S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

10 Mar, 2025

By Sarah James and STEFAN MODRICH

| Recent executive orders from US President Donald Trump seek to increase White House oversight of independent agencies. Source: Jim Watson/AFP via Getty Images. |

Major tech, media and telecom companies will likely need to adjust how they lobby and interact with federal policymakers following President Donald Trump's executive actions regarding independent agencies.

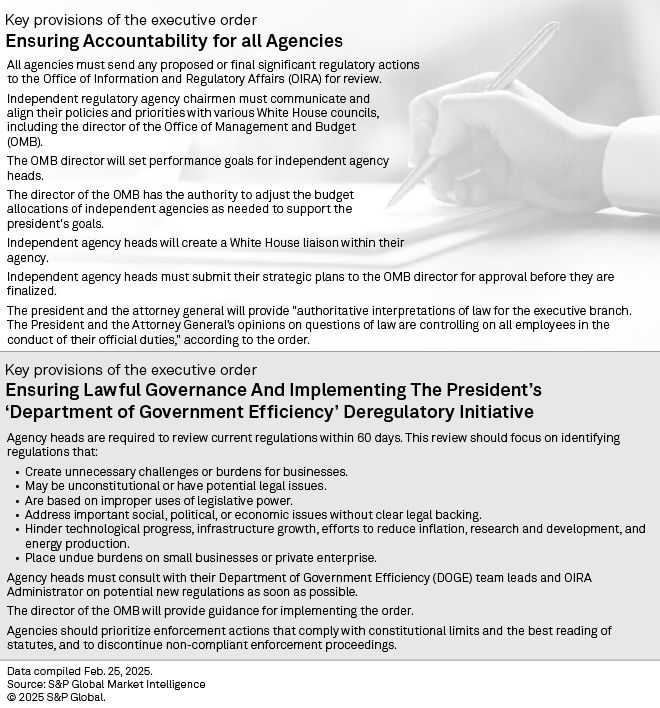

Among Trump's recently signed executive orders, one requires independent regulatory agencies to submit "significant" regulations for White House review and consult with the president on priorities and strategic plans. Another order directs agency heads to work with the White House’s Office of Management and Budget director and the Department of Governmental Efficiency initiative to identify regulations that are unconstitutional or that are based on "unlawful designations of legislative power." Following these moves, lobbying activity traditionally conducted at the agency level could move to the White House.

While Trump's executive orders affect operations across all federal agencies, two agencies in particular hold sway over technology, media and telecommunications companies: the Federal Communications Commission and the Federal Trade Commission. Both agencies, which have operated since the early 20th century, historically were run by leaders appointed by the party controlling the White House; however, day-to-day operations have been largely left to those appointed agency heads. Now, the Trump administration says more White House oversight is needed.

"It centralizes more and more power in the White House over the way in which the agency works," said William Kovacic, a former FTC chair and current law professor at George Washington University. "There are already some measures of control. These strengthen those measures of control considerably and give the president and the president's advisers a still stronger hand in determining what the [agency] does and how it does it."

The FCC and FTC did not respond to requests for comment.

Prioritization and deregulation

Going into Trump's second term in the White House, most industries expected a deregulatory wave. Broadcasters such as Sinclair Inc. and Nexstar Media Group Inc. looked forward to a rollback of the FCC rules that have prevented station consolidation; similarly, the biggest tech and media firms anticipated changes to the FTC's antitrust protections, adopted during the Biden administration.

Now, the outlook for those things is mixed, legal experts said.

"Companies in heavily regulated sectors — including banking, technology, energy, and telecommunications — should expect heightened White House influence over agency decision-making, potentially leading to shifts in enforcement priorities and compliance expectations," wrote Marc Martin, a partner at the international law firm Perkins Coie LLP, and associate Dania Assas. "Organizations should closely monitor agency guidance and be prepared for policy changes as White House priorities evolve."

For broadcasters in particular, deregulation is still likely to occur, said Clyde Wayne Crews, a senior fellow in regulatory studies at the Competitive Enterprise Institute, a libertarian think tank. Crews pointed to another Trump executive order, which requires 10 prior regulations to be eliminated for each one new regulation an agency advances.

"The idea here is to put speed bumps in the way of issuing bad rules, especially if they extend the bounds of what's in the statute," Crews said. "But the idea is not to put barriers in the way of rolling them back."

With this order, Crews expects "a capital 'D' deregulatory" push.

For tech companies, though, Crews said the outlook is less favorable. Trump's pick to chair the FTC, Andrew Ferguson, said in February that the agency's 2023 merger guidelines, issued with the Justice Department under the Biden administration, remain in effect. The guidelines lowered the thresholds at which a merger was considered anticompetitive, subjecting a larger number of deals to scrutiny.

