Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

14 Mar, 2025

By Tom Jacobs

US insurers have fared better than the broader market in recent weeks as uncertainty around the Trump administration's tariff policy sent share prices falling.

A 20% tariff on all imports from China and 25% tariffs on most Canadian and Mexican imports went into effect March 4. The following day, March 5, the Trump administration granted a one-month exemption on tariffs impacting goods from Mexico and Canada for US automakers, then postponed the 25% tariffs on selected imports from Mexico and some imports from Canada for a month. The imposition of a 25% tariff on Canadian steel and aluminum March 12 added to the uncertainty.

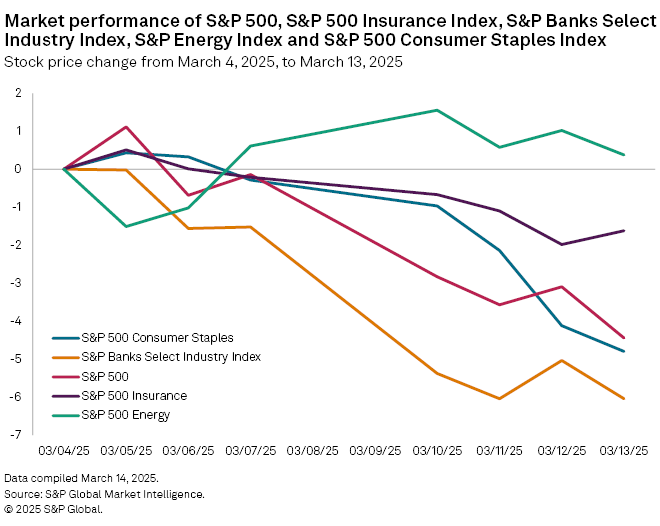

While the broader S&P 500 fell 4.44% since March 4 as of market close March 13, the S&P 500 Insurance Index was down only 1.62%.

The conflicting actions on the tariffs from the White House have created a very difficult investing environment, said CFRA Research analyst Cathy Seifert.

"You have a very uncertain macro environment and uncertain geopolitical risk," Seifert said in an interview, "and you have an administration that is not committed to ensuring the stability of any of those facets."

Playing defense

With the threat of recession and rising inflation, insurance companies are better suited than other businesses to weather the storm. Piper Sandler analyst Paul Newsome attributed that to the "defensive" nature of the sector, meaning the companies have consistent dividends, and stable earnings and products regardless of the health of the stock market.

"[Insurance] is just a very defensive business. ... Macroeconomic factors have relatively limited impact," Newsome said in an interview. "There are negatives in that you don't see as much economic growth [or] business growth, but in recessions, people drive less and you see fewer claims."

Insurers did well compared with other sectors, such as banking and consumer-focused companies, over the same period. The S&P Banks Select Industry Index was down 6.04% and the S&P Consumer Staples Index fell 4.80%.

One industry that was in positive territory was the energy sector with the S&P 500 Energy rising 0.37% over the same period.

Seifert said that in the face of investor uncertainty, personal lines insurers are the lowest risk because of their low volatility and the demand for their products.

"They don't have a high correlation to overall equity market performance," Seifert said. "So that gives them a little bit of cover during times like this."

Elephant in the room

The danger zone is with the property insurers and commercial lines. Seifert said the degree to which Trump's planned tariffs affect the price of lumber and other building materials is "the elephant in the room."

"[The current tariffs] on lumber will put upward cost pressure on building costs, meaning the cost to rebuild and insure will be more expensive," Seifert said "That's a pressure on homeowners insurers and this is an industry that currently has pricing power, so I expect that, ultimately, that cost is going to be passed on to consumers."

Personal lines carriers want to avoid a big spike in inflation, particularly in goods that need to be repaired such as cars or housing, Newsome said.

"Anything that affects fixing things affects all insurers," he said. "It just has a more magnified effect on personal lines than it does on commercial lines."