phones and headsets, not only Apple-branded ones, but Apple's iPhones comprise the bulk of imports.

In 2015, mainland China's smartphone exports were more than triple those of five markets combined — Vietnam, Mexico, Malaysia, Thailand and Taiwan. In 2024, mainland China's exports were almost equaled by the combined exports of the following five markets — Vietnam, Mexico, India, Thailand and Taiwan — for the first time. While the share of mainland China exports dropped, others, such as Vietnam and India, gained.

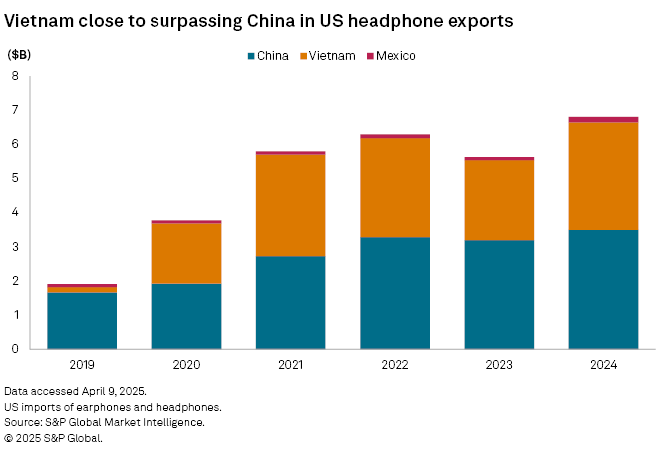

Apple's diversification of its supply chains away from mainland China will likely accelerate with the new tariffs. The company is ramping up phone production in India, where it now produces for local and overseas markets. Meanwhile, Vietnam has become a hub of Apple's headphone production, including AirPods. Vietnam could soon surpass mainland China in headphone exports to the US.

Investing in US

That is not to say Apple is not ramping up investment in the US. Earlier this year, it promised a $500 billion investment over the next four years.

However, analysts note that the $500 billion is largely dedicated to building new servers to support Apple Intelligence, Apple's struggling AI system, rather than onshoring production of consumer products.

"The main supply chain impact of Apple's four-year plan for $500 billion of spending in the US is a move to source servers for AI-type tools in Texas, likely at a plant to be run by Hon Hai Precision Industry Co. Ltd., using chips produced in Arizona by Taiwan Semiconductor Manufacturing Co. Ltd.," Panjiva research analysts said in a recent note.

In addition to the Houston-based server manufacturing facility, Apple also pledged to double its US Advanced Manufacturing Fund. Part of that fund includes a multibillion-dollar commitment from Apple to produce advanced silicon in Taiwan Semiconductor's Fab 21 facility in Arizona.

Damage already done

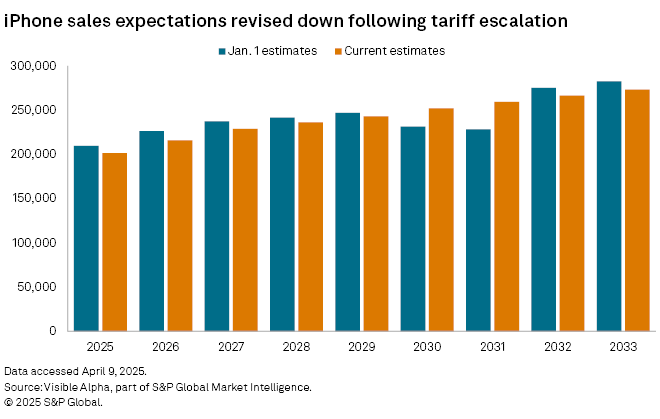

Given Apple's exposure to the ongoing tariff uncertainty, analysts have lowered their forecasts for revenue and iPhone sales for the coming years.

"We continue to believe the base case numbers for 2025 and 2026 come down ~10% based on demand destruction and cost increases," Wedbush Securities analyst Dan Ives said in a research note.

According to Visible Alpha consensus analyst estimates, iPhone revenue could be 4% to 5% lower in 2025 and 2026, respectively, compared with consensus estimates three months ago, before news of the tariffs broke. Much of the decline in sales is expected to occur in mainland China.

"The [mainland] China end-market exposure is significant, as is the potential supply chain issues that could impact costs. Revenue and profit growth in key markets are exposed to tariff issues," said Melissa Otto, head of Visible Alpha research at S&P Global.

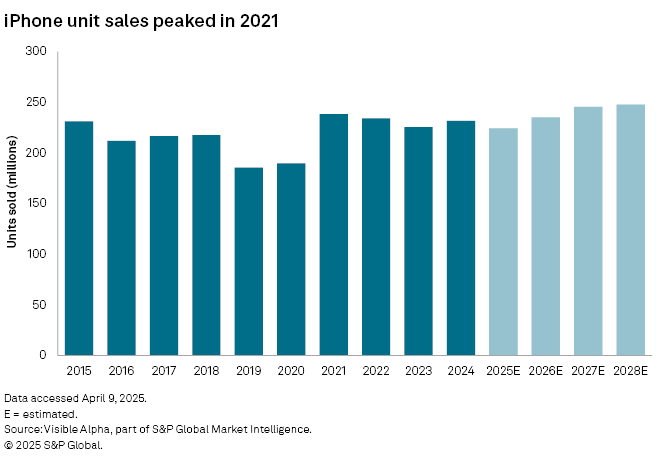

The tariffs compound Apple's competitive challenges amid a wider slowdown in smartphone sales. Sales of iPhone units reached a peak in 2021 before flatlining over the following years as consumer upgrade cycles slowed. In the mainland Chinese market, Apple is facing competition from lower-priced competitors, such as Huawei Technologies Co. Ltd. In Western markets, Alphabet Inc.'s Pixel line of phones is growing rapidly, albeit from a low base.

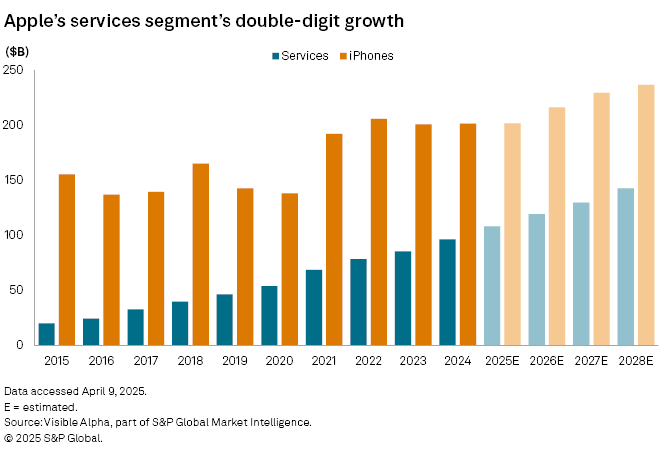

Revenue growth has come from higher iPhone prices and the burgeoning high-margin services segment, which includes offerings such as Apple Music, Apple Pay and iCloud. Apple's services business has grown to $96 billion in 2024 from about $20 billion in 2015.

However, the services growth is predicated upon Apple maintaining and growing its current iPhone installed base of about 1.5 billion devices.