S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

17 Apr, 2025

By Tim Siccion and Shambhavi Gupta

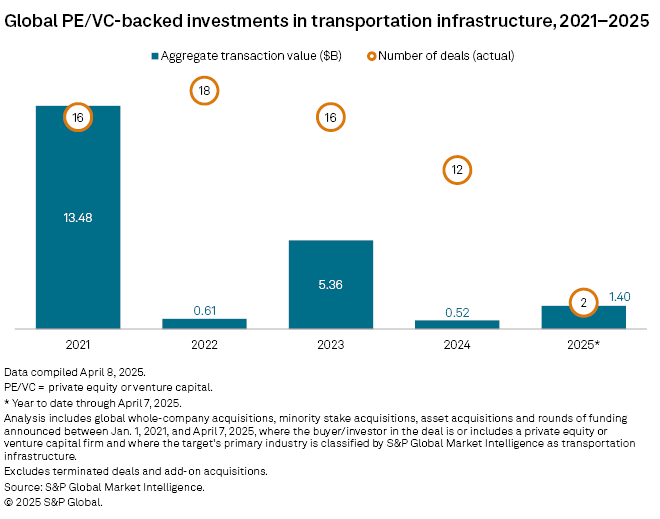

The value of global private equity and venture capital deals in transportation infrastructure so far in 2025 has already exceeded the amount reached for full year 2024, spurred by the European debt markets and government support.

Investments for the year through April 7 totaled $1.40 billion across two transactions, nearly tripling the $520 million across 12 deals in 2024, according to S&P Global Market Intelligence data. Transportation infrastructure includes facilities such as airports, highways and seaports.

UK and European government allocation of funds to transportation infrastructure and favorable debt market conditions in Europe are significant drivers of private equity investments in the sector, Sullivan Street Partners Ltd. founder and Managing Partner Richard Sanders told Market Intelligence.

The two deals in 2025 were investments in UK-based airport operators: Ardian SAS's proposed $1.1 billion purchase of a 10% stake in FGP Topco Ltd. and Blackstone Inc.'s planned $305 million acquisition of 22% of AGS Airports Ltd.

– Catch up on venture capital activity in March.

– Read up on the trends in US private equity assets under management.

– Explore our In Play reports for the latest rumored deals.

Fundraising on the rise

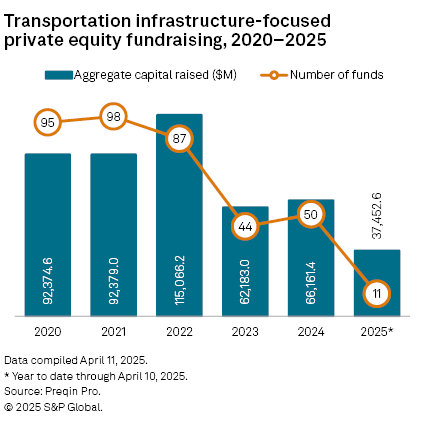

Global private equity fundraising targeting transportation infrastructure for the year through April 10 reached $37.45 billion, already more than half the $66.16 billion accumulated in 2024, according to Preqin Pro data.

Transportation infrastructure facilities are attractive to private equity firms looking for stable cash flow, though these assets still carry risks for investors, Sanders said.

"[I]nvestments depend on how you operate in an infrastructure environment where reputation and delivery are paramount. There are rare assets that got it right over the long term," Sanders said.

In the US, the repair and upgrade of the nation's roadway network has attracted investor interest, according to investment bank Harris Williams LLC

"Areas with strong appeal include striping and roadway maintenance, flagging and traffic control, transportation engineering and intelligent transportation systems," wrote Harris Williams Managing Director Matt White in emailed comments.

Road infrastructure investment opportunities are expected to grow as funding from the 2021 US infrastructure bill continues to be dispersed, according to a report from the investment bank.

Further incentives for private equity could come from the Federal Infrastructure Bank Act of 2025, an initiative that aims to facilitate infrastructure investments from private sector partners.

Funds seeking capital

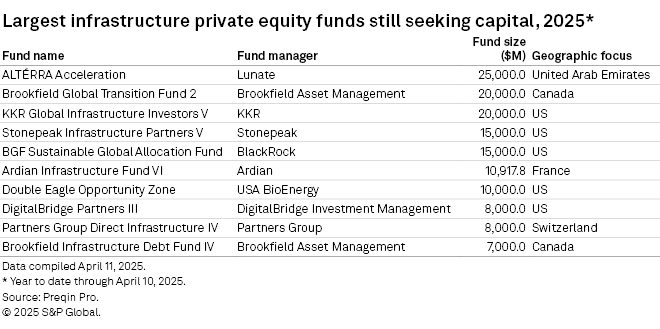

Infrastructure-focused funds often include a broad mandate that goes beyond transportation to include datacenters, energy facilities and telecom systems.

Lunate's United Arab Emirates-focused Altérra Acceleration fund, which targets $25 billion, is the largest vehicle worldwide that is seeking capital, Preqin data showed.

Brookfield Asset Management Ltd.'s Canada-focused Brookfield Global Transition Fund 2, with a target of $20 billion, is the second largest.

Tariffs to 'moderately' affect transportation infrastructure

Sanders believes that the US tariffs, which have been paused shortly after they were imposed at the start of April, will slightly affect the global transportation infrastructure industry.

"There might be some supply chains that would be moderately affected," Sanders said, noting how the tariffs could potentially increase raw material costs such as concrete and steel for some companies. "There would be second-order disruption of global supply chains where there's bound to be some knock-on impacts."

Some private equity firms are looking at the transportation sector for consolidation opportunities.

"While we have a number of private equity firms picking over the space, there's not that many valuable assets," Sanders added. "The opportunity to buy platforms you'd be happy consolidating is really limited."