"A lot of the status quo in antitrust enforcement continues," Crews said, noting he would like to see this changed. "I think it's a discordant policy with respect to the other streamlining that they're attempting to do."

'Proactive engagement'

As companies and industry groups wait to get a sense of how independent agencies will operate under the new orders, legal experts said they would not be surprised to see more direct interaction with the White House.

"Businesses may wish to expand their advocacy to the White House as well as independent agencies," Martin and Assas wrote. "Proactive engagement will be critical."

Already, tech industry leaders have been aligning themselves more closely with the White House. Apple Inc. CEO Tim Cook, as well as Alphabet Inc., Meta Platforms Inc., and Amazon.com Inc. all donated $1 million to Trump's inauguration fund, and the CEOs of those companies were all present at the Capitol rotunda for the inauguration ceremony. While donations to inauguration funds are common among companies, the size of the donations was historic.

"I do know there's suddenly wisdom to all the big tech heads paying for the inauguration," said Eric Troutman, an attorney with Troutman Amin LLP. "You want to make sure you're on Mr. Trump's good side right now."

Future questions

Legal experts said two major developments are on the long-term horizon that will provide greater clarity on agency directions: First, they expect more detailed guidance from the White House; and second, they expect the constitutionality of some of these moves to be litigated in court.

In terms of White House guidance, one outstanding question is how agencies can and should handle nonpartisan actions that have historically required technical expertise.

"I think the most likely scenario is that most agencies grind to a halt, except on those matters on which Mr. Trump literally dictates, 'You will do X,'" said Troutman. "As to everything else, I think just from a practical standpoint, some level of paralysis is likely."

In the case of the FCC, an example of nonpartisan action might include spectrum management. On Feb. 27, the FCC voted unanimously to advance a notice of proposed rulemaking to bring unused mid-band spectrum to market by reauctioning certain AWS-3 spectrum licenses. Originally auctioned off in 2014, about 200 licenses returned to the FCC's inventory after the 2014 buyers defaulted on payments.

The proposed rulemaking is not yet subject to Trump's independent agency executive order. Published in the Federal Register on Feb. 24, that order included a 60-day window before taking effect. Once in effect, however, it is unclear whether the FCC would need White House permission on its rules for reauctioning spectrum licenses.

"Possibility No. 1 is that essentially Mr. Trump's plan is to more or less let the regular operations of these agencies continue around nonpolitical issues," Troutman said. "Another possibility, though … is that Mr. Trump does not believe in the functioning of these agencies at all."

This latter possibility would align with comments from Office of Management and Budget Director Russell Vought, who told former Fox News anchor Tucker Carlson in November 2024 that under a strict reading of the US Constitution, "the whole notion of an independent agency should be thrown out."

Under the independent agency executive order, the Office of Management and Budget director will review agency priorities and can also adjust agency budget allocations.

Crews suggested that some functions overseen by independent agencies, such as spectrum management, could shift to the private sector.

"The idea is if government is too big and it's doing too many things, you want to move those things out of the federal sector," Crews said.

While this would require a significant change over the status quo, Crews said industries would ultimately benefit.

"The wireless space should take heart in the fact that there's a little bit more of an opportunity to take a bigger look at the need to deregulate infrastructure across the board," Crews said.

CTIA, the trade group representing the US wireless industry, did not respond to a request for comment.

Legal challenges

In the meantime, the executive orders are expected to face legal challenges. As Congress has historically set the rulemaking requirements for agencies, Trump's claim of executive authority could result in a separation of powers clash.

A key question is whether the Trump administration will limit its authority over agencies to enforcement actions, or whether the White House will also direct the creation of regulations — a power that generally comes from Congress. Enforcement actions are the fines or penalties agencies apply when a company or individual has violated the regulations — or rules or standards — previously established by the agency to govern behavior within a particular industry.

"I think that it's probably constitutional to the extent that it is enforcement only," Troutman said. "Where it gets incredibly murky and challenging is if he's trying to control regulation. … That would be an executive officer seizing legislative control, which is a blatant violation of separation of powers doctrine."

There is also a question of court challenges to agency rulemakings under the executive orders. The existing Supreme Court precedent, established under Skidmore v. Swift & Co., is that agencies must show expertise and their actions must be consistent in both procedure and substance with what they have done in the past, according to Jim Dunstan, general counsel at technology think tank TechFreedom.

If the White House begins directing policy at agencies, "You've now lost the two most important prongs of Skidmore deference," Dunstan said. "You've lost the argument that you're the expert agency … and you've lost the consistency in process."

That could make any agency rulemaking vulnerable on appeal.

Between the forthcoming challenges to the orders themselves and potential challenges to individual rulemakings, Dunstan expects the courts to be busy for some time.

"Agency politics are going to become more and more difficult going forward," Dunstan said. "It's going to take many years for the courts to sort this out